Region:Middle East

Author(s):Shubham

Product Code:KRAD5447

Pages:86

Published On:December 2025

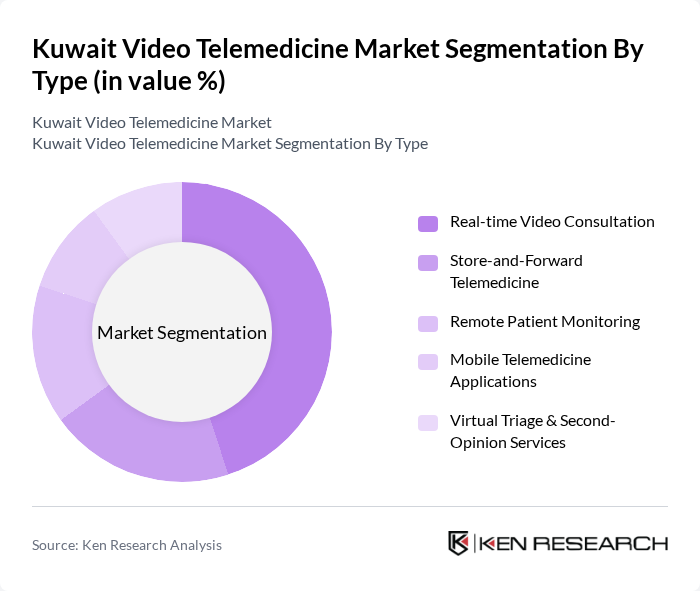

By Type:The video telemedicine market can be segmented into various types, including Real-time Video Consultation, Store-and-Forward Telemedicine, Remote Patient Monitoring, Mobile Telemedicine Applications, and Virtual Triage & Second-Opinion Services. Among these, Real-time Video Consultation is the leading sub-segment, driven by the increasing demand for immediate medical advice and the convenience it offers to patients. The rise in smartphone usage and internet accessibility has further propelled this segment, making it the preferred choice for many users.

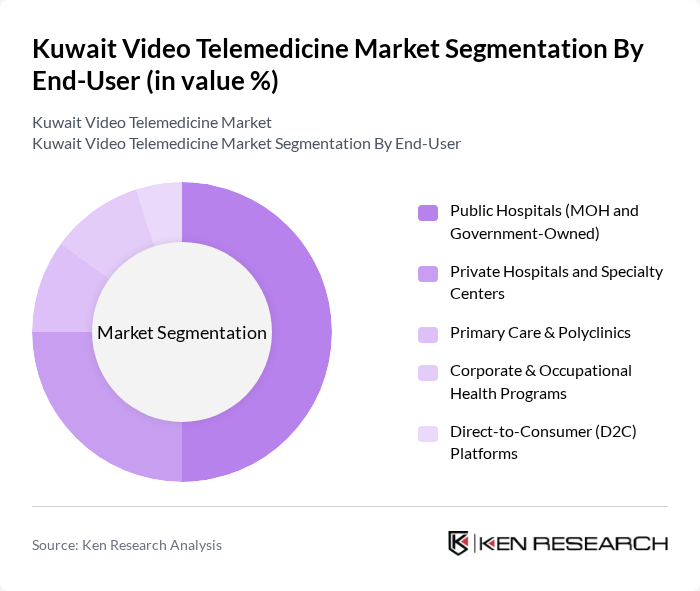

By End-User:The end-user segmentation includes Public Hospitals (MOH and Government-Owned), Private Hospitals and Specialty Centers, Primary Care & Polyclinics, Corporate & Occupational Health Programs, and Direct-to-Consumer (D2C) Platforms. Public Hospitals are the dominant end-user segment, as they are increasingly adopting telemedicine solutions to enhance service delivery and manage patient loads effectively. The support from the Ministry of Health in Kuwait for telehealth initiatives has also played a crucial role in this segment's growth.

The Kuwait Video Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health (Kuwait) – Central Telemedicine & eHealth Programs, Kuwait Telemedicine Center – Jaber Al-Ahmad Hospital Initiative, Dhaman Health Assurance Hospitals Company (DHAMAN), Kuwait Hospital – Teleconsultation & Virtual Clinic Services, Dar Al Shifa Hospital – Online Video Consultation Platform, New Mowasat Hospital – Telemedicine & Remote Follow-up Services, Kuwait Telecare – Local Multispecialty Video Telehealth Platform, VEZEETA FZ-LLC – Regional Appointment & Teleconsultation Platform Operating in Kuwait, Okadoc – GCC Digital Health Platform with Video Consultation in Kuwait, MyClinic Kuwait – Virtual Clinic and Online Consultation Service, Sehteq / Yodawy – Digital Health & Teleconsultation Partnering with Providers in Kuwait, Altibbi – Arabic Telehealth Platform Serving Users in Kuwait, Babylon Health – International Telehealth Provider with GCC Deployments, Doctori Online – GCC Telemedicine Platform Accessible from Kuwait, InstaPract – Regional Video Consultation Platform Serving Kuwait-based Patients contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait video telemedicine market appears promising, driven by ongoing technological innovations and increasing consumer acceptance. As the government continues to invest in digital health infrastructure, the integration of advanced technologies like AI and machine learning will enhance service delivery. Additionally, the growing emphasis on mental health services through telemedicine is expected to expand the market further, catering to diverse healthcare needs and improving overall patient care in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Video Consultation Store-and-Forward Telemedicine Remote Patient Monitoring Mobile Telemedicine Applications Virtual Triage & Second-Opinion Services |

| By End-User | Public Hospitals (MOH and Government-Owned) Private Hospitals and Specialty Centers Primary Care & Polyclinics Corporate & Occupational Health Programs Direct-to-Consumer (D2C) Platforms |

| By Specialty | Primary Care & Family Medicine Mental & Behavioral Health Dermatology Pediatrics & Neonatal Care Chronic Disease Management (e.g., Diabetes, Cardiology) |

| By Technology | Web-based Video Platforms Mobile Health (mHealth) Applications Cloud-based Telemedicine Platforms Integrated EMR/Telehealth Solutions Connected Devices & Wearables |

| By Payment Model | Self-pay / Out-of-pocket Private Insurance Reimbursement Government-funded & MOH Programs Corporate & Employer-sponsored Plans |

| By User Demographics | Kuwaiti Nationals Expatriate Population Age Groups (Children, Adults, Elderly) Patients with Chronic Conditions |

| By Region | Kuwait City & Metropolitan Area Other Urban Governorates Semi-urban & Remote Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Insights | 100 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patient Experience Feedback | 140 | Telemedicine Users, General Patients, Caregivers |

| Regulatory Perspectives | 50 | Health Policy Makers, Regulatory Officials |

| Technology Adoption Trends | 80 | IT Managers, Health Tech Innovators |

| Market Entry Strategies | 60 | Business Development Managers, Market Analysts |

The Kuwait Video Telemedicine Market is valued at approximately USD 760 million, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and increased demand for accessible medical services, particularly accelerated by the COVID-19 pandemic.