Region:Middle East

Author(s):Dev

Product Code:KRAE0178

Pages:88

Published On:December 2025

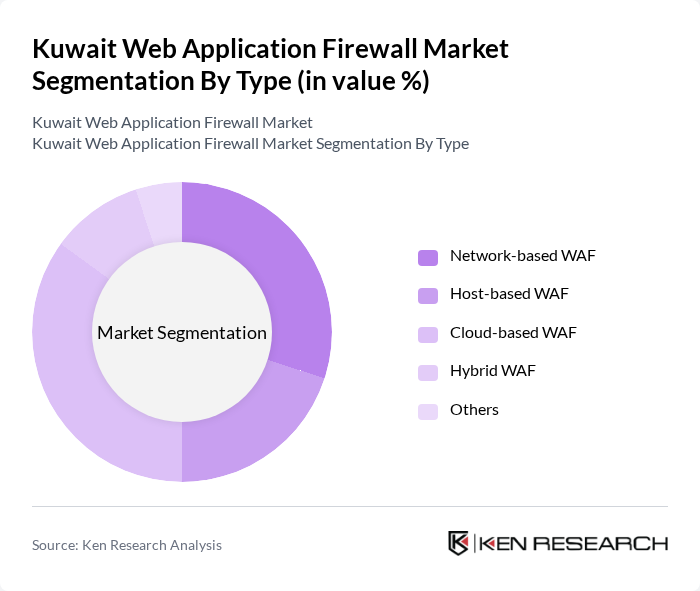

By Type:The market is segmented into various types of web application firewalls, including network-based, host-based, cloud-based, hybrid, and others. Among these, cloud-based WAFs are gaining traction due to their scalability and ease of deployment, making them particularly appealing to businesses transitioning to cloud environments. The demand for network-based WAFs remains strong, especially among large enterprises that require robust security measures for their on-premises applications.

By End-User:The end-user segmentation includes banking and financial services, retail, healthcare, telecommunications, and others. The banking and financial services sector is the largest consumer of web application firewalls, driven by the need to protect sensitive financial data and comply with stringent regulations. Retailers are also increasingly adopting WAFs to secure e-commerce platforms and customer data, especially as online shopping continues to grow.

The Kuwait Web Application Firewall Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fortinet, Imperva, F5 Networks, Barracuda Networks, Akamai Technologies, Cloudflare, Radware, Citrix Systems, Check Point Software Technologies, Sucuri, Trustwave, Palo Alto Networks, McAfee, Trend Micro, and IBM Security contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait Web Application Firewall market is poised for significant growth as organizations increasingly recognize the importance of cybersecurity in a digital-first world. With the government’s commitment to enhancing national cybersecurity and the rising threat landscape, businesses are expected to prioritize investments in WAF solutions. Additionally, the integration of AI-driven technologies and managed security services will likely reshape the market, providing innovative solutions to combat sophisticated cyber threats while ensuring compliance with emerging regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Network-based WAF Host-based WAF Cloud-based WAF Hybrid WAF Others |

| By End-User | Banking and Financial Services Retail Healthcare Telecommunications Others |

| By Deployment Model | On-Premises Cloud Hybrid Others |

| By Industry Vertical | Government Education Manufacturing Energy and Utilities Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Others |

| By Security Features | DDoS Protection SQL Injection Prevention Cross-Site Scripting Protection Bot Mitigation Others |

| By Pricing Model | Subscription-based Pay-as-you-go One-time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Web Application Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Application Protection | 80 | Healthcare IT Directors, Data Protection Officers |

| Retail E-commerce Security | 70 | eCommerce Managers, IT Infrastructure Leads |

| Government Cybersecurity Initiatives | 60 | Government IT Officials, Cybersecurity Policy Makers |

| Telecommunications Application Security | 90 | Network Security Engineers, Risk Management Specialists |

The Kuwait Web Application Firewall Market is valued at approximately USD 0.6 billion, reflecting a five-year historical analysis. This growth is primarily driven by increasing cyber threats and the adoption of cloud services, including security-as-a-service models.