Region:Asia

Author(s):Shubham

Product Code:KRAC0591

Pages:84

Published On:August 2025

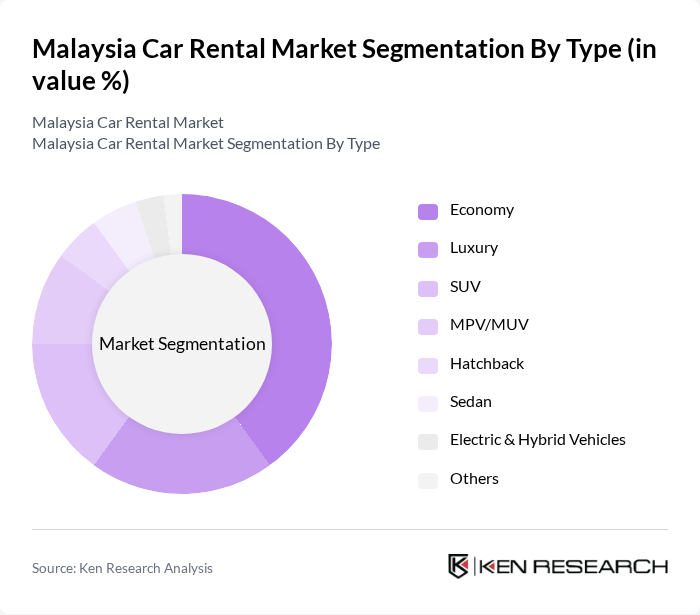

By Type:The car rental market can be segmented into various types, including Economy, Luxury, SUV, MPV/MUV, Hatchback, Sedan, Electric & Hybrid Vehicles, and Others. Each of these segments caters to different consumer preferences and needs, with Economy and Luxury vehicles being particularly popular among tourists and business travelers. Industry sources note strong demand for economy-focused options alongside gradual integration of electric and hybrid vehicles as sustainability offerings expand .

The Economy segment dominates the market due to its affordability and practicality, appealing to budget-conscious travelers and locals. Ongoing recovery in tourism and preference for cost-effective mobility continue to support economy rentals, while premium and luxury cater to corporate and affluent travelers. The trend towards sustainable travel is gradually increasing the demand for Electric & Hybrid Vehicles as operators pilot and add EV models in fleets, aided by national EV incentives .

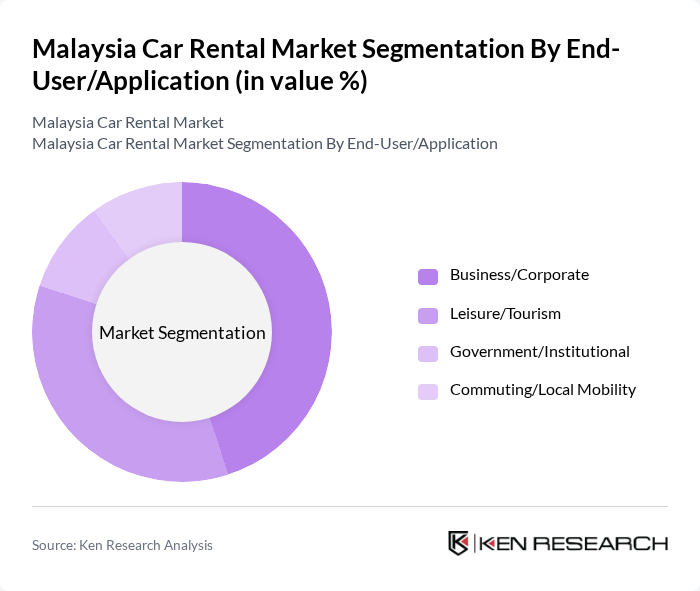

By End-User/Application:The market can be segmented based on end-users, including Business/Corporate, Leisure/Tourism, Government/Institutional, and Commuting/Local Mobility. Each segment reflects different usage patterns and requirements, with business travel and tourism being the primary drivers of demand. Industry commentary highlights corporate mobility needs and tourism flows as core demand pillars, with ride-hailing and allowances as relevant substitutes for certain use cases .

The Business/Corporate segment leads the market, driven by the high volume of business travel in urban centers and flexible fleet solutions. The Leisure/Tourism segment follows, supported by domestic and inbound tourism. Government and institutional rentals add steady but smaller volumes, while local commuting remains niche given substitutes such as ride-hailing and car allowances in corporate policies .

The Malaysia Car Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Malaysia (The Hertz Corporation), Avis Malaysia (Avis Budget Group), Europcar Malaysia (Europcar Mobility Group), Hawk Rent A Car, Mayflower Car Rental Sdn Bhd, Orix Car Rentals (ORIX Malaysia), SOCAR Malaysia, GoCar Malaysia, Green Matrix Car Rental, PRAC — Pacific Rent A Car, Kasina Baru Sdn Bhd (Kasina Rent-A-Car), Prima Odyssey Sdn Bhd, EPTA Car Rental (EP Car Rental), Kk Rent A Car & Tours (KK Rent A Car), Sixt via Franchise/Partners in Malaysia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysia car rental market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital platforms for booking and fleet management is expected to enhance operational efficiency. Additionally, the growing trend towards eco-friendly transportation solutions will likely lead to increased demand for electric vehicle rentals. As the market adapts to these changes, operators who embrace innovation and sustainability will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy Luxury SUV MPV/MUV Hatchback Sedan Electric & Hybrid Vehicles Others |

| By End-User/Application | Business/Corporate Leisure/Tourism Government/Institutional Commuting/Local Mobility |

| By Rental Duration | Short-Term (Hourly/Daily/Weekly) Long-Term (Monthly/Annual Leasing) |

| By Booking Channel | Online (Web/App, OTAs) Offline (Counters/Call Centers) Direct Corporate Contracts |

| By Payment Method | Credit/Debit Cards E-Wallets/Mobile Payments Cash & Bank Transfer |

| By Fleet Size | Small Fleets (<100 vehicles) Medium Fleets (100–999 vehicles) Large Fleets (?1,000 vehicles) |

| By Geographic Coverage | Klang Valley (Kuala Lumpur/Selangor) Penang Johor Sabah & Sarawak Other Urban/Secondary Cities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 120 | Tourists, Vacation Planners |

| Corporate Car Rentals | 100 | Corporate Travel Managers, HR Executives |

| Long-term Rentals | 80 | Business Owners, Expatriates |

| Ride-sharing Services | 70 | Drivers, Fleet Operators |

| Luxury Car Rentals | 60 | High-net-worth Individuals, Event Planners |

The Malaysia car rental market is valued at approximately USD 550600 million, reflecting a recovery in travel and corporate mobility demand. This valuation is consistent with various industry trackers that report similar figures in recent periods.