Region:Asia

Author(s):Geetanshi

Product Code:KRAA8138

Pages:93

Published On:September 2025

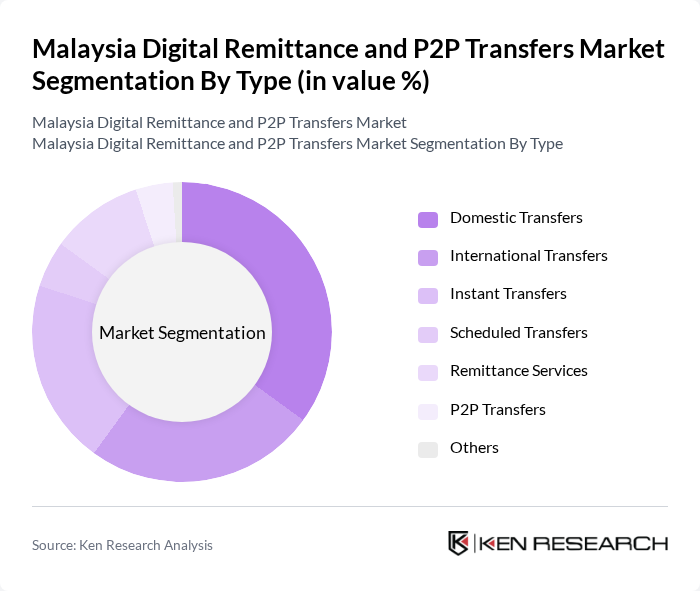

By Type:The market is segmented into various types, including Domestic Transfers, International Transfers, Instant Transfers, Scheduled Transfers, Remittance Services, P2P Transfers, and Others. Among these, Domestic Transfers and Instant Transfers are particularly prominent due to the increasing demand for quick and efficient money transfer solutions within the country.

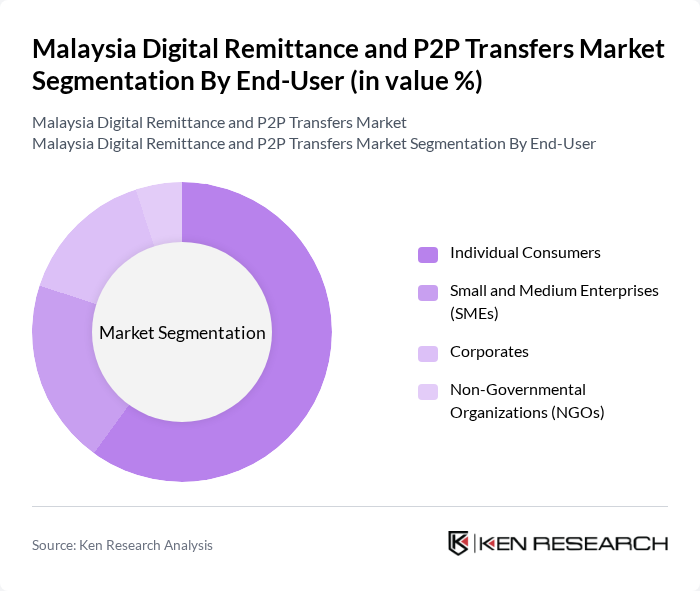

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). Individual Consumers dominate the market, driven by the increasing number of people utilizing digital platforms for personal transactions and remittances.

The Malaysia Digital Remittance and P2P Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maybank, CIMB Bank, RHB Bank, Hong Leong Bank, TransferWise, Western Union, PayPal, GrabPay, Touch 'n Go, DuitNow, MoneyGram, Alipay, WeChat Pay, Xendit, and Revolut contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's digital remittance and P2P transfers market appears promising, driven by technological advancements and increasing consumer acceptance. As digital wallets gain traction, the market is likely to see a shift towards more integrated payment solutions. Additionally, the collaboration between fintech companies and traditional banks is expected to enhance service offerings, making transactions more efficient. With a growing focus on user experience and security, the market is poised for significant growth, catering to the evolving needs of consumers in a digital-first economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transfers International Transfers Instant Transfers Scheduled Transfers Remittance Services P2P Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Geographic Reach | Local Transfers Regional Transfers Global Transfers |

| By Customer Segment | Students Migrant Workers Expatriates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Remittance Users | 150 | Expatriates, Young Professionals |

| P2P Transfer Service Providers | 100 | Product Managers, Business Development Executives |

| Financial Institutions | 80 | Banking Executives, Compliance Officers |

| Regulatory Bodies | 50 | Policy Makers, Financial Analysts |

| Consumer Advocacy Groups | 30 | Consumer Rights Advocates, Financial Educators |

The Malaysia Digital Remittance and P2P Transfers Market is valued at approximately USD 10 billion, reflecting significant growth driven by the adoption of digital payment solutions and the increasing number of migrant workers sending remittances.