Region:Europe

Author(s):Shubham

Product Code:KRAB2610

Pages:100

Published On:October 2025

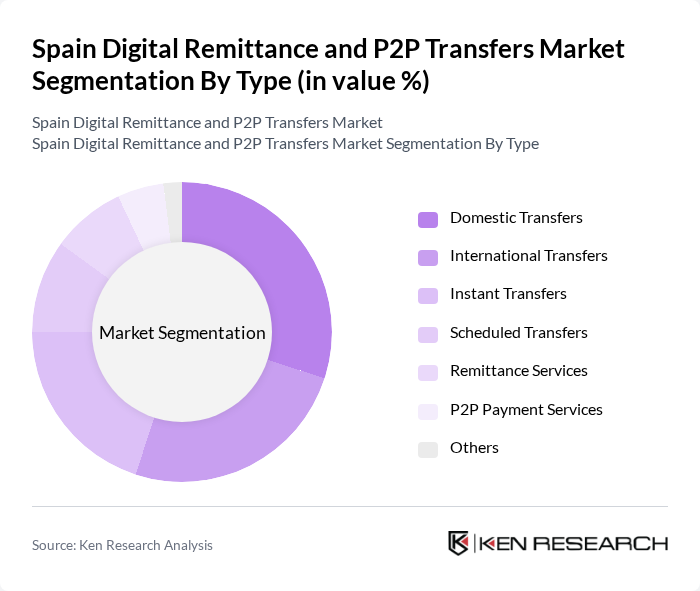

By Type:The market can be segmented into various types, including Domestic Transfers, International Transfers, Instant Transfers, Scheduled Transfers, Remittance Services, P2P Payment Services, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of digital financial services. Person-to-person transfers and remittance services are particularly prominent, driven by the needs of expatriates and migrant workers, while instant and scheduled transfers are gaining traction due to the demand for convenience and flexibility .

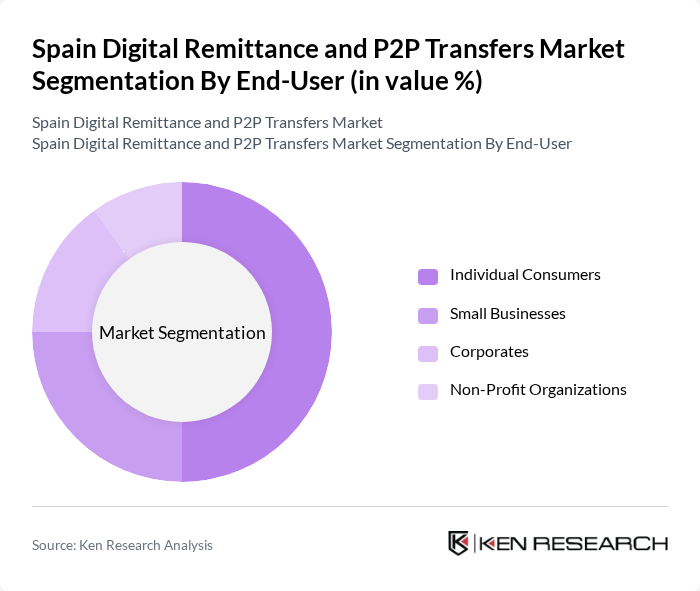

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Non-Profit Organizations. Each segment has unique requirements and usage patterns, influencing the overall dynamics of the market. Individual consumers represent the largest segment, primarily due to the widespread use of digital remittance services for personal transactions, while small businesses and corporates are increasingly adopting these solutions for cross-border payments and payroll management .

The Spain Digital Remittance and P2P Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wise (formerly TransferWise), PayPal, Western Union, MoneyGram, Revolut, N26, Remitly, WorldRemit, Azimo, Skrill, Xoom (a PayPal service), Bizum, CaixaBank, ING Spain, Banco Santander contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance and P2P transfers market in Spain appears promising, driven by technological advancements and evolving consumer preferences. The integration of blockchain technology is expected to enhance transaction security and efficiency, while the growth of mobile wallets will facilitate easier access to financial services. Additionally, as cashless transactions become more prevalent, the market is likely to see increased adoption of digital payment solutions, further transforming the landscape of remittances and peer-to-peer transfers.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transfers International Transfers Instant Transfers Scheduled Transfers Remittance Services P2P Payment Services Others |

| By End-User | Individual Consumers Small Businesses Corporates Non-Profit Organizations |

| By Payment Method | Bank Transfers Mobile Wallets Credit/Debit Cards Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Customer Segment | Expatriates Students Freelancers |

| By Service Provider Type | Banks Fintech Companies Traditional Money Transfer Operators Online Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Remittance Users | 120 | Expatriates, International Students |

| P2P Transfer Service Providers | 60 | Product Managers, Marketing Directors |

| Financial Regulators | 40 | Policy Makers, Compliance Officers |

| Consumer Financial Advisors | 50 | Financial Planners, Investment Advisors |

| Technology Providers in Fintech | 45 | CTOs, Software Developers |

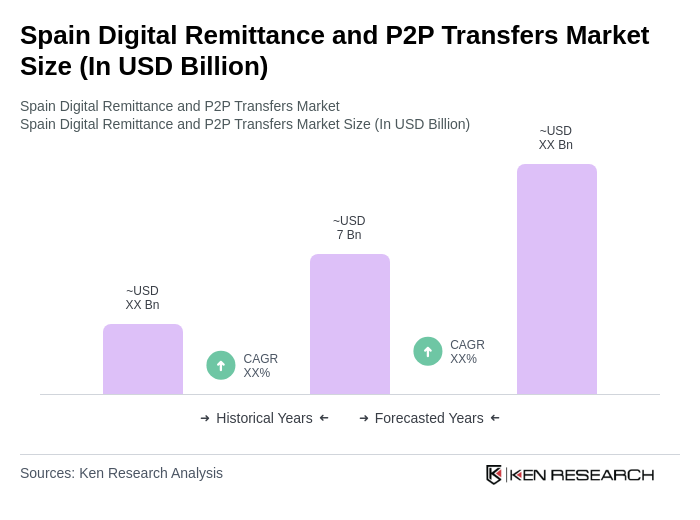

The Spain Digital Remittance and P2P Transfers Market is valued at approximately USD 7 billion, driven by factors such as the increasing number of expatriates, the rise of digital banking solutions, and the growing acceptance of mobile payment platforms.