Region:Asia

Author(s):Rebecca

Product Code:KRAE2938

Pages:98

Published On:February 2026

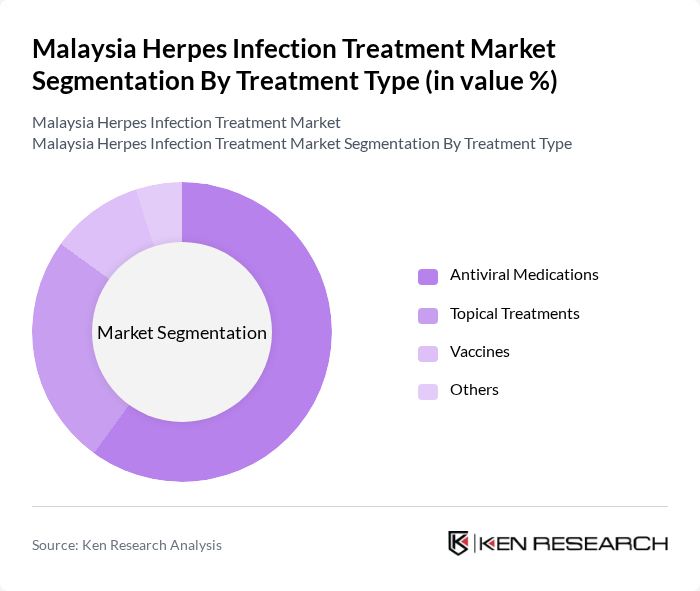

By Treatment Type:The treatment type segmentation includes various methods used to manage herpes infections. The primary subsegments are antiviral medications, topical treatments, vaccines, and others. Antiviral medications are the most widely used due to their effectiveness in managing symptoms and reducing outbreaks. Topical treatments are also popular for localized relief, while vaccines are still in developmental stages. The "Others" category includes alternative therapies and supportive treatments.

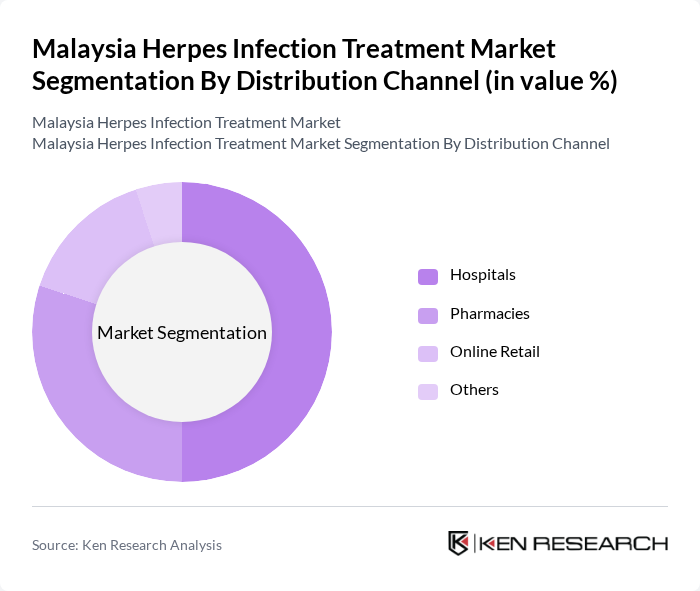

By Distribution Channel:The distribution channel segmentation encompasses the various avenues through which herpes treatment products are made available to consumers. This includes hospitals, pharmacies, online retail, and other channels. Hospitals are the primary distribution channel due to their comprehensive healthcare services, while pharmacies provide easy access to medications. Online retail is gaining traction as consumers seek convenience and privacy in purchasing treatments.

The Malaysia Herpes Infection Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as GSK (GlaxoSmithKline), Pfizer Inc., Merck & Co., Inc., AbbVie Inc., Aurobindo Pharma, Mylan N.V., Teva Pharmaceutical Industries Ltd., Novartis AG, Johnson & Johnson, Sanofi S.A., Hikma Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy's Laboratories, Astellas Pharma Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the herpes infection treatment market in Malaysia appears promising, driven by ongoing advancements in medical technology and increased public health initiatives. As the healthcare infrastructure continues to expand, more individuals will gain access to effective treatments. Additionally, the integration of telemedicine is expected to facilitate consultations, making it easier for patients to receive care. These trends indicate a potential for significant market growth, improving health outcomes for those affected by herpes infections.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Antiviral Medications Topical Treatments Vaccines Others |

| By Distribution Channel | Hospitals Pharmacies Online Retail Others |

| By Patient Demographics | Age Group (18-30, 31-45, 46-60, 60+) Gender Socioeconomic Status Others |

| By Treatment Setting | Inpatient Outpatient Home Care Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Treatment Duration | Short-term Treatment Long-term Management Others |

| By Insurance Coverage | Fully Covered Partially Covered Not Covered Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Dermatologists, Infectious Disease Specialists |

| Pharmacy Sector | 80 | Pharmacists, Pharmacy Managers |

| Patient Experience | 150 | Patients diagnosed with herpes infections |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Public Health Experts |

| Alternative Treatment Providers | 40 | Practitioners of complementary and alternative medicine |

The Malaysia Herpes Infection Treatment Market is valued at approximately USD 155 million, reflecting a significant increase driven by rising awareness of sexually transmitted infections and advancements in antiviral therapies.