Region:Asia

Author(s):Geetanshi

Product Code:KRAE6709

Pages:119

Published On:December 2025

By Product Type:The product type segmentation includes various formulations of parenteral lipid emulsions. The dominant sub-segment is Lipid Injectable Emulsions (Soybean Oil-based), which is widely used due to its established efficacy and safety profile, longstanding use in parenteral nutrition protocols in Malaysian public and private hospitals, cost-effectiveness versus newer blends, and wider formulary listing across MOH Malaysia tender contracts. Mixed-Lipid Emulsions (MCT/Long-Chain Triglyceride Blends) are gaining traction due to their versatility in clinical applications. Propofol Emulsion Formulations are essential for anesthesia, while Specialty Emulsions cater to specific patient needs, such as omega-3 enrichment.

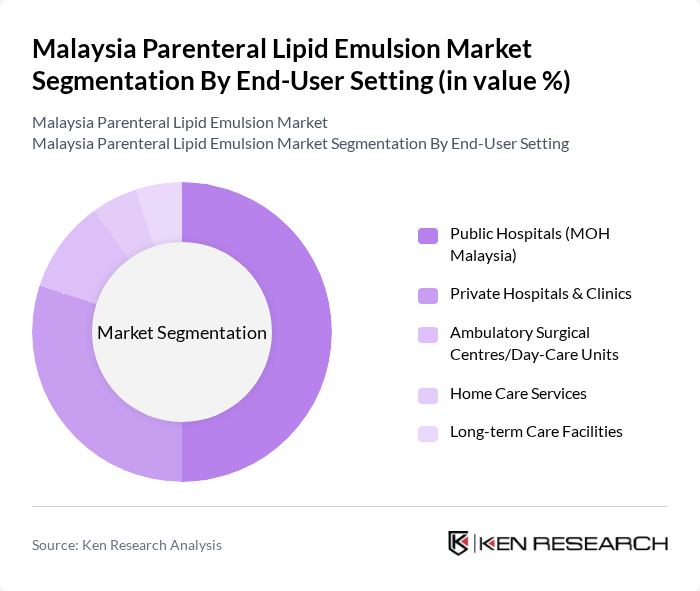

By End-User Setting:The end-user setting segmentation highlights the various healthcare environments utilizing parenteral lipid emulsions. Public Hospitals (MOH Malaysia) represent the largest segment due to their extensive patient base and government support, dominating high-volume parenteral nutrition use, government tender procurement, and large ICU/ward bed capacity. Private Hospitals & Clinics are also significant, offering specialized services driven by premium services, medical tourism and higher per-case incident use of sedation/anaesthesia emulsions. Ambulatory Surgical Centres and Home Care Services are emerging segments, reflecting the trend towards outpatient care and patient-centered approaches.

The Malaysia Parenteral Lipid Emulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fresenius Kabi Malaysia Sdn Bhd, B. Braun Medical Industries Sdn Bhd, Abbott Laboratories (Malaysia) Sdn Bhd, Baxter Healthcare Sdn Bhd, Otsuka Pharmaceutical Co., Ltd., Epsilon Healthcare Sdn Bhd, Pharmaniaga Berhad, Hovid Berhad, Duopharma Biotech Berhad, Medispec (M) Sdn Bhd, Systagenix Wound Management, Merck Sharp & Dohme (Malaysia) Sdn Bhd, Sanofi-Aventis (Malaysia) Sdn Bhd, GlaxoSmithKline (Malaysia) Sdn Bhd, Pfizer Malaysia Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia parenteral lipid emulsion market appears promising, driven by increasing healthcare investments and a growing focus on personalized nutrition solutions. As the healthcare infrastructure expands, more patients will have access to specialized nutritional therapies. Additionally, the integration of digital health technologies is expected to enhance patient monitoring and treatment efficacy, further propelling market growth in future. The emphasis on sustainability in production processes will also shape the industry, aligning with global trends towards environmentally friendly practices.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Lipid Injectable Emulsions (Soybean Oil-based) Mixed-Lipid Emulsions (MCT/Long-Chain Triglyceride Blends) Propofol Emulsion Formulations (for Anaesthesia/Sedation) Specialty Emulsions (Structured Lipids, Omega-3 Enriched Fat Emulsions) |

| By End-User Setting | Public Hospitals (MOH Malaysia) Private Hospitals & Clinics Ambulatory Surgical Centres/Day-Care Units Home Care Services Long-term Care Facilities |

| By Distribution Channel | Direct Sales to Hospitals Pharmaceutical Distributors Hospital Formulary Procurement Specialty Pharmacy Networks Online/E-commerce Channels |

| By Formulation Type | Ready-to-Use Emulsions Compounded Emulsions Nano- and Microemulsion Formulations |

| By Packaging Type | Bottles Multi-Chamber Bags Vials Prefilled Syringes |

| By Patient Demographics | Neonatal & Pediatric Patients Adult Patients Geriatric Patients |

| By Clinical Application | Critical Care/ICU Patients Oncology Patients Post-Surgical Patients Gastrointestinal Disorder Patients |

| By Region | Kuala Lumpur & Selangor (Central Region) Penang & Kedah (Northern Region) Johor & Negeri Sembilan (Southern Region) Sabah & Sarawak (Eastern Region) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 45 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Distributors | 38 | Sales Managers, Distribution Heads |

| Healthcare Professionals in Parenteral Nutrition | 42 | Clinical Nutritionists, Dietitians |

| Regulatory Bodies and Health Authorities | 18 | Policy Makers, Regulatory Affairs Specialists |

| Research Institutions and Academia | 27 | Researchers, Professors in Nutrition and Pharmacy |

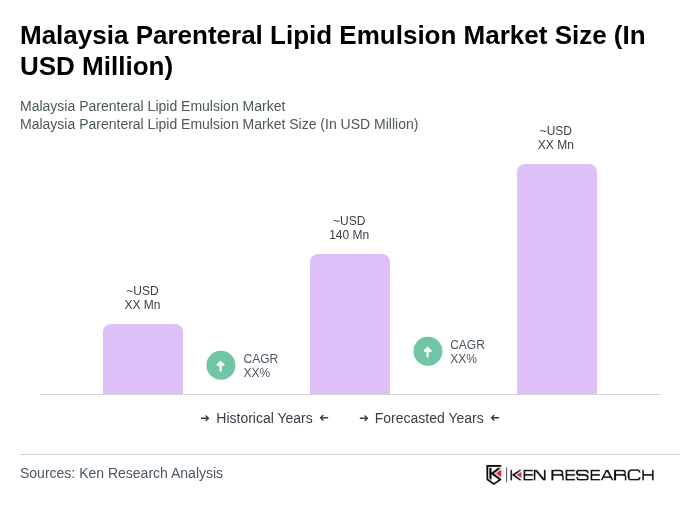

The Malaysia Parenteral Lipid Emulsion Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by increased adoption of parenteral nutrition and advancements in lipid emulsion formulations.