Region:Asia

Author(s):Rebecca

Product Code:KRAC8386

Pages:92

Published On:November 2025

By Type:The market is segmented into various types of clinical nutrition products, including Enteral Nutrition, Parenteral Nutrition, Oral Nutritional Supplements, Pediatric Nutrition, Adult Nutrition, Geriatric Nutrition, Disease-Specific Nutrition, and Others. Among these, Oral Nutritional Supplements and Enteral Nutrition are currently dominating the market due to their convenience, established use in both hospital and homecare settings, and increasing consumer preference for easy-to-consume nutritional solutions. The growing trend of self-care, preventive health measures, and the need for nutritional support in chronic disease management have led to a surge in demand for these products, particularly among adults and the elderly .

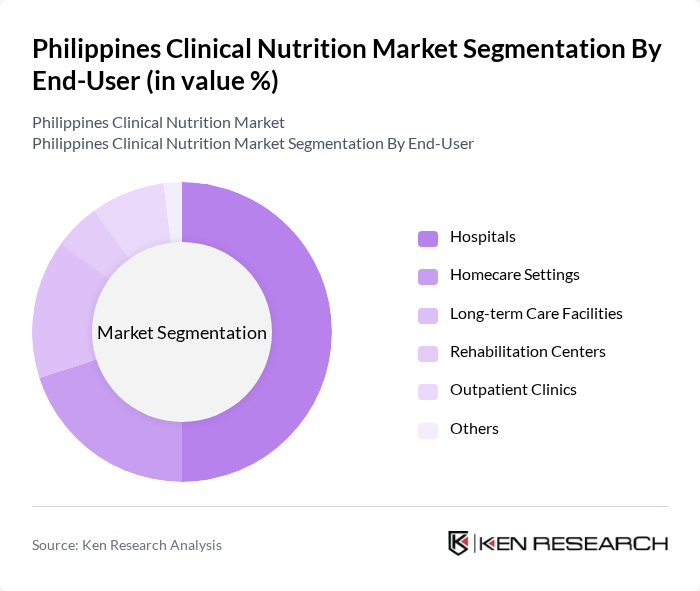

By End-User:The clinical nutrition market is segmented by end-users, including Hospitals, Homecare Settings, Long-term Care Facilities, Rehabilitation Centers, Outpatient Clinics, and Others. Hospitals are the leading end-user segment, driven by the increasing number of patients requiring specialized nutritional support during recovery and the rising trend of hospitalizations for chronic diseases. Homecare settings are also gaining traction as more patients seek nutritional support outside of traditional healthcare facilities, supported by the growth of specialty health stores and improved access to clinical nutrition products .

The Philippines Clinical Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi, Mead Johnson Nutrition, Baxter International, GlaxoSmithKline, Herbalife Nutrition Ltd., B. Braun Melsungen AG, United Laboratories, Inc. (Unilab), Vitacare, BioEssence, USANA Health Sciences, Mead Johnson & Company, LLC, Aspen Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines clinical nutrition market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The increasing integration of digital health solutions, such as telehealth services, is expected to enhance access to nutrition counseling and product recommendations. Additionally, the growing trend towards preventive healthcare will likely encourage consumers to invest in clinical nutrition products, fostering a proactive approach to health management and creating new avenues for market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Enteral Nutrition Parenteral Nutrition Oral Nutritional Supplements Pediatric Nutrition Adult Nutrition Geriatric Nutrition Disease-Specific Nutrition (e.g., for cancer, metabolic disorders) Others |

| By End-User | Hospitals Homecare Settings Long-term Care Facilities Rehabilitation Centers Outpatient Clinics Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Retail Supermarkets and Hypermarkets Direct Sales (Medical Detailing) Others |

| By Formulation | Powdered Formulations Liquid Formulations Ready-to-Use Formulations Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Nutritional Content | High Protein Low Carb Gluten-Free Fiber-Enriched Others |

| By Policy Support | Subsidies for Clinical Nutrition Products Tax Incentives for Manufacturers Research Grants for Nutritional Studies Public Health Nutrition Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Nutritionists in Hospitals | 60 | Registered Nutritionists, Clinical Dietitians |

| Outpatient Nutrition Services | 50 | Healthcare Providers, Nutrition Program Coordinators |

| Nutrition Education Programs | 40 | Public Health Officials, Community Health Workers |

| Patient Experience Surveys | 100 | Patients receiving clinical nutrition services |

| Healthcare Policy Makers | 40 | Government Health Officials, Policy Analysts |

The Philippines Clinical Nutrition Market is valued at approximately USD 70 million, driven by factors such as the increasing prevalence of chronic diseases, a growing aging population, and rising health awareness among consumers.