Philippines Parenteral Nutrition Market Overview

- The Philippines Parenteral Nutrition Market is valued at USD 20 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of chronic diseases, a rise in the geriatric population, and advancements in healthcare infrastructure. The demand for parenteral nutrition solutions has surged due to the growing awareness of nutritional support in clinical settings, particularly for patients unable to consume food orally. Recent trends include the adoption of multi-chamber bags for improved safety and convenience, and the integration of digital monitoring for nutrition therapy optimization .

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Parenteral Nutrition Market. Metro Manila leads due to its concentration of healthcare facilities and advanced medical services, while Cebu and Davao are significant due to their growing healthcare infrastructure and increasing patient populations. These cities are pivotal in driving the demand for parenteral nutrition products, supported by a robust network of hospitals and clinics .

- The Philippines government has implemented regulations to ensure the safety and efficacy of parenteral nutrition products. The Department of Health (DOH), through the Food and Drug Administration (FDA) Philippines, enforces Administrative Order No. 2014-0030, “Guidelines on the Unified Licensing Requirements and Procedures of the Food and Drug Administration,” which mandates that all parenteral nutrition solutions must comply with Good Manufacturing Practice (GMP) standards, undergo product registration, and pass pre-market evaluation and post-market surveillance before approval. This regulation aims to enhance patient safety and ensure that healthcare providers have access to high-quality nutritional products .

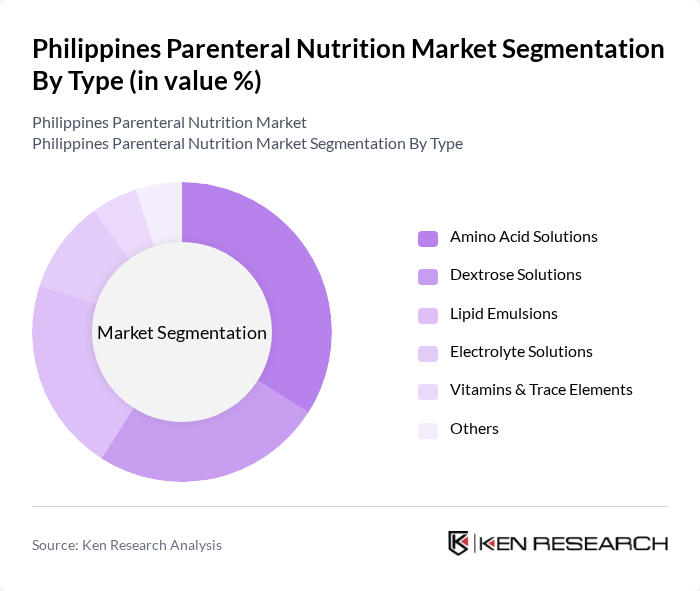

Philippines Parenteral Nutrition Market Segmentation

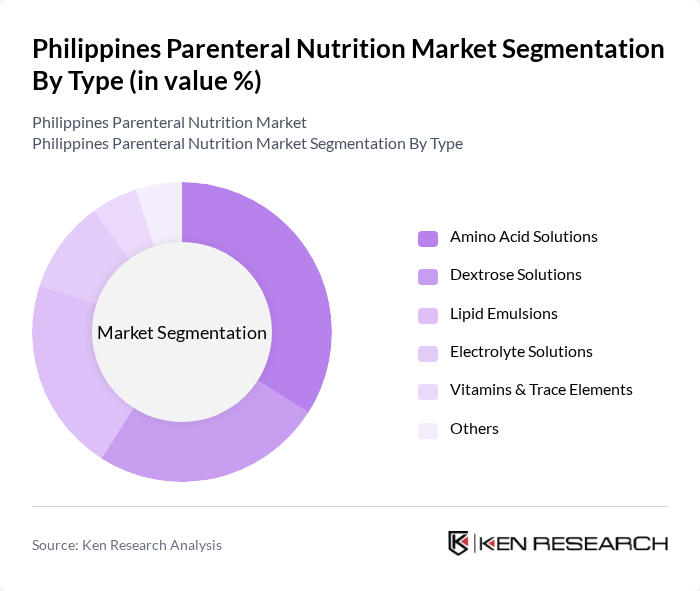

By Type:The market is segmented into various types of parenteral nutrition solutions, including Amino Acid Solutions, Dextrose Solutions, Lipid Emulsions, Electrolyte Solutions, Vitamins & Trace Elements, and Others. Among these, Amino Acid Solutions are currently dominating the market due to their essential role in providing the necessary building blocks for protein synthesis in patients who cannot consume food orally. The increasing incidence of malnutrition and the need for tailored nutritional support in hospitals and homecare settings are driving the demand for these solutions. Recent innovations include the introduction of balanced amino acid formulations and the use of lipid emulsions with improved safety profiles .

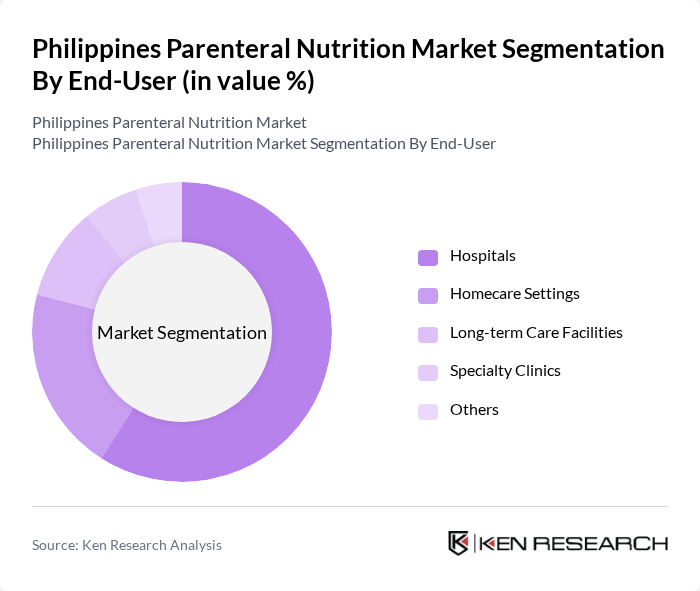

By End-User:The parenteral nutrition market is segmented by end-users, including Hospitals, Homecare Settings, Long-term Care Facilities, Specialty Clinics, and Others. Hospitals are the leading end-user segment, primarily due to the high demand for nutritional support in critical care and surgical units. The increasing number of patients requiring parenteral nutrition in hospital settings, coupled with advancements in medical technology, is driving the growth of this segment. There is also a gradual increase in home-based parenteral nutrition, reflecting a shift towards outpatient and remote care models .

Philippines Parenteral Nutrition Market Competitive Landscape

The Philippines Parenteral Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Otsuka Pharmaceutical Co., Ltd., Clinigen Group plc, EUSA Pharma, Grifols S.A., Terumo Corporation, Pfizer Inc., Merck KGaA, Amgen Inc., Hikma Pharmaceuticals PLC, Sandoz (a Novartis division), Astellas Pharma Inc., Sanofi S.A., Zuellig Pharma Philippines, United Laboratories, Inc. (Unilab), Metro Drug Inc., Lloyd Laboratories Inc., DKSH Philippines contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Parenteral Nutrition Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The Philippines is witnessing a significant rise in chronic diseases, with the World Health Organization reporting that non-communicable diseases accounted for68% of total deathsin recent years.This trend is expected to continue, with an estimatedFilipinos diagnosed with diabetes in future. Such health challenges necessitate effective nutritional interventions, driving demand for parenteral nutrition solutions tailored to manage these conditions effectively.

- Rising Geriatric Population:The geriatric population in the Philippines is projected to reachapproximately 12 millionin future, according to the Philippine Statistics Authority.This demographic shift is accompanied by an increased prevalence of age-related health issues, necessitating specialized nutritional support. Parenteral nutrition offers a viable solution for elderly patients who may have difficulty absorbing nutrients through traditional means, thus propelling market growth in this segment.

- Advancements in Parenteral Nutrition Formulations:Innovations in parenteral nutrition formulations are enhancing the efficacy and safety of these products. The introduction of new amino acid blends and lipid emulsions is expected to improve patient outcomes significantly. The Philippine Food and Drug Administration has approved several new formulations in recent years, reflecting a commitment to advancing nutritional therapies, which is anticipated to boost market demand as healthcare providers adopt these innovations.

Market Challenges

- High Cost of Parenteral Nutrition Products:The cost of parenteral nutrition products remains a significant barrier to access in the Philippines. A typical parenteral nutrition regimen can cost betweenper day, making it unaffordable for many patients, especially in lower-income brackets. This financial strain limits the widespread adoption of these essential nutritional therapies, hindering market growth.

- Limited Access in Rural Areas:Access to parenteral nutrition products is particularly challenging in rural regions of the Philippines, where healthcare infrastructure is often inadequate. According to the Department of Health, onlyabout 30% of rural health facilitiesare equipped to provide specialized nutritional support.This disparity in access creates significant barriers for patients who require parenteral nutrition, limiting the overall market potential in these underserved areas.

Philippines Parenteral Nutrition Market Future Outlook

The future of the parenteral nutrition market in the Philippines appears promising, driven by increasing healthcare investments and a growing focus on personalized nutrition. As the government enhances healthcare infrastructure, more patients will gain access to essential nutritional therapies. Additionally, the integration of technology in nutrition management is expected to streamline patient care, improving outcomes and driving demand for innovative parenteral nutrition solutions tailored to individual needs.

Market Opportunities

- Expansion of Healthcare Infrastructure:The Philippine government is investing heavily in healthcare infrastructure, with a budget allocation ofover PHP 200 billion in future.This investment aims to improve access to healthcare services, including specialized nutritional therapies, creating a favorable environment for the growth of the parenteral nutrition market.

- Development of Innovative Products:There is a growing opportunity for companies to develop innovative parenteral nutrition products that cater to specific patient needs. With the increasing prevalence of chronic diseases, tailored formulations that address unique nutritional requirements can significantly enhance patient outcomes and drive market growth, particularly in urban healthcare settings.