Region:Asia

Author(s):Rebecca

Product Code:KRAB0211

Pages:93

Published On:August 2025

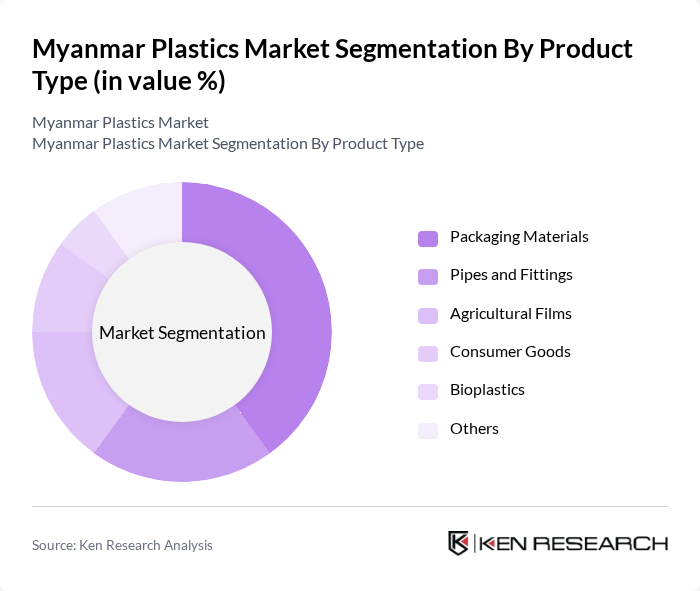

By Product Type:The product type segmentation includes packaging materials, pipes and fittings, agricultural films, consumer goods, bioplastics, and others. Among these, packaging materials dominate the market due to their extensive use in food and beverage industries, driven by consumer demand for convenience, safety, and shelf-life extension. The rise in e-commerce and retail sectors has further propelled the need for innovative, protective, and sustainable packaging solutions, making this sub-segment a key driver in the overall market landscape.

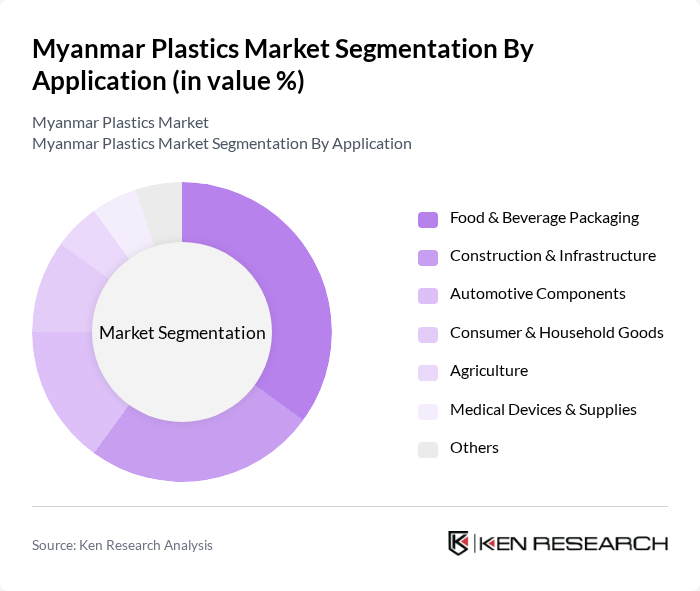

By Application:The application segmentation encompasses food & beverage packaging, construction & infrastructure, automotive components, consumer & household goods, agriculture, medical devices & supplies, and others. Food & beverage packaging is the leading application area, driven by the increasing demand for packaged food products and beverages, especially with the rise of urban lifestyles and on-the-go consumption. Innovations in packaging, such as lightweight, recyclable, and tamper-evident solutions, have become critical for market growth. Construction and infrastructure applications also contribute substantially, with plastics used in pipes, fittings, insulation, and building materials.

The Myanmar Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Myanmar Plastic Industries Ltd., Aung Myin Hmu Plastic Co., Ltd., Myanmar Polypropylene Co., Ltd., Shwe Pyi Tan Plastic Factory, Myaungmya Plastic Factory, Golden Myanmar Plastic Industries, Myanmar Plastic & Packaging Industries Co., Ltd., Asia Plastic Manufacturing Co., Ltd., Yadanar Plastic Co., Ltd., Mandalay Plastic Factory, Hlaing Plastic Co., Ltd., Thura Plastic Co., Ltd., Kachin Plastic Industries, Naypyidaw Plastic Co., Ltd., Yangon Plastic Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Myanmar plastics market appears promising, driven by increasing demand for sustainable packaging solutions and government support for industrial growth. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in biodegradable materials and innovative production technologies. Additionally, the expansion of e-commerce is expected to create new opportunities for packaging solutions, further stimulating market growth. Overall, the combination of rising consumer awareness and supportive policies will shape a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Packaging Materials Pipes and Fittings Agricultural Films Consumer Goods Bioplastics Others |

| By Application | Food & Beverage Packaging Construction & Infrastructure Automotive Components Consumer & Household Goods Agriculture Medical Devices & Supplies Others |

| By End-User Industry | Packaging Industry Building & Construction Agriculture Automotive Electrical & Electronics Others |

| By Region | Yangon Mandalay Naypyidaw Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Packaging Manufacturers | 60 | Production Managers, Sales Directors |

| Recycling Facility Operators | 45 | Operations Managers, Environmental Compliance Officers |

| Retail Sector Distributors | 40 | Supply Chain Managers, Procurement Specialists |

| Consumer Goods Producers | 55 | Product Development Managers, Marketing Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The Myanmar Plastics Market is valued at approximately USD 1.1 billion, based on a five-year historical analysis. This valuation reflects the latest volume-based estimates and average price levels for plastics in the region.