Region:Asia

Author(s):Geetanshi

Product Code:KRAC0008

Pages:96

Published On:August 2025

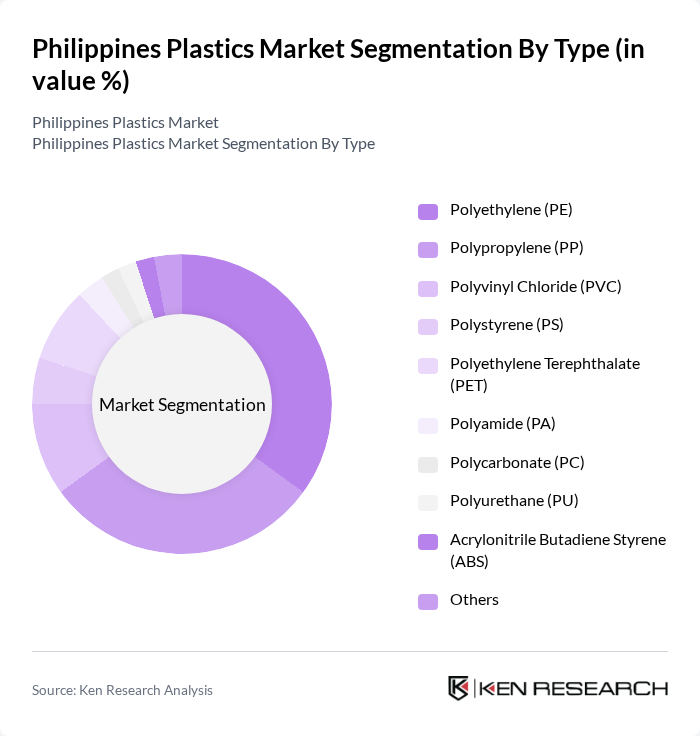

By Type:The plastics market in the Philippines is segmented into various types, including Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Polyamide (PA), Polycarbonate (PC), Polyurethane (PU), Acrylonitrile Butadiene Styrene (ABS), and Others. Among these, Polyethylene (PE) and Polypropylene (PP) are the leading subsegments due to their versatility and widespread use in packaging, consumer goods, and construction. The demand for these materials is driven by their cost-effectiveness, adaptability to various applications, and strong presence in both flexible and rigid packaging.

By Application:The applications of plastics in the Philippines are diverse, including Packaging, Construction, Automotive & Transportation, Electrical & Electronics, Consumer Goods, Healthcare & Medical Devices, Agriculture, and Others. The packaging segment dominates the market due to the increasing demand for food and beverage packaging solutions, as well as the rapid growth of e-commerce and retail. Construction is the second-largest application, driven by infrastructure development and urbanization. Medical devices are emerging as a fast-growing segment, reflecting rising healthcare investments.

The Philippines Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petron Corporation, Chemrez Technologies, Inc., NPC Alliance Corporation, D&L Industries, Inc., Philippine Resins Industries, Inc., Nan Ya Plastics Corporation, JG Summit Petrochemical Corporation, Universal Robina Corporation, San Miguel Corporation, First Philippine Industrial Corporation, Dow Chemical Philippines, Inc., LyondellBasell Industries, DuPont Far East, Inc., BASF Philippines, Inc., Philippine Plastics Industry Association, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines plastics market is poised for transformation as sustainability becomes a central theme in production and consumption. With government initiatives promoting eco-friendly practices and the rise of biodegradable alternatives, manufacturers are likely to invest in innovative solutions. Additionally, the ongoing expansion of the construction and packaging sectors will continue to drive demand. As consumer awareness regarding plastic waste increases, companies that adapt to these trends will find new avenues for growth and profitability in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Polyamide (PA) Polycarbonate (PC) Polyurethane (PU) Acrylonitrile Butadiene Styrene (ABS) Others |

| By Application | Packaging Construction Automotive & Transportation Electrical & Electronics Consumer Goods Healthcare & Medical Devices Agriculture Others |

| By End-User Industry | Packaging Automotive & Transportation Infrastructure & Construction Consumer Goods Healthcare & Pharmaceuticals Electrical & Electronics Others |

| By Sales Channel | Direct Sales Distributors Online Retail Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Medium High |

| By Sustainability Level | Conventional Plastics Biodegradable Plastics Recycled Plastics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Insights | 150 | Production Managers, Quality Control Supervisors |

| Retail Market Analysis | 100 | Store Managers, Category Buyers |

| Environmental Impact Studies | 80 | Environmental Scientists, Policy Makers |

| Consumer Behavior Research | 120 | End Consumers, Sustainability Advocates |

| Recycling and Waste Management | 90 | Waste Management Officers, Recycling Plant Managers |

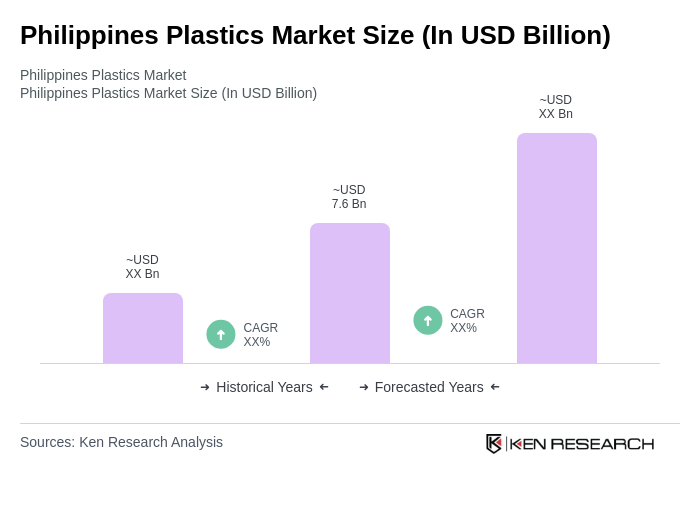

The Philippines Plastics Market is valued at approximately USD 7.6 billion, driven by increasing demand for packaging solutions, particularly in the food and beverage sector, and rising construction activities across the country.