Region:Central and South America

Author(s):Rebecca

Product Code:KRAB2924

Pages:80

Published On:October 2025

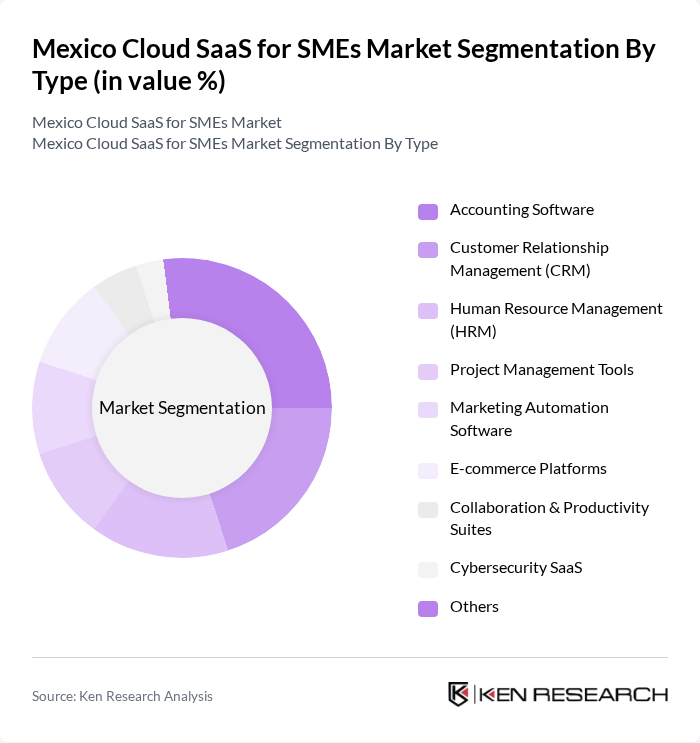

By Type:This segmentation includes various software solutions that cater to the operational needs of SMEs. The subsegments are Accounting Software, Customer Relationship Management (CRM), Human Resource Management (HRM), Project Management Tools, Marketing Automation Software, E-commerce Platforms, Collaboration & Productivity Suites, Cybersecurity SaaS, and Others. Each of these subsegments plays a crucial role in enhancing business efficiency and productivity.

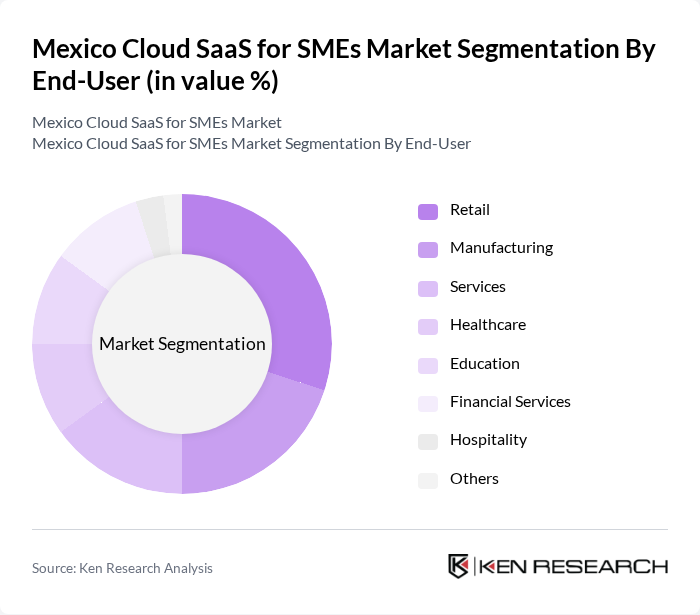

By End-User:This segmentation focuses on the various industries that utilize cloud SaaS solutions. The subsegments include Retail, Manufacturing, Services, Healthcare, Education, Financial Services, Hospitality, and Others. Each industry has unique requirements and benefits from tailored SaaS solutions that enhance operational efficiency and customer engagement.

The Mexico Cloud SaaS for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft, Oracle, SAP, Salesforce, Google Cloud, Zoho, HubSpot, Freshworks, Odoo, QuickBooks (Intuit), Xero, Bitrix24, Kio Networks, NEORIS, CONTPAQi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico Cloud SaaS market for SMEs appears promising, driven by ongoing digital transformation and increasing internet accessibility. As more SMEs recognize the cost benefits and operational efficiencies of cloud solutions, adoption rates are expected to rise significantly. Additionally, the integration of advanced technologies such as AI and automation will further enhance service offerings, making cloud SaaS an essential component of SME growth strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Accounting Software Customer Relationship Management (CRM) Human Resource Management (HRM) Project Management Tools Marketing Automation Software E-commerce Platforms Collaboration & Productivity Suites Cybersecurity SaaS Others |

| By End-User | Retail Manufacturing Services Healthcare Education Financial Services Hospitality Others |

| By Business Size | Micro Enterprises Small Enterprises Medium Enterprises |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium |

| By Industry Vertical | Financial Services Real Estate Transportation and Logistics Professional Services Public Sector Others |

| By Geographic Coverage | Urban Areas Rural Areas Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Cloud Adoption Trends | 120 | IT Managers, Business Owners |

| Industry-Specific SaaS Needs | 90 | Operations Managers, Financial Officers |

| Challenges in Cloud Migration | 60 | Technical Leads, Project Managers |

| Perceptions of Cloud Security | 50 | Compliance Officers, Risk Managers |

| Future SaaS Trends for SMEs | 70 | Industry Analysts, Technology Consultants |

The Mexico Cloud SaaS for SMEs market is valued at approximately USD 2.6 billion, reflecting significant growth driven by the increasing adoption of digital transformation initiatives among small and medium enterprises.