Region:Europe

Author(s):Shubham

Product Code:KRAA4940

Pages:85

Published On:September 2025

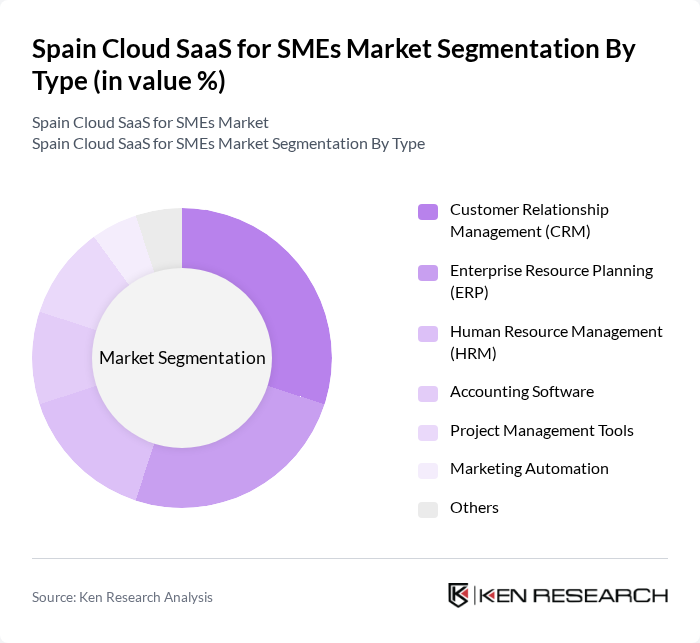

By Type:The market is segmented into various types of cloud-based software solutions that cater to the diverse needs of SMEs. The primary subsegments include Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Resource Management (HRM), Accounting Software, Project Management Tools, Marketing Automation, and Others. Among these, CRM solutions are particularly popular as they help businesses manage customer interactions and improve sales processes.

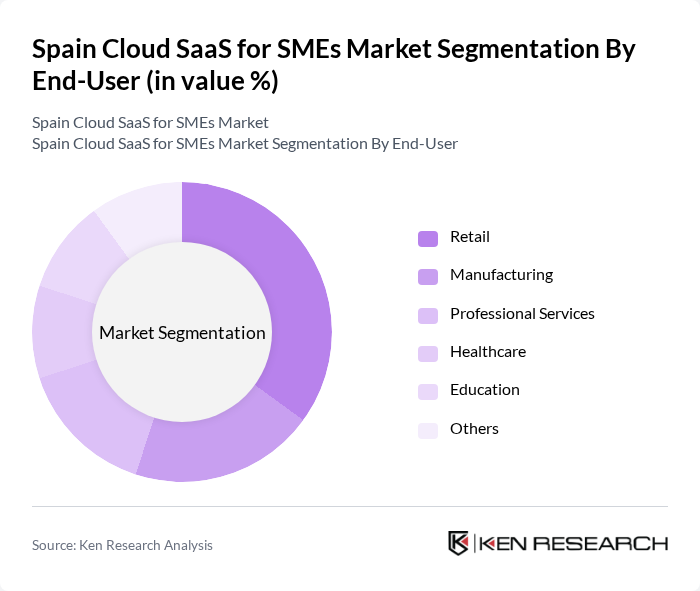

By End-User:The end-user segmentation includes various industries that utilize cloud SaaS solutions, such as Retail, Manufacturing, Professional Services, Healthcare, Education, and Others. The retail sector is a significant contributor to the market, driven by the need for efficient inventory management and customer engagement tools.

The Spain Cloud SaaS for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, SAP SE, Microsoft Corporation, Oracle Corporation, Zoho Corporation, HubSpot, Inc., Freshworks Inc., Xero Limited, QuickBooks (Intuit Inc.), Adobe Inc., Asana, Inc., Monday.com Ltd., Smartsheet Inc., ServiceTitan, Inc., Wrike, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Cloud SaaS market for SMEs appears promising, driven by ongoing digital transformation efforts and increasing reliance on technology. As more SMEs recognize the benefits of cloud solutions, particularly in enhancing operational efficiency and supporting remote work, adoption rates are expected to rise significantly. Additionally, the integration of advanced technologies like AI and machine learning will further enhance the capabilities of cloud SaaS offerings, making them more attractive to SMEs seeking competitive advantages in their respective industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Relationship Management (CRM) Enterprise Resource Planning (ERP) Human Resource Management (HRM) Accounting Software Project Management Tools Marketing Automation Others |

| By End-User | Retail Manufacturing Professional Services Healthcare Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-as-you-go Others |

| By Industry Vertical | Financial Services Telecommunications Transportation and Logistics Energy and Utilities Others |

| By Company Size | Micro Enterprises Small Enterprises Medium Enterprises Others |

| By Geographic Region | Northern Spain Southern Spain Eastern Spain Western Spain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Cloud Adoption Trends | 150 | IT Managers, Business Owners |

| Sector-Specific SaaS Utilization | 100 | Operations Managers, Financial Officers |

| Barriers to Cloud Migration | 80 | Technology Consultants, Business Analysts |

| Impact of Government Initiatives | 70 | Policy Makers, Industry Experts |

| Future SaaS Needs and Expectations | 90 | Product Managers, Marketing Directors |

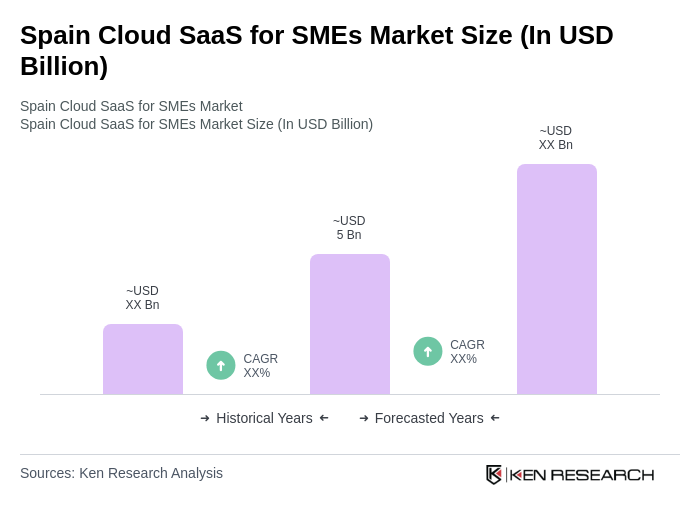

The Spain Cloud SaaS market for SMEs is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital transformation initiatives among small and medium enterprises seeking to enhance operational efficiency and customer engagement.