Region:Middle East

Author(s):Dev

Product Code:KRAC3427

Pages:81

Published On:October 2025

By Component:The market is segmented intoSoftwareandServices. The Software segment leads due to the increasing demand for comprehensive ERP solutions that integrate business functions such as finance, supply chain, and human resources. Services—including implementation, customization, and ongoing support—remain essential as organizations seek expert assistance in deploying and maintaining ERP systems .

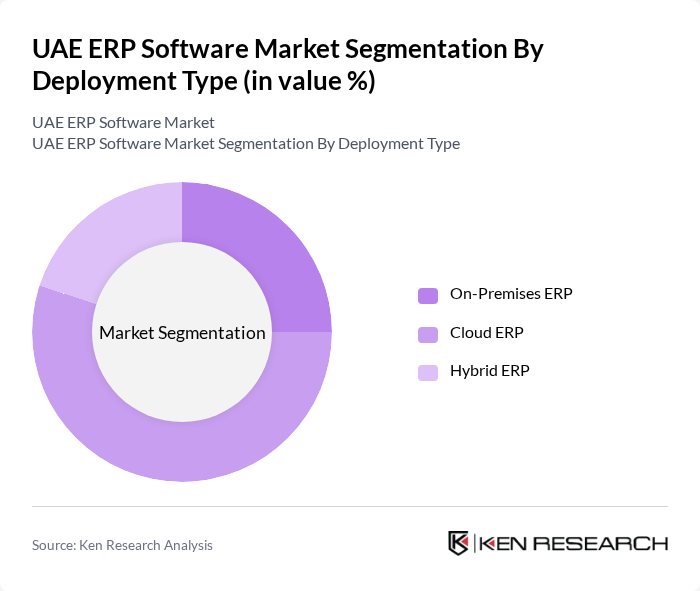

By Deployment Type:The market is categorized intoOn-Premises ERP,Cloud ERP, andHybrid ERP. Cloud ERP is currently dominating the market due to its flexibility, scalability, lower upfront costs, and ease of updates, making it attractive for businesses of all sizes. On-Premises ERP remains relevant for organizations with specific security and compliance requirements, while Hybrid ERP offers a balanced approach for those seeking both control and cloud benefits .

The UAE ERP Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Middle East & North Africa (L.L.C), Oracle Corporation, Microsoft Gulf FZ LLC, Infor FZ LLC, Sage Software Middle East FZ-LLC, Epicor Software Middle East Ltd, Odoo S.A., IFS AB, Unit4, Zoho Corporation, Acumatica, Syspro, QAD Inc., Workday, Inc., IBM Middle East FZ LLC, D2M Solutions Ltd (ESI Services), TrueBays IT Software Trading LLC, and Doosan Heavy Industries UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE ERP software market is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly prioritize digital transformation, the integration of AI and machine learning into ERP systems will enhance operational efficiency and decision-making capabilities. Furthermore, the growing emphasis on user experience will lead to more intuitive interfaces, making ERP solutions more accessible to a broader range of businesses, including SMEs, which are expected to play a crucial role in market growth.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services |

| By Deployment Type | On-Premises ERP Cloud ERP Hybrid ERP |

| By Function | Financial Management Human Resource Management Customer Management Inventory Management Supply Chain Management Others |

| By End User | Manufacturing BFSI Healthcare Retail Government & Utilities IT & Telecom Others |

| By Region | Dubai Abu Dhabi Sharjah Rest of UAE |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector ERP Adoption | 60 | IT Managers, Operations Directors |

| Retail Industry ERP Implementation | 50 | Supply Chain Managers, Retail Executives |

| Healthcare ERP Solutions | 40 | Healthcare Administrators, IT Directors |

| Financial Services ERP Usage | 55 | CFOs, Financial Analysts |

| Government Sector ERP Integration | 45 | Public Sector IT Managers, Policy Makers |

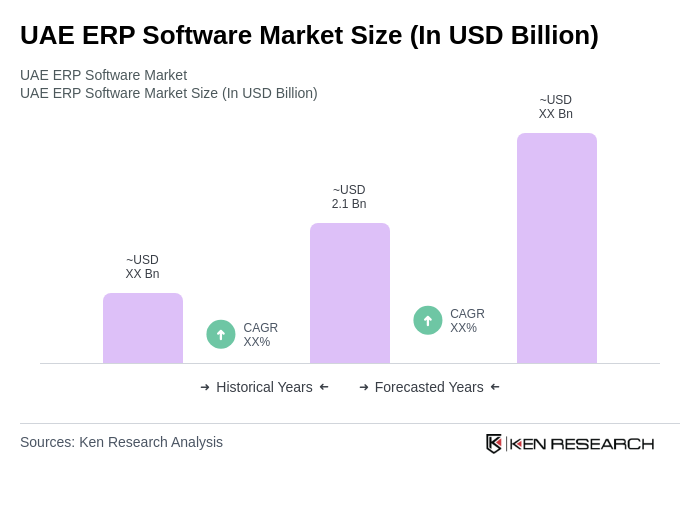

The UAE ERP Software Market is valued at approximately USD 2.1 billion, driven by the increasing adoption of digital transformation initiatives across various sectors, including manufacturing, retail, healthcare, and banking.