Mexico Digital Healthcare Wearables Market Overview

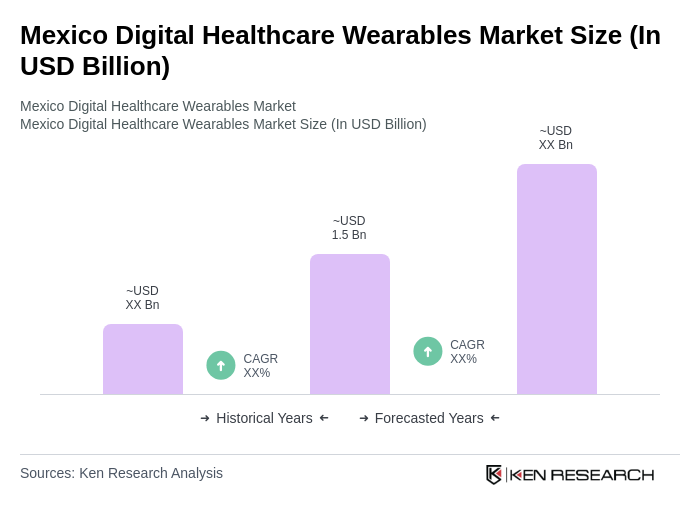

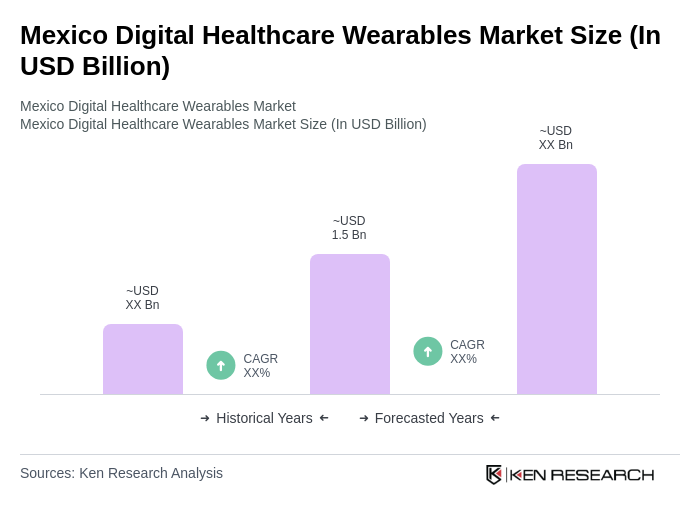

- The Mexico Digital Healthcare Wearables Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of chronic diseases, rising health awareness among consumers, and advancements in technology that enhance the functionality of wearables. The integration of artificial intelligence and machine learning in health monitoring devices has further propelled market expansion.

- Key cities such as Mexico City, Guadalajara, and Monterrey dominate the market due to their high population density, urbanization, and access to healthcare facilities. These cities also have a growing tech-savvy population that is increasingly adopting digital health solutions, making them pivotal in the growth of the digital healthcare wearables market.

- In 2023, the Mexican government implemented regulations mandating that all wearable health devices must comply with safety and efficacy standards set by the Federal Commission for the Protection against Sanitary Risk (COFEPRIS). This regulation aims to ensure that consumers have access to safe and reliable health monitoring devices, thereby fostering trust in digital healthcare solutions.

Mexico Digital Healthcare Wearables Market Segmentation

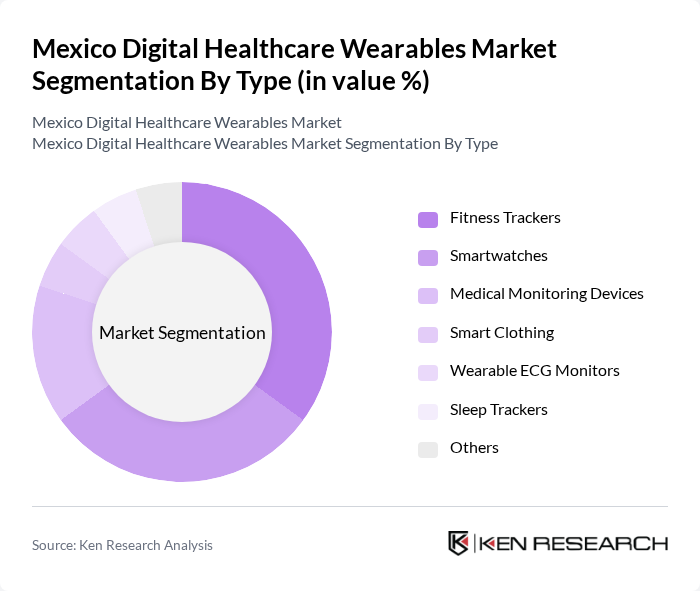

By Type:The market is segmented into various types of digital healthcare wearables, including fitness trackers, smartwatches, medical monitoring devices, smart clothing, wearable ECG monitors, sleep trackers, and others. Among these, fitness trackers and smartwatches are the most popular due to their multifunctionality and ease of use. The increasing focus on health and fitness has led to a surge in demand for these devices, making them the leading subsegments in the market.

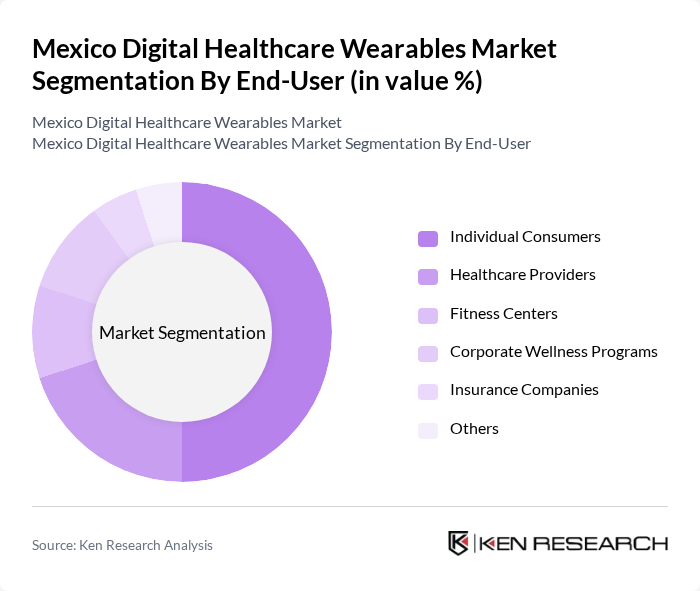

By End-User:The end-user segmentation includes individual consumers, healthcare providers, fitness centers, corporate wellness programs, insurance companies, and others. Individual consumers represent the largest segment, driven by the growing trend of personal health management and fitness tracking. The increasing adoption of wearables for health monitoring among consumers has significantly contributed to this segment's dominance.

Mexico Digital Healthcare Wearables Market Competitive Landscape

The Mexico Digital Healthcare Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Fitbit, Inc., Garmin Ltd., Samsung Electronics Co., Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Philips Healthcare, Medtronic plc, Withings S.A., Polar Electro Oy, Oura Health Ltd., Whoop, Inc., BioTelemetry, Inc., Abbott Laboratories, AliveCor, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Mexico Digital Healthcare Wearables Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and hypertension in Mexico is a significant growth driver for digital healthcare wearables. According to the World Health Organization, approximately 13 million Mexicans suffer from diabetes, and the prevalence of hypertension is around 31%. This growing health crisis necessitates innovative solutions like wearables for monitoring health metrics, thereby driving market demand. The increasing burden on healthcare systems further emphasizes the need for effective management tools.

- Rising Health Awareness Among Consumers:Health awareness in Mexico is on the rise, with a reported 62% of the population actively seeking ways to improve their health. This trend is supported by the National Institute of Public Health, which indicates that 72% of Mexicans are now more conscious of their lifestyle choices. As consumers become more proactive about their health, the demand for wearables that track fitness and health metrics is expected to increase, driving market growth significantly.

- Technological Advancements in Wearable Devices:The rapid evolution of technology in wearable devices is a crucial growth driver for the market. In future, it is projected that over 22 million wearable devices will be sold in Mexico, reflecting a 16% increase from previous years. Innovations such as improved battery life, enhanced sensors, and integration with mobile applications are making wearables more appealing. These advancements not only enhance user experience but also expand the functionalities of wearables, attracting a broader consumer base.

Market Challenges

- High Cost of Advanced Wearables:The high cost associated with advanced wearable devices poses a significant challenge in the Mexican market. Premium devices can range from $210 to $520, making them less accessible to a large segment of the population. According to the National Institute of Statistics and Geography, approximately 42% of Mexicans live on less than $6 a day, limiting their ability to invest in such technologies. This economic barrier restricts market penetration and growth potential.

- Data Privacy and Security Concerns:Data privacy and security issues are critical challenges facing the digital healthcare wearables market in Mexico. A survey by the Mexican Association of Internet indicates that 67% of users are concerned about how their health data is managed. With increasing incidents of data breaches globally, consumers are hesitant to adopt wearables that require personal health information. This skepticism can hinder market growth as companies must invest in robust security measures to gain consumer trust.

Mexico Digital Healthcare Wearables Market Future Outlook

The future of the digital healthcare wearables market in Mexico appears promising, driven by technological advancements and increasing health consciousness among consumers. As the government continues to promote digital health initiatives, the integration of wearables into everyday healthcare practices is expected to grow. Additionally, the expansion of telehealth services will likely enhance the functionality and appeal of wearables, making them indispensable tools for health management. This evolving landscape presents significant opportunities for innovation and market growth.

Market Opportunities

- Expansion of Telehealth Services:The growth of telehealth services in Mexico presents a substantial opportunity for wearable manufacturers. With an estimated 32% increase in telehealth consultations expected in future, wearables that facilitate remote monitoring can enhance patient engagement and adherence to treatment plans. This synergy between telehealth and wearables can lead to improved health outcomes and increased market demand.

- Collaborations with Healthcare Providers:Collaborations between wearable manufacturers and healthcare providers can unlock new market opportunities. By integrating wearables into clinical practices, healthcare providers can leverage real-time data for better patient management. This partnership can enhance the credibility of wearables, leading to increased adoption rates among patients and healthcare professionals alike, ultimately driving market growth.