Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB4577

Pages:83

Published On:October 2025

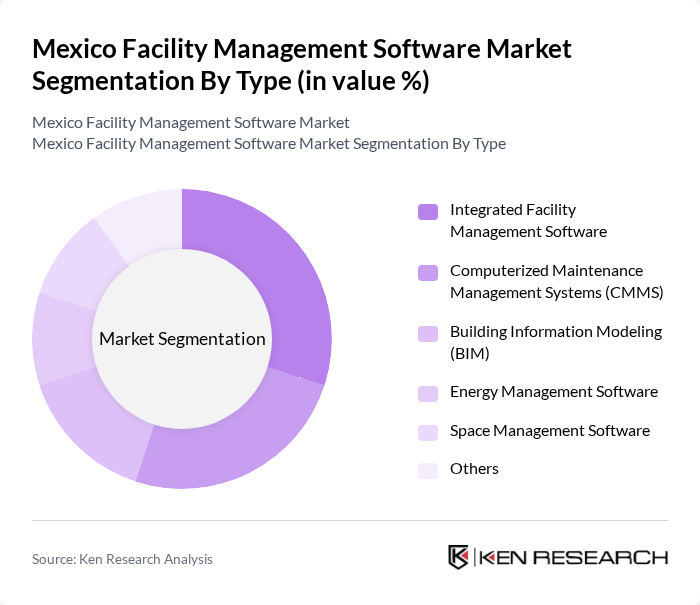

By Type:The facility management software market can be segmented into Integrated Facility Management Software, Computerized Maintenance Management Systems (CMMS), Building Information Modeling (BIM), Energy Management Software, Space Management Software, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and reducing costs for organizations. Integrated Facility Management Software is increasingly preferred for its ability to centralize diverse facility operations, while CMMS and BIM are gaining traction for maintenance automation and digital modeling, respectively .

The Integrated Facility Management Software segment is currently leading the market due to its comprehensive approach to managing various facility operations under a single platform. This software allows organizations to streamline processes, improve communication, and enhance decision-making capabilities. The growing trend of digital transformation in businesses is also contributing to the increased adoption of integrated solutions, as they provide a holistic view of facility management .

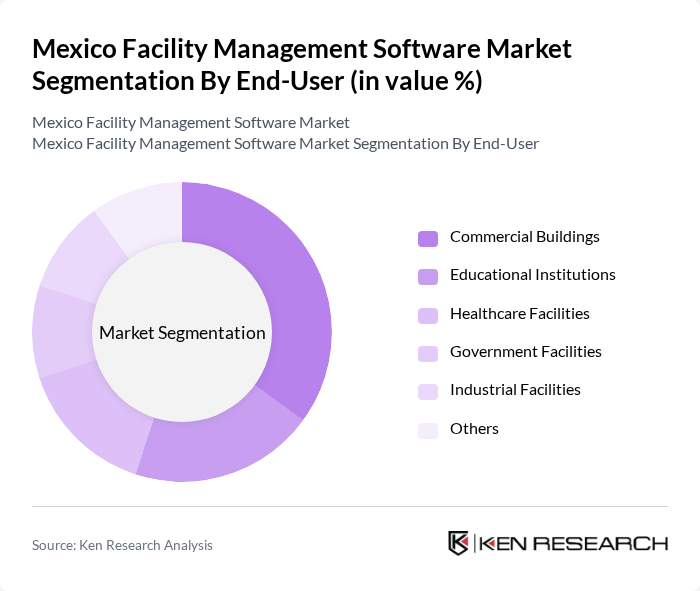

By End-User:The end-user segmentation includes Commercial Buildings, Educational Institutions, Healthcare Facilities, Government Facilities, Industrial Facilities, and Others. Each of these sectors has unique requirements and challenges that facility management software addresses effectively. Commercial buildings represent the largest segment due to the high demand for efficient management solutions in office and retail environments, while healthcare and industrial sectors are rapidly increasing their adoption to meet compliance and operational efficiency goals .

Among the end-user segments, Commercial Buildings dominate the market due to the high demand for efficient management solutions in office spaces and retail environments. The increasing focus on operational efficiency and cost reduction in commercial real estate drives the adoption of facility management software. Additionally, the need for compliance with safety and environmental regulations further propels the demand in this sector .

The Mexico Facility Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Archibus, Inc., Planon Corporation, FMX, Inc., Accruent, LLC, iOffice Corp., SpaceIQ, Inc., MCS Solutions, Axxerion, Trimble Inc., eMaint Enterprises, LLC, Dude Solutions, Inc., and CBRE Group (for facility management integration) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico facility management software market appears promising, driven by technological advancements and increasing awareness of operational efficiency. As businesses continue to embrace digital transformation, the integration of AI and IoT will become more prevalent, enhancing the capabilities of facility management solutions. Additionally, the focus on sustainability will push companies to adopt energy-efficient practices, further driving demand for innovative software solutions that support these initiatives and improve overall facility management.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Facility Management Software Computerized Maintenance Management Systems (CMMS) Building Information Modeling (BIM) Energy Management Software Space Management Software Others |

| By End-User | Commercial Buildings Educational Institutions Healthcare Facilities Government Facilities Industrial Facilities Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Functionality | Maintenance Management Space Management Asset Management Energy Management Security Management |

| By Industry Vertical | Real Estate Retail Manufacturing Hospitality Transportation |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting Services Training and Support Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 60 | Facility Managers, Operations Directors |

| Healthcare Facility Management Software | 50 | Healthcare Administrators, IT Managers |

| Educational Institution Management | 40 | Campus Facility Managers, IT Coordinators |

| Real Estate Management Solutions | 45 | Property Managers, Asset Managers |

| Manufacturing Facility Software | 40 | Production Managers, Maintenance Supervisors |

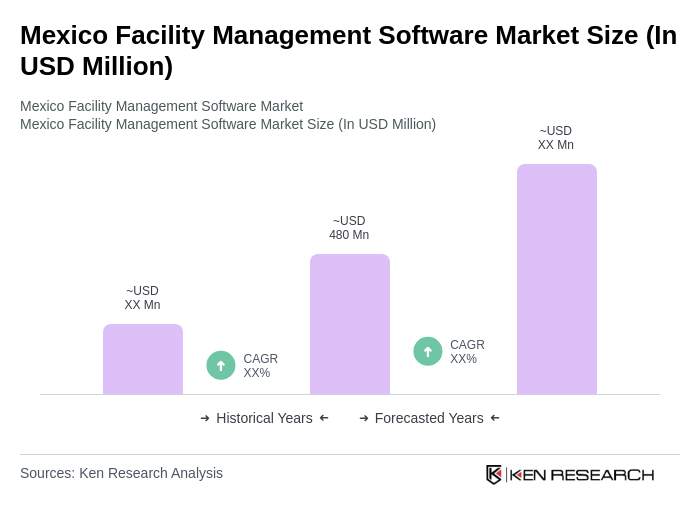

The Mexico Facility Management Software Market is valued at approximately USD 480 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for digital transformation in building operations and asset lifecycle management.