Region:Central and South America

Author(s):Shubham

Product Code:KRAB0544

Pages:100

Published On:August 2025

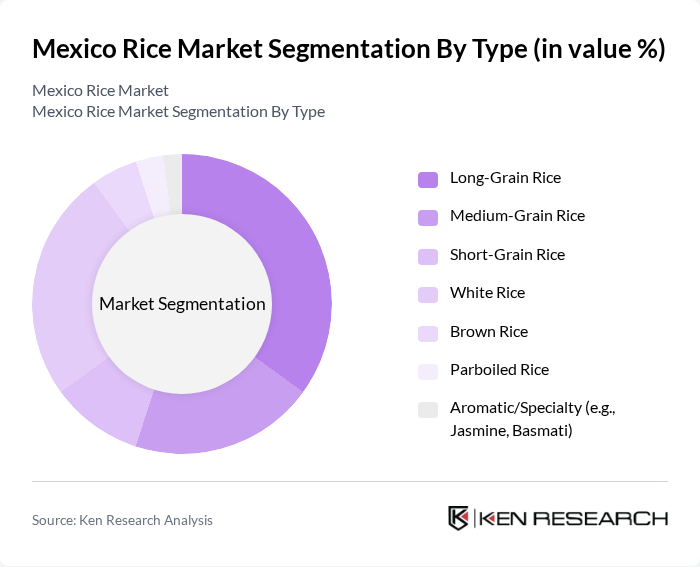

By Type:The rice market can be segmented into various types, including Long-Grain Rice, Medium-Grain Rice, Short-Grain Rice, White Rice, Brown Rice, Parboiled Rice, and Aromatic/Specialty Rice. Among these, Long-Grain Rice is the most popular due to its versatility in cooking and preference among consumers for dishes like fried rice and pilafs. White Rice also holds a significant share, favored for its neutral flavor and quick cooking time. The demand for Brown Rice has been increasing as health trends shift towards whole grains.

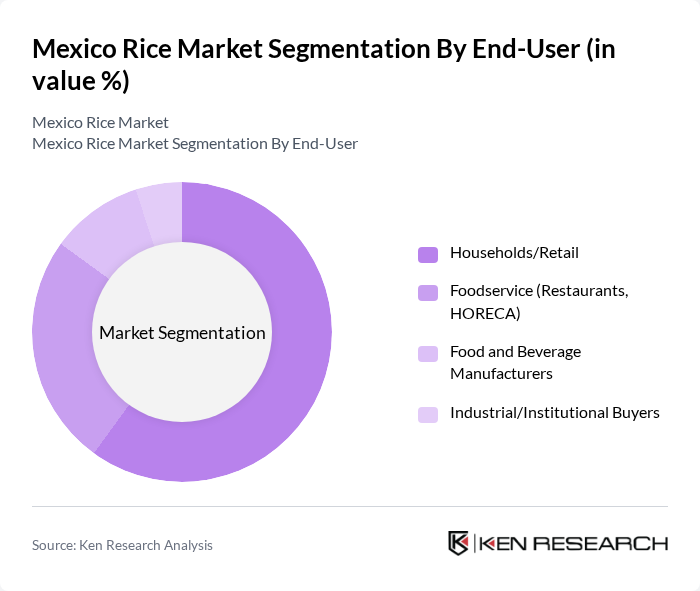

By End-User:The rice market is segmented by end-user into Households/Retail, Foodservice (Restaurants, HORECA), Food and Beverage Manufacturers, and Industrial/Institutional Buyers. Households/Retail dominate the market, driven by the staple nature of rice in Mexican cuisine. The Foodservice sector is also significant, as restaurants and catering services increasingly incorporate rice into their menus, reflecting changing consumer preferences for diverse and international dishes.

The Mexico Rice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo SOS Mexico (Arroz SOS, Doña Pepa), Ebro Foods, S.A. (Brillante; presence in Mexico), Arroz Morelos (Denominación de Origen, growers/processors), Arrocera San Pedro, S.A. de C.V. (brands: San Pedro), Arrocera La Merced, S.A. de C.V. (Arroz La Merced), Grupo Altex (importing, processing, foodservice supply), Cargill de México (rice importing and trading), Suministros de Granos de México (trader/wholesaler), Comercializadora Mayorista de Arroces (COMA), Arrocera Yavaros, S.A. de C.V., Arroz Costeño (Guerrero/Oaxaca regional brand), Arroz La Cosecha (regional packaged brand), Arroz La Huerta del Valle, Walmart de México y Centroamérica (Great Value private label rice), Soriana (private label rice and distribution) contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico rice market is poised for transformation, driven by evolving consumer preferences and technological advancements. As health consciousness rises, demand for organic and fortified rice products is expected to increase, presenting new avenues for growth. Additionally, the integration of e-commerce platforms will facilitate direct-to-consumer sales, enhancing market accessibility. Sustainable farming practices will also gain traction, aligning with global trends towards environmental responsibility, ultimately shaping a more resilient and innovative rice industry in Mexico.

| Segment | Sub-Segments |

|---|---|

| By Type | Long-Grain Rice Medium-Grain Rice Short-Grain Rice White Rice Brown Rice Parboiled Rice Aromatic/Specialty (e.g., Jasmine, Basmati) |

| By End-User | Households/Retail Foodservice (Restaurants, HORECA) Food and Beverage Manufacturers Industrial/Institutional Buyers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience and Traditional Grocery (Tiendas) Wholesale/Cash & Carry Online Retail/E-commerce |

| By Packaging Type | Bulk (25–50 kg) Retail Packs (0.5–10 kg) Ready-to-Cook/Microwaveable Packs Eco-Friendly/Reusable Packaging |

| By Price Range | Premium Mid-Range Economy |

| By Quality | Premium Quality Standard Quality Value/Low Quality |

| By Region | Central Mexico Northern Mexico Pacific Coast The Bajío Yucatán Peninsula Baja California |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rice Farmers | 100 | Farm Owners, Agricultural Managers |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Directors |

| Retail Sector Insights | 70 | Store Managers, Category Buyers |

| Consumer Preferences | 140 | Household Decision Makers, Health-Conscious Consumers |

| Export Market Analysis | 60 | Export Managers, Trade Analysts |

The Mexico Rice Market is valued at approximately USD 1.1 billion, reflecting a steady growth driven by increasing consumer demand for rice as a staple food and a shift towards whole grain and organic varieties.