Region:Middle East

Author(s):Dev

Product Code:KRAA1585

Pages:99

Published On:August 2025

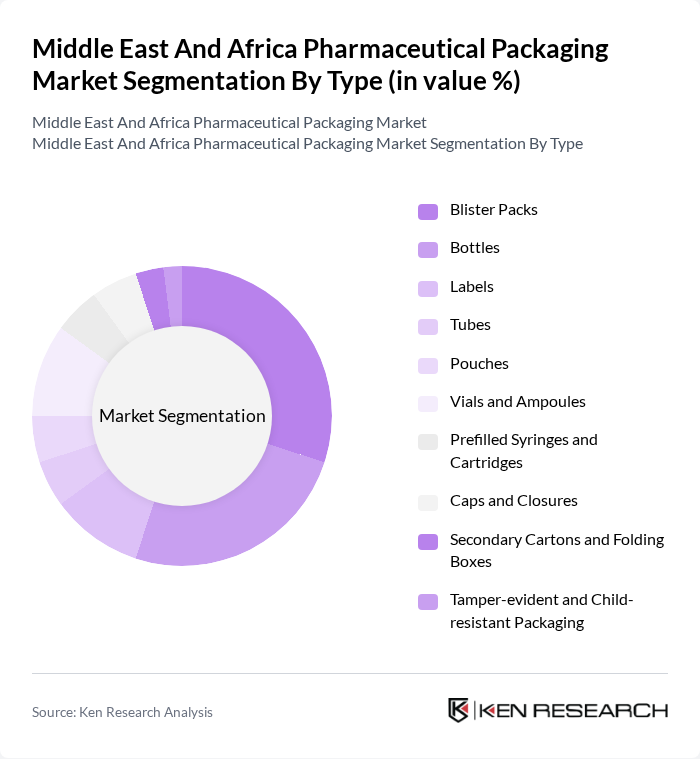

By Type:The market is segmented into various types of packaging solutions, including blister packs, bottles, labels, tubes, pouches, vials and ampoules, prefilled syringes and cartridges, caps and closures, secondary cartons and folding boxes, and tamper-evident and child-resistant packaging. Among these, blister packs are gaining significant traction due to their ability to provide effective protection against moisture and contamination, which is crucial for maintaining the integrity of pharmaceutical products. The increasing consumer preference for unit-dose packaging is also contributing to the growth of this segment.

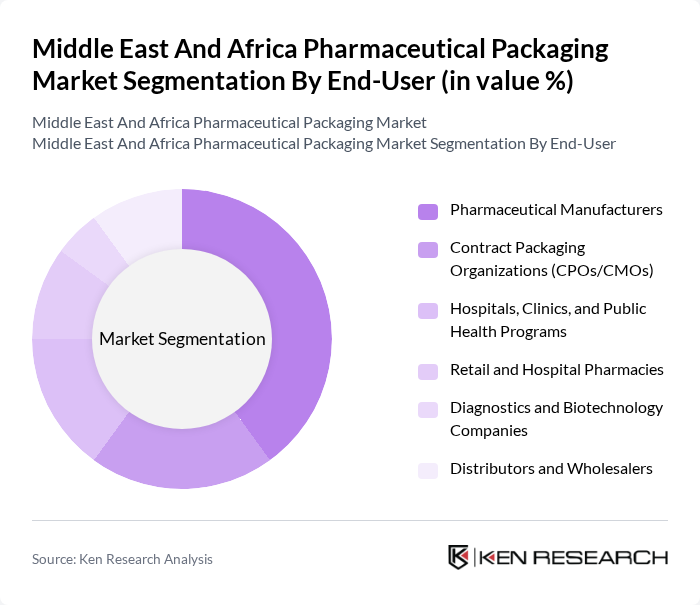

By End-User:The end-user segmentation includes pharmaceutical manufacturers, contract packaging organizations (CPOs/CMOs), hospitals, clinics, public health programs, retail and hospital pharmacies, diagnostics and biotechnology companies, and distributors and wholesalers. Pharmaceutical manufacturers are the leading end-users, driven by the need for efficient and compliant packaging solutions that meet regulatory requirements and enhance product safety. The increasing focus on patient-centric packaging is also influencing this segment's growth.

The Middle East And Africa Pharmaceutical Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, AptarGroup, Inc., Berry Global, Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Mondi Group, Constantia Flexibles Group GmbH, Huhtamaki Oyj, Schott AG, Gerresheimer AG, Nipro Corporation, Stevanato Group S.p.A., CCL Industries Inc., Saudi Arabian Packaging Industry WLL (SAPIN), Nampak Limited, Piramal Pharma Solutions (Packaging Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical packaging market in the Middle East and Africa appears promising, driven by technological advancements and a growing emphasis on sustainability. As the region continues to embrace smart packaging solutions, manufacturers are expected to invest in innovative technologies that enhance product safety and consumer engagement. Additionally, the increasing focus on eco-friendly materials will likely reshape packaging strategies, aligning with global sustainability trends and consumer preferences for environmentally responsible products, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Blister Packs Bottles Labels Tubes Pouches Vials and Ampoules Prefilled Syringes and Cartridges Caps and Closures Secondary Cartons and Folding Boxes Tamper-evident and Child-resistant Packaging |

| By End-User | Pharmaceutical Manufacturers Contract Packaging Organizations (CPOs/CMOs) Hospitals, Clinics, and Public Health Programs Retail and Hospital Pharmacies Diagnostics and Biotechnology Companies Distributors and Wholesalers |

| By Material | Plastic (PE, PP, PET, PVC, Others) Glass (Borosilicate, Type I/II/III) Metal (Aluminum Foils, Lids, Collapsible Tubes) Paper and Paperboard Bioplastics and Sustainable Materials |

| By Application | Solid Dosage Forms (Tablets, Capsules) Liquid Dosage Forms (Oral, Ophthalmic) Injectable and Parenteral Topical and Semi-Solid Vaccines and Cold Chain |

| By Distribution Channel | Direct Sales to Pharma Companies Regional Distributors/Agents Online B2B Platforms Government Tenders and Procurement NGO and Multilateral Procurement |

| By Region | Gulf Cooperation Council (GCC) North Africa South Africa East Africa West and Central Africa |

| By Price Range | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Production Managers, Quality Assurance Heads |

| Packaging Suppliers | 90 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Managers |

| Logistics and Distribution Companies | 80 | Logistics Managers, Supply Chain Analysts |

| Healthcare Professionals | 70 | Pharmacists, Hospital Administrators |

The Middle East and Africa Pharmaceutical Packaging Market is valued at approximately USD 5.3 billion, reflecting a significant growth trajectory driven by the demand for advanced packaging solutions that ensure drug safety and compliance with regulatory standards.