Region:Middle East

Author(s):Rebecca

Product Code:KRAC0171

Pages:88

Published On:August 2025

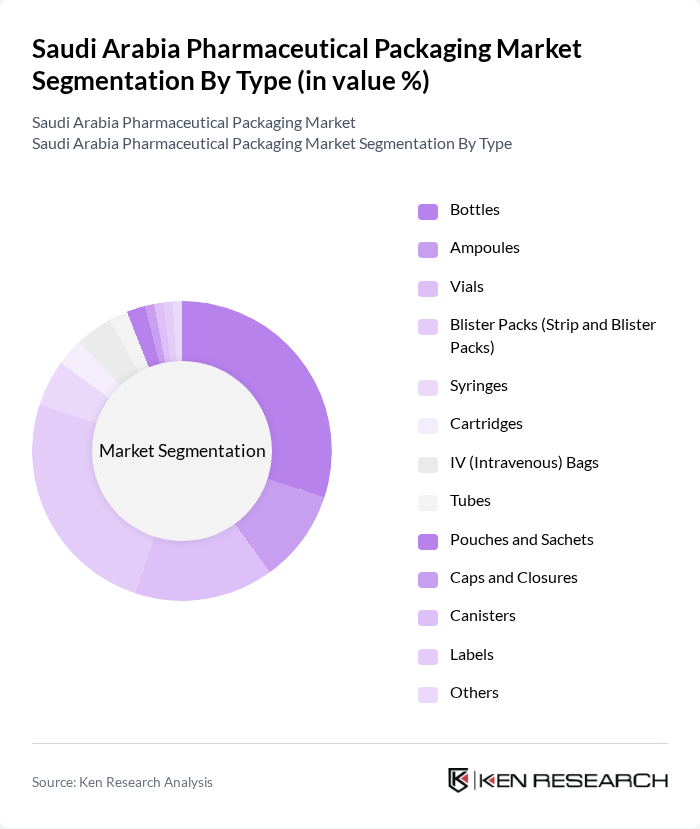

By Type:The market is segmented into various types of packaging, including bottles, ampoules, vials, blister packs, syringes, cartridges, IV bags, tubes, pouches, caps, canisters, labels, and others. Among these, bottles and blister packs are the most widely used due to their versatility and effectiveness in preserving the integrity of pharmaceutical products. The demand for eco-friendly packaging solutions is also on the rise, influencing the choice of materials and designs. Plastic and glass remain the dominant materials, with a significant shift toward sustainable and user-friendly packaging formats .

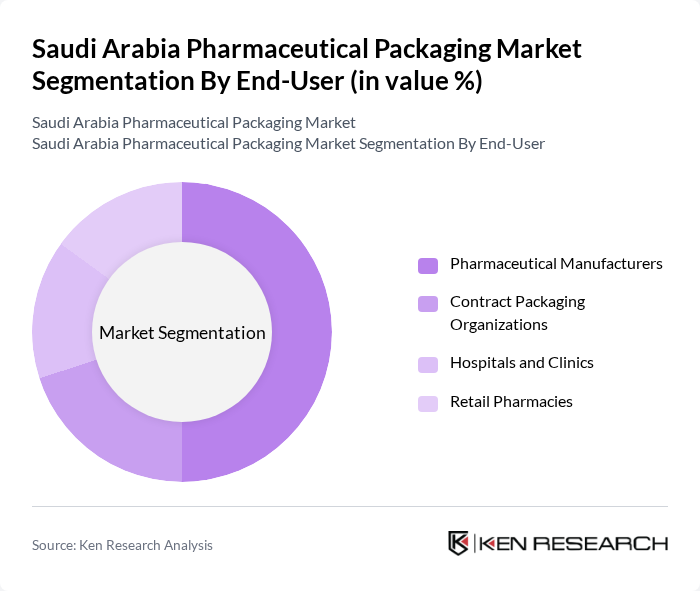

By End-User:The end-user segmentation includes pharmaceutical manufacturers, contract packaging organizations, hospitals and clinics, and retail pharmacies. Pharmaceutical manufacturers are the leading end-users, driven by the need for efficient and compliant packaging solutions that ensure product safety and efficacy. The increasing number of hospitals and clinics also contributes to the demand for specialized packaging tailored to specific medical needs. There is also a trend toward outsourcing packaging services to specialized contract packaging organizations, reflecting the growing complexity and regulatory requirements in the sector .

The Saudi Arabia Pharmaceutical Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Obeikan Healthcare, Napco National, Al-Amoudi Group (Al-Amoudi Plastic & Packaging), Al Watania Plastics, CCL Industries, Becton Dickinson and Company (BD), Gulf Pharmaceutical Industries (Julphar), Tabuk Pharmaceuticals, Riyadh Pharma, Al-Dawaa Pharmacies, Al-Nahdi Medical Company, United Pharmacies, Al-Jazeera Pharmaceutical Industries, Dar Al Dawa Development and Investment Company, Saudi International Trading Company (SITC), Al-Faisaliah Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmaceutical packaging market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the government continues to prioritize healthcare reforms, the demand for innovative and sustainable packaging solutions is expected to rise. Additionally, the integration of digital technologies in packaging processes will enhance efficiency and compliance, positioning local manufacturers to better compete in the global market while addressing consumer needs for safety and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles Ampoules Vials Blister Packs (Strip and Blister Packs) Syringes Cartridges IV (Intravenous) Bags Tubes Pouches and Sachets Caps and Closures Canisters Labels Others |

| By End-User | Pharmaceutical Manufacturers Contract Packaging Organizations Hospitals and Clinics Retail Pharmacies |

| By Material Type | Plastic Glass Paper and Paperboard Aluminum Foil Other Materials |

| By Application | Prescription Drugs Over-the-Counter Drugs Biopharmaceuticals |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Central Region Eastern Region Western Region |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Quality Assurance Officers |

| Packaging Suppliers | 60 | Sales Managers, Product Development Managers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Managers |

| Logistics and Distribution | 50 | Supply Chain Managers, Warehouse Supervisors |

| Healthcare Providers | 50 | Pharmacists, Hospital Procurement Officers |

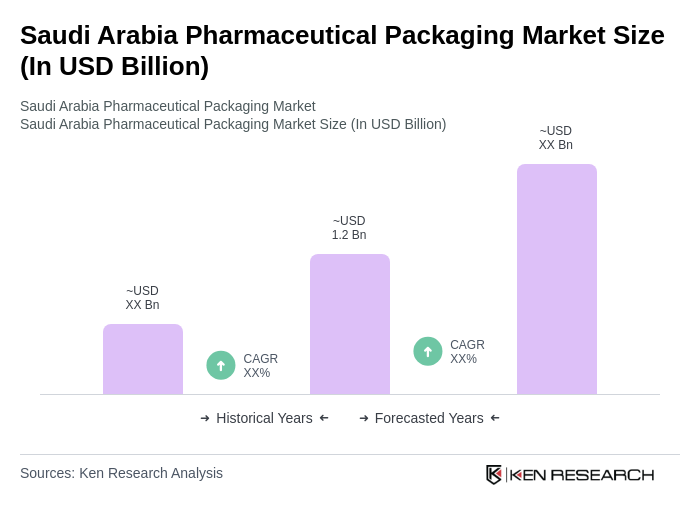

The Saudi Arabia Pharmaceutical Packaging Market is valued at approximately USD 1.2 billion, driven by increasing demand for pharmaceutical products, advancements in packaging technologies, and a focus on patient safety and compliance.