Region:Middle East

Author(s):Rebecca

Product Code:KRAC0200

Pages:88

Published On:August 2025

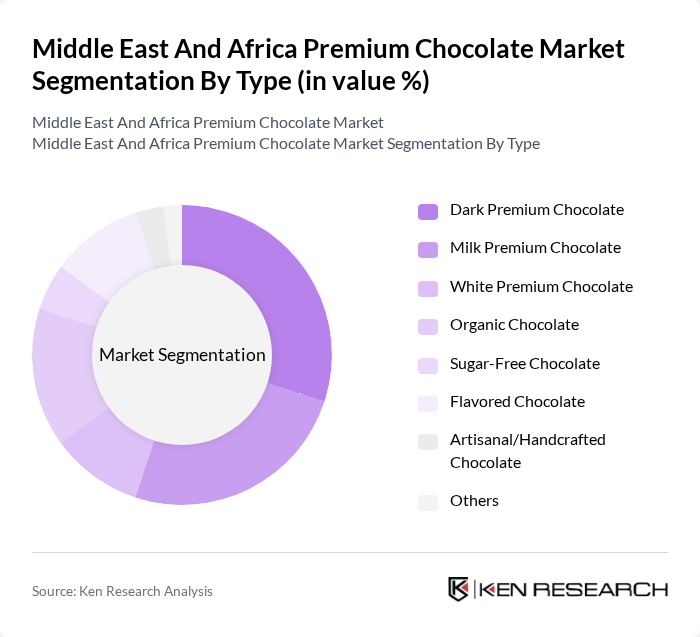

By Type:The premium chocolate market is segmented into Dark Premium Chocolate, Milk Premium Chocolate, White Premium Chocolate, Organic Chocolate, Sugar-Free Chocolate, Flavored Chocolate, Artisanal/Handcrafted Chocolate, and Others. Dark Premium Chocolate is gaining significant traction due to its perceived health benefits, higher cocoa content, and appeal to health-conscious consumers. Milk Premium Chocolate remains popular, especially among younger consumers and families. Organic and Sugar-Free options are increasingly sought after by niche markets focused on health, wellness, and sustainability. The market also sees rising demand for artisanal and flavored chocolates, reflecting consumer interest in unique taste experiences and premium ingredients .

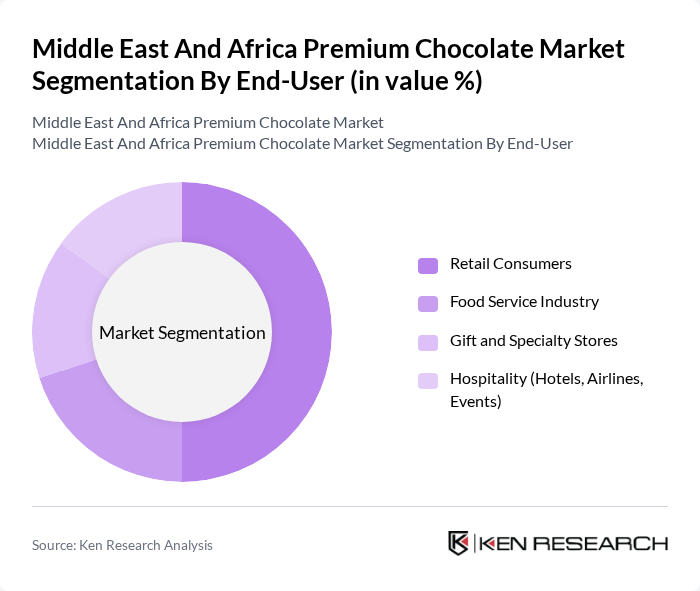

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Gift and Specialty Stores, and Hospitality (Hotels, Airlines, Events). Retail Consumers dominate the market, driven by the increasing trend of gifting, personal consumption, and the influence of festive and celebratory occasions. The Food Service Industry is also significant, as restaurants, cafes, and hotels increasingly incorporate premium chocolates into their menus and offerings, enhancing the overall consumer experience. Gift and Specialty Stores, as well as the Hospitality sector, are important channels for premium chocolate distribution, especially during holidays and special events .

The Middle East And Africa Premium Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut AG, Mondelez International, Inc., Ferrero Group, Nestlé S.A., Lindt & Sprüngli AG, Mars, Incorporated, Godiva Chocolatier, Patchi SAL, Al Nassma Chocolate LLC, De Villiers Chocolate, Hotel Chocolat Group plc, Cacao Barry, Ghirardelli Chocolate Company, Green & Black's, Valrhona SAS, Butlers Chocolates, Neuhaus NV, Le Chocolatier (South Africa) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the premium chocolate market in the Middle East and Africa appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, manufacturers are likely to focus on developing healthier chocolate options. Additionally, the rise of e-commerce will facilitate broader market access, enabling brands to reach a wider audience. These factors, combined with a growing interest in sustainable practices, will likely enhance the market's resilience and growth potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Premium Chocolate Milk Premium Chocolate White Premium Chocolate Organic Chocolate Sugar-Free Chocolate Flavored Chocolate Artisanal/Handcrafted Chocolate Others |

| By End-User | Retail Consumers Food Service Industry Gift and Specialty Stores Hospitality (Hotels, Airlines, Events) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Duty-Free & Travel Retail Others |

| By Price Range | Premium Super Premium Mid-Range Economy |

| By Packaging Type | Boxed Chocolate Wrapped Chocolate Bulk Chocolate Gift Packaging |

| By Occasion | Festivals & Religious Holidays Birthdays & Anniversaries Corporate Gifting Weddings & Celebrations |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Sub-Saharan Africa (Nigeria, Kenya, South Africa, Ghana, Others) Levant (Jordan, Lebanon, Syria) South Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Chocolate Outlets | 120 | Store Managers, Retail Buyers |

| Online Chocolate Retailers | 90 | E-commerce Managers, Digital Marketing Specialists |

| Chocolate Manufacturers | 60 | Production Managers, Quality Control Officers |

| Consumer Preferences Survey | 140 | Chocolate Consumers, Food Enthusiasts |

| Distribution Channel Analysis | 70 | Logistics Managers, Supply Chain Analysts |

The Middle East and Africa Premium Chocolate Market is valued at approximately USD 2.1 billion, reflecting a significant growth trend driven by rising disposable incomes and increased consumer access to premium chocolate brands.