Global Premium Chocolate Market Overview

- The Global Premium Chocolate Market is valued at USD 39 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality, artisanal chocolates, as well as a rising trend toward healthier options, such as organic and sugar-free varieties. The market is further supported by the growing popularity of gifting premium chocolates during festive seasons and special occasions, the expansion of e-commerce channels, and the adoption of sustainable and eco-friendly packaging by leading brands .

- Countries such as Switzerland, Belgium, and the United States continue to dominate the premium chocolate market due to their rich chocolate-making traditions and high-quality production standards. These nations are home to renowned brands that have established a strong global presence, leveraging their heritage, expertise, and ongoing innovation to attract discerning consumers willing to pay a premium for quality .

- In 2023, the European Union adopted Regulation (EU) 2023/1115 on deforestation-free supply chains, issued by the European Parliament and the Council. This regulation requires that all cocoa and chocolate products placed on the EU market must be sourced from land not subject to deforestation after 2020 and mandates due diligence from operators and traders to ensure sustainable and traceable supply chains. This initiative is expected to enhance consumer trust and drive demand for premium chocolates that comply with these sustainability standards .

Global Premium Chocolate Market Segmentation

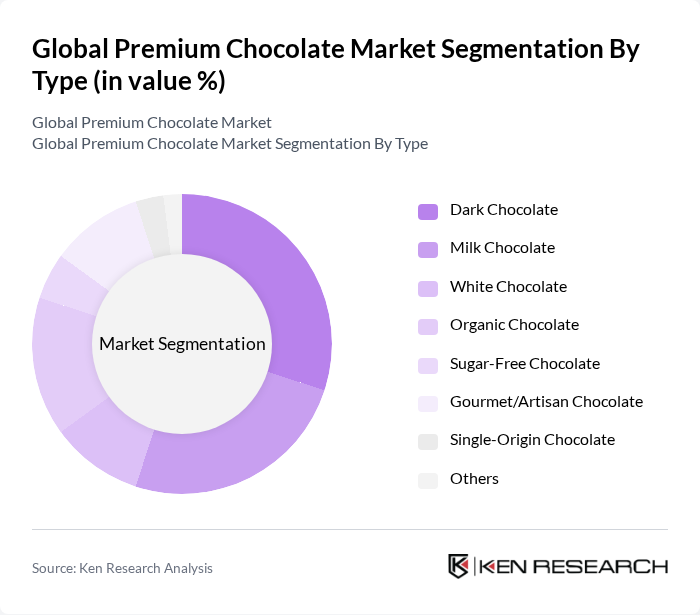

By Type:The premium chocolate market is segmented into Dark Chocolate, Milk Chocolate, White Chocolate, Organic Chocolate, Sugar-Free Chocolate, Gourmet/Artisan Chocolate, Single-Origin Chocolate, and Others. Each subsegment addresses specific consumer preferences, including demand for higher cocoa content, ethical sourcing, specialty flavors, and dietary needs. The rise of single-origin and bean-to-bar chocolates, as well as functional and "better-for-you" formulations, is shaping the competitive landscape .

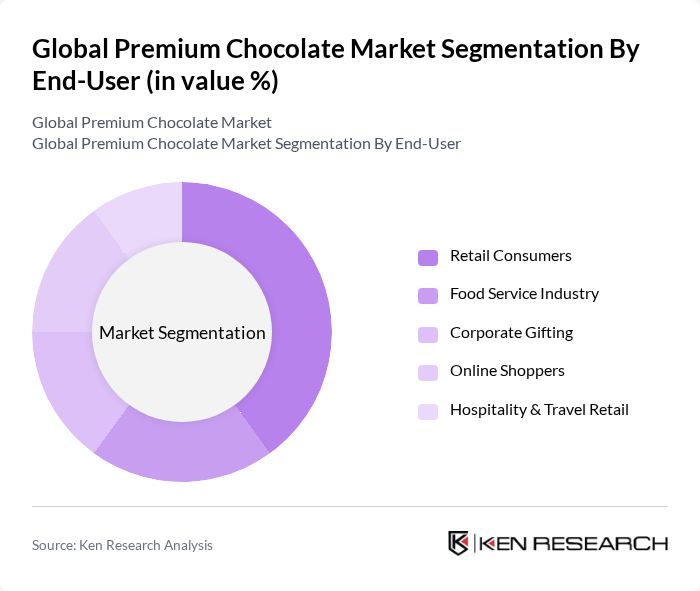

By End-User:The end-user segmentation of the premium chocolate market includes Retail Consumers, Food Service Industry, Corporate Gifting, Online Shoppers, and Hospitality & Travel Retail. Each segment reflects distinct purchasing behaviors and preferences, with retail consumers and online shoppers driving significant growth, particularly through e-commerce and gourmet gifting channels .

Global Premium Chocolate Market Competitive Landscape

The Global Premium Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lindt & Sprüngli AG, Ferrero Group, Godiva Chocolatier, Ghirardelli Chocolate Company, Mondelez International, Inc. (owner of Côte d'Or, Green & Black's, and others), Mars, Incorporated (including Ethel M, Dove/Galaxy), Nestlé S.A., Barry Callebaut AG, Valrhona, TCHO Chocolate, Theo Chocolate, Alter Eco, Green & Black's, Compartés Chocolatier, Amedei Tuscany, Guylian, Hotel Chocolat Group plc, Endangered Species Chocolate contribute to innovation, geographic expansion, and service delivery in this space.

Global Premium Chocolate Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for High-Quality Products:The premium chocolate segment has seen a surge in consumer interest, with the global market for high-quality chocolate projected to reach $98 billion in future. This growth is driven by a shift in consumer preferences towards artisanal and gourmet products, as evidenced by a 15% increase in sales of premium chocolate brands in future. The rise of social media and food influencers has further fueled this demand, encouraging consumers to seek out unique and high-quality chocolate experiences.

- Rising Health Consciousness and Preference for Dark Chocolate:Health trends are significantly influencing chocolate consumption, with dark chocolate sales increasing by 20% in future. Consumers are increasingly aware of the health benefits associated with dark chocolate, such as its high antioxidant content and potential cardiovascular benefits. According to the World Health Organization, the global prevalence of obesity is expected to rise to 39% in future, prompting consumers to opt for healthier indulgences like dark chocolate, which is perceived as a guilt-free treat.

- Expansion of E-commerce and Online Retail Channels:The e-commerce sector for premium chocolate has expanded rapidly, with online sales projected to account for 30% of total chocolate sales in future. This growth is supported by a 25% increase in online chocolate purchases in future, driven by convenience and the ability to access a wider variety of products. Major retailers are investing in their online platforms, enhancing customer experience through personalized recommendations and subscription services, which further boosts sales in this channel.

Market Challenges

- Fluctuating Cocoa Prices:The premium chocolate market faces significant challenges due to volatile cocoa prices, which have seen fluctuations of up to 30% in the past year. Factors such as climate change, political instability in cocoa-producing regions, and supply chain disruptions contribute to this instability. As cocoa prices rise, manufacturers may struggle to maintain profit margins, potentially leading to increased retail prices that could deter price-sensitive consumers from purchasing premium products.

- Intense Competition from Mass Market Brands:The premium chocolate segment is increasingly challenged by mass market brands that are introducing their own high-quality offerings at competitive prices. In future, mass market brands captured 40% of the premium chocolate market share, leveraging economies of scale to offer lower prices. This competition pressures premium brands to innovate and differentiate their products, which can strain resources and impact profitability, especially for smaller artisanal producers.

Global Premium Chocolate Market Future Outlook

The future of the premium chocolate market appears promising, driven by evolving consumer preferences and a growing focus on sustainability. As consumers increasingly seek out ethically sourced and organic products, brands that prioritize transparency and sustainable practices are likely to thrive. Additionally, the rise of innovative flavors and personalized offerings will continue to attract consumers, enhancing brand loyalty. The market is expected to adapt to these trends, fostering a dynamic environment for growth and innovation in the coming years.

Market Opportunities

- Growth in Emerging Markets:Emerging markets present significant opportunities for premium chocolate brands, with countries like India and Brazil experiencing a 30% increase in chocolate consumption in future. As disposable incomes rise, consumers in these regions are more willing to spend on premium products, creating a lucrative market for high-quality chocolate offerings.

- Increasing Demand for Organic and Fair-Trade Products:The demand for organic and fair-trade chocolate is on the rise, with sales increasing by 18% in future. Consumers are becoming more conscious of the ethical implications of their purchases, driving brands to adopt sustainable sourcing practices. This trend not only enhances brand reputation but also opens new market segments focused on health and sustainability.