Middle East Anime Market Overview

- The Middle East Anime Market is valued at USD 970 million, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of anime among diverse demographics, fueled by the rise of streaming platforms and social media engagement. The market has seen a surge in demand for both localized and original content, reflecting a growing acceptance and appreciation of anime culture in the region. The expansion of internet distribution and merchandising has further accelerated market development, with streaming services and online fan communities playing a pivotal role in audience engagement .

- Countries such as the United Arab Emirates, Saudi Arabia, and Egypt dominate the Middle East Anime Market due to their robust entertainment infrastructure and high internet penetration rates. The UAE, in particular, has become a hub for anime events and conventions, attracting fans and creators alike. This cultural enthusiasm, combined with significant investments in media and entertainment, positions these countries as leaders in the anime sector. Saudi Arabia stands out for its large anime fanbase and active support for local industry development, while the UAE and Egypt continue to host major conventions and foster vibrant fan communities .

- In 2023, the Saudi Arabian government implemented the "Saudi Anime Initiative" under the General Entertainment Authority, aimed at promoting local content production in the anime sector. This initiative includes a funding program of USD 200 million to support local creators and studios, encouraging the development of original anime series that reflect regional culture and narratives. The regulation, as outlined in the Saudi Vision 2030 framework and the General Entertainment Authority’s official guidelines, mandates operational standards for local content production, licensing requirements for studios, and eligibility criteria for funding access. This aims to enhance the domestic entertainment landscape and reduce reliance on imported content .

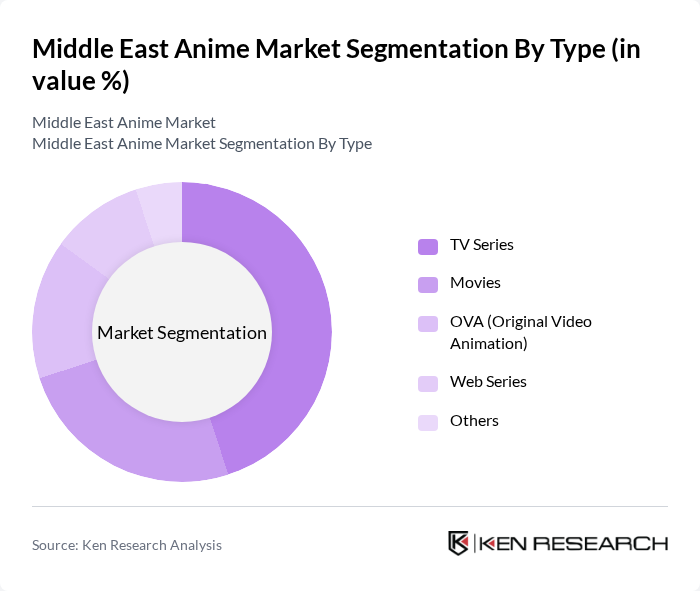

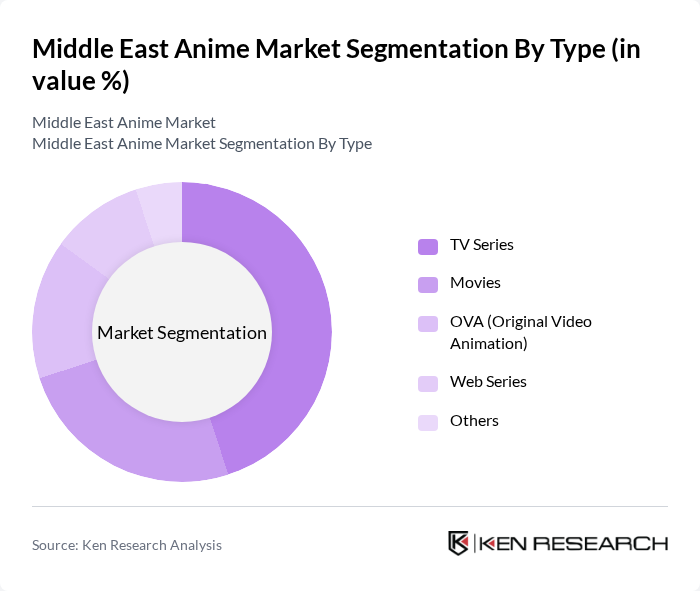

Middle East Anime Market Segmentation

By Type:The market is segmented into various types, including TV Series, Movies, OVA (Original Video Animation), Web Series, and Others. Among these, TV Series has emerged as the dominant segment, driven by the binge-watching culture fostered by streaming platforms. The demand for serialized content allows for deeper storytelling and character development, appealing to a wide audience. Movies and OVAs also contribute significantly, but the episodic nature of TV Series keeps viewers engaged over longer periods, solidifying its leadership in the market. Internet distribution is the largest revenue-generating channel, reflecting the shift in consumer viewing habits towards digital platforms .

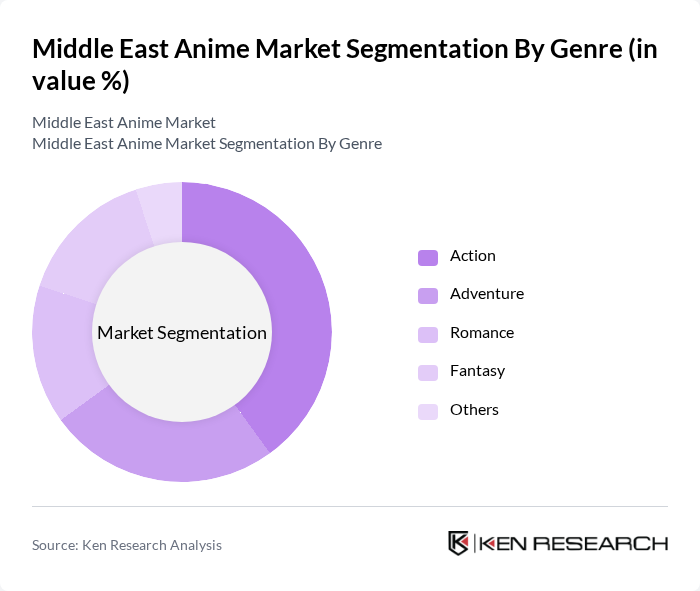

By Genre:The anime market is also categorized by genre, including Action, Adventure, Romance, Fantasy, and Others. Action is the leading genre, appealing to a broad audience with its dynamic storytelling and engaging visuals. The popularity of action-packed series is further amplified by their adaptation into video games and merchandise, creating a comprehensive entertainment ecosystem. Adventure and Fantasy genres follow closely, attracting viewers with imaginative worlds and compelling narratives, while Romance caters to a niche audience, contributing to the overall diversity of the market. The region also sees strong demand for genres that integrate fantasy and adventure elements, reflecting local preferences for immersive and visually rich content .

Middle East Anime Market Competitive Landscape

The Middle East Anime Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crunchyroll, Toonz Media Group, Manga Productions, Aniplex, Bandai Namco Arts, Toei Animation, Pierrot, Studio Ghibli, Bioworld, Sunrise, Bones Studio, Kyoto Animation, Madhouse, Sony Pictures Entertainment, Good Smile Company, Sentai Holdings, VIZ Media, Eleven Arts, AnimeLab, OLM, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Anime Market Industry Analysis

Growth Drivers

- Increasing Popularity of Anime Culture:The Middle East has seen a significant rise in anime viewership, with over 1.5 million viewers tuning into popular anime series on streaming platforms in future. This surge is attributed to the growing acceptance of anime as a mainstream entertainment form, particularly among youth aged 15-30, who represent approximately 30% of the region's population. The cultural shift is further supported by social media platforms, where anime-related content garners millions of views, enhancing its visibility and appeal.

- Rise of Streaming Platforms:The proliferation of streaming services has transformed anime accessibility in the Middle East. In future, subscriptions to platforms like Crunchyroll and Netflix increased by 40%, with over 2 million new subscribers reported. This growth is driven by localized content offerings and the availability of dubbed and subtitled versions, catering to diverse linguistic demographics. The convenience of on-demand viewing has further solidified anime's position in the entertainment landscape, attracting a broader audience.

- Expansion of Anime Conventions and Events:The number of anime conventions in the Middle East has doubled since 2020, with over 20 major events held in future, attracting more than 500,000 attendees collectively. These events foster community engagement and provide platforms for local artists and creators. The increasing participation of international guests and industry professionals enhances the region's reputation as a burgeoning hub for anime culture, stimulating interest and investment in local anime projects.

Market Challenges

- Limited Local Content Production:Despite the growing interest in anime, local production remains underdeveloped, with only 5% of anime content consumed in the region being produced locally. This reliance on imported content limits the diversity of narratives and cultural representation. The lack of investment in local talent and infrastructure hampers the potential for homegrown anime, which could resonate more deeply with regional audiences and reflect local cultures and values.

- Cultural Sensitivity Issues:Cultural sensitivity poses a significant challenge for anime distribution in the Middle East. Content that may be acceptable in Japan can face backlash due to differing cultural norms and values. For instance, approximately 30% of anime titles face censorship or modification before release in the region. This can lead to dissatisfaction among fans and limit the authenticity of the content, potentially hindering the growth of the anime market.

Middle East Anime Market Future Outlook

The future of the Middle East anime market appears promising, driven by increasing investments in local production and the growing influence of digital platforms. As more creators emerge and collaborate with international studios, the region is likely to see a rise in culturally relevant content. Additionally, the integration of technology, such as augmented reality experiences, will enhance viewer engagement. The market is poised for expansion, with a focus on nurturing local talent and fostering community-driven initiatives to sustain growth.

Market Opportunities

- Collaborations with Local Creators:Collaborating with local creators presents a significant opportunity to develop culturally resonant anime content. By investing in local talent, international studios can create narratives that reflect regional values, potentially increasing viewership. This approach could lead to a 25% increase in local content production in future, fostering a more vibrant anime culture in the Middle East.

- Merchandise and Licensing Potential:The anime merchandise market in the Middle East is projected to reach $200 million in future, driven by the popularity of anime characters and franchises. This growth presents opportunities for licensing agreements and partnerships with local retailers. By tapping into this lucrative market, companies can enhance brand visibility and create additional revenue streams, further supporting the anime ecosystem in the region.