Region:Middle East

Author(s):Dev

Product Code:KRAD3356

Pages:100

Published On:November 2025

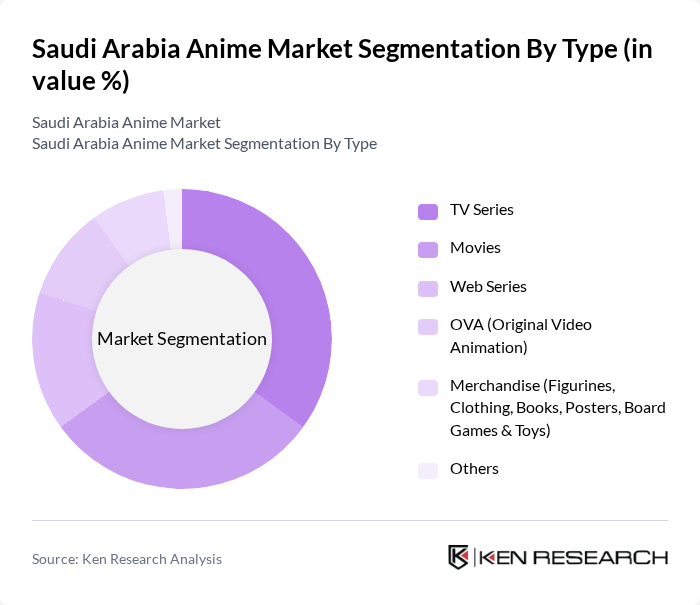

By Type:The anime market in Saudi Arabia is segmented into various types, including TV Series, Movies, Web Series, OVA (Original Video Animation), Merchandise, and Others. Among these, TV Series and Movies are the most popular, driven by the increasing availability of streaming platforms and the demand for high-quality content. The rise of digital consumption has also led to a significant increase in the popularity of web series and OVAs, while merchandise sales continue to thrive due to the dedicated fanbase.

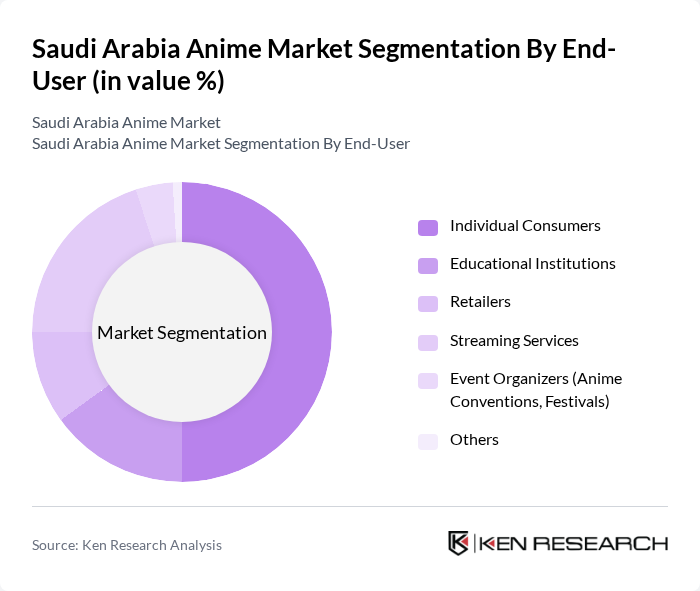

By End-User:The end-user segmentation of the anime market includes Individual Consumers, Educational Institutions, Retailers, Streaming Services, Event Organizers, and Others. Individual consumers represent the largest segment, driven by the growing interest in anime among the youth. Streaming services have also gained significant traction, providing easy access to a wide range of content. Educational institutions are increasingly incorporating anime into their curricula, further expanding the market.

The Saudi Arabia Anime Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manga Productions, Spacetoon, MBC Group, Crunchyroll, Netflix, Toei Animation, Aniplex, Good Smile Company, Sony Group Corporation, BANDAI NAMCO Holdings Inc., Kodansha Ltd., Shueisha Inc., Viz Media, OLM, Inc., Studio Ghibli contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anime market in Saudi Arabia appears promising, driven by a combination of increasing youth engagement and government initiatives aimed at fostering local content creation. As the popularity of anime continues to rise, the establishment of more local studios and collaborations with international creators is expected. Additionally, the integration of anime into educational content could further enhance its appeal, creating a more vibrant and diverse anime culture that resonates with the Saudi audience.

| Segment | Sub-Segments |

|---|---|

| By Type | TV Series Movies Web Series OVA (Original Video Animation) Merchandise (Figurines, Clothing, Books, Posters, Board Games & Toys) Others |

| By End-User | Individual Consumers Educational Institutions Retailers Streaming Services Event Organizers (Anime Conventions, Festivals) Others |

| By Genre | Action Romance Fantasy Horror Comedy Others |

| By Distribution Channel | Online Streaming (Crunchyroll, Netflix, Shahid, YouTube) Television Broadcast (MBC Group, Spacetoon) DVD/Blu-ray Sales Physical Retail (Anime Stores, Bookstores) Merchandise Sales (Online & Offline) Others |

| By Demographics | Age Group (Children, Teens, Adults) Gender (Male, Female) Geographic Location (Urban, Rural) Others |

| By Format | Digital (Streaming, Download, e-Manga) Physical (DVD/Blu-ray, Print Manga, Merchandise) Others |

| By Engagement Level | Casual Viewers Dedicated Fans Collectors Event Attendees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anime Streaming Services | 60 | Subscribers, Content Managers |

| Anime Merchandise Retail | 50 | Retail Managers, Brand Representatives |

| Anime Conventions and Events | 40 | Event Organizers, Attendees |

| Anime Content Creation | 45 | Animators, Scriptwriters, Producers |

| Fan Communities and Engagement | 55 | Community Managers, Active Fans |

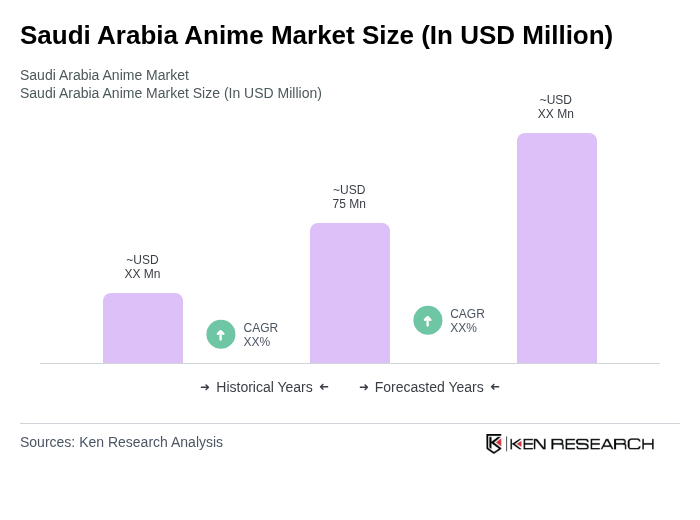

The Saudi Arabia Anime Market is valued at approximately USD 75 million, reflecting significant growth driven by the increasing popularity of anime among the youth, the rise of streaming platforms, and the acceptance of Japanese culture in the region.