Region:Middle East

Author(s):Dev

Product Code:KRAA2234

Pages:96

Published On:August 2025

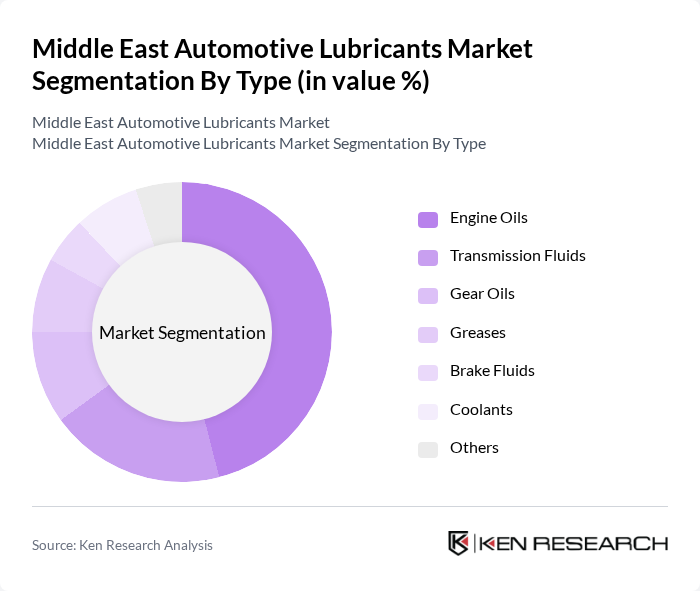

By Type:The market is segmented into various types of lubricants, including engine oils, transmission fluids, gear oils, greases, brake fluids, coolants, and others. Among these, engine oils are the most dominant segment due to their essential role in vehicle performance and maintenance. The increasing focus on engine efficiency and the growing trend of synthetic oils are driving the demand for high-quality engine lubricants .

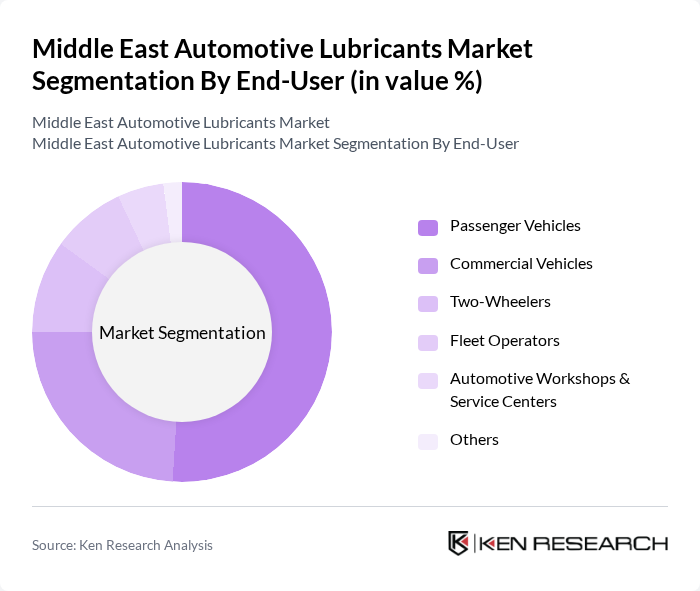

By End-User:The end-user segmentation includes passenger vehicles, commercial vehicles, two-wheelers, fleet operators, automotive workshops & service centers, and others. The passenger vehicles segment holds the largest share, driven by the increasing number of personal vehicles and the growing awareness of vehicle maintenance among consumers. The rise in disposable income and urbanization also contribute to the demand for automotive lubricants in this segment .

The Middle East Automotive Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco (Petronas Lubricants Arabia Ltd.), ADNOC Distribution, TotalEnergies Marketing Middle East, Gulf Oil Middle East Ltd., Castrol (BP Middle East), ExxonMobil (Mobil 1), FUCHS Petrolub SE, Chevron Corporation, Petromin Corporation, Aljomaih and Shell Lubricating Oil Company (JOSLOC), Behran Oil Company, Valvoline Inc., Amsoil Inc., Motul S.A., Liqui Moly GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East automotive lubricants market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers innovate to develop eco-friendly lubricants, the market is likely to see a shift towards synthetic and bio-based products. Additionally, the rise of digital technologies in sales and marketing will enhance customer engagement and streamline distribution channels, further supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Oils Transmission Fluids Gear Oils Greases Brake Fluids Coolants Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Fleet Operators Automotive Workshops & Service Centers Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Dealers Others |

| By Packaging Type | Bulk Packaging (Drums, Barrels, Totes) Retail Packaging (Bottles, Cans) Industrial Packaging Others |

| By Base Oil | Mineral Oil Synthetic Oil Semi-Synthetic Oil Bio-based Oil |

| By Application | Engine Protection Transmission Performance Fuel Efficiency Emission Reduction Others |

| By Country | Saudi Arabia United Arab Emirates Kuwait Oman Qatar Bahrain Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Lubricants | 120 | Automotive Technicians, Service Managers |

| Commercial Vehicle Lubricants | 90 | Fleet Managers, Procurement Officers |

| Industrial Lubricants for Automotive Manufacturing | 60 | Manufacturing Engineers, Quality Control Managers |

| Aftermarket Lubricants | 100 | Retailers, Automotive Parts Distributors |

| Lubricant Additives Market | 50 | Product Development Managers, Chemical Engineers |

The Middle East Automotive Lubricants Market is valued at approximately USD 1.2 billion, driven by factors such as increasing vehicle ownership, demand for high-performance lubricants, and advancements in lubricant technology that enhance engine efficiency and longevity.