Region:Middle East

Author(s):Dev

Product Code:KRAD6357

Pages:98

Published On:December 2025

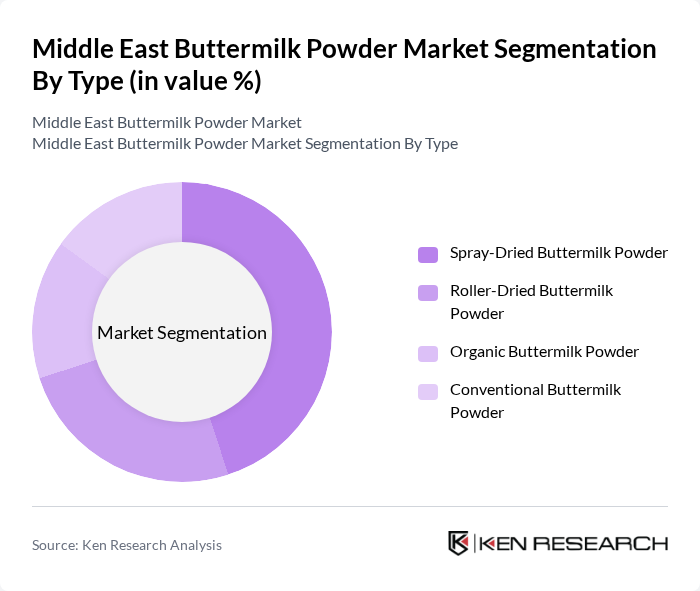

By Type:The market is segmented into four main types: Spray-Dried Buttermilk Powder, Roller-Dried Buttermilk Powder, Organic Buttermilk Powder, and Conventional Buttermilk Powder. Among these, Spray-Dried Buttermilk Powder is the leading subsegment due to its widespread use in various food applications, including bakery products and dairy beverages. The convenience of storage and longer shelf life associated with spray-dried products further enhances its popularity among manufacturers and consumers alike.

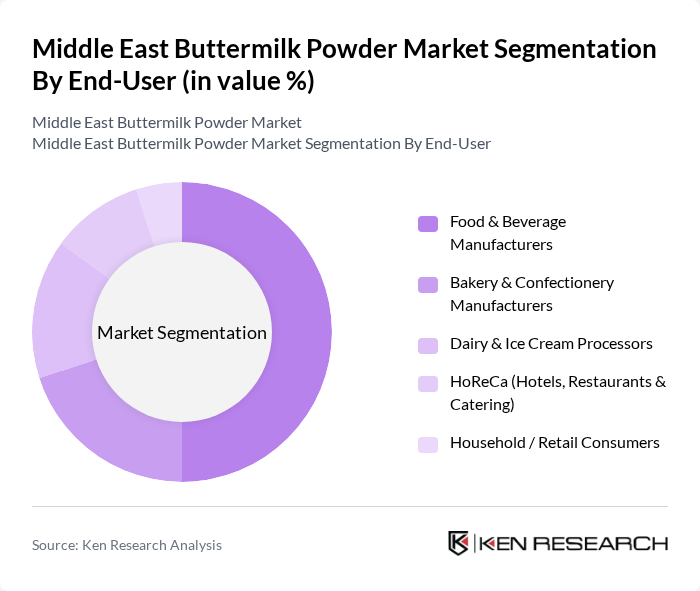

By End-User:The end-user segmentation includes Food & Beverage Manufacturers, Bakery & Confectionery Manufacturers, Dairy & Ice Cream Processors, HoReCa (Hotels, Restaurants & Catering), and Household/Retail Consumers. The Food & Beverage Manufacturers segment holds the largest share, driven by the increasing incorporation of buttermilk powder in various food products, including snacks, dairy beverages, and ready-to-eat meals. The growing trend of health and wellness among consumers also boosts the demand for buttermilk powder in this sector.

The Middle East Buttermilk Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company (Saudi Arabia), Al Safi Danone (Saudi Arabia), Al Ain Dairy (United Arab Emirates), Emirates Industry for Camel Milk & Products – Camelicious (United Arab Emirates), Al Rawabi Dairy Company (United Arab Emirates), Almarai – Beyti for Food Industries (Egypt), Juhayna Food Industries (Egypt), National Agricultural Development Company (NADEC) (Saudi Arabia), Saudia Dairy & Foodstuff Company (SADAFCO) (Saudi Arabia), Al Watania Dairy (Saudi Arabia), Arla Foods amba (including Middle East operations), FrieslandCampina Middle East, Lactalis Group (Middle East & North Africa), Fonterra Co-operative Group (Middle East & Africa), Nestlé Middle East & North Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East buttermilk powder market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek nutritious dairy options, the demand for buttermilk powder is expected to rise. Additionally, innovations in processing technology will enhance product quality and shelf life, making buttermilk powder more appealing to manufacturers and consumers alike. The market is poised for growth as it adapts to these trends and challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Spray-Dried Buttermilk Powder Roller-Dried Buttermilk Powder Organic Buttermilk Powder Conventional Buttermilk Powder |

| By End-User | Food & Beverage Manufacturers Bakery & Confectionery Manufacturers Dairy & Ice Cream Processors HoReCa (Hotels, Restaurants & Catering) Household / Retail Consumers |

| By Distribution Channel | B2B (Direct Sales, Distributors & Importers) B2C – Supermarkets/Hypermarkets B2C – Convenience & Specialty Stores B2C – Online Retail & E-commerce Platforms |

| By Packaging Type | Bulk Industrial Bags (15–25 kg) Intermediate Bulk Containers & Totes Retail Packs (? 5 kg) Sachets & Single-Serve Packs |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Others) Rest of Middle East (Iran, Yemen and Others) |

| By Application | Bakery (Bread, Cakes, Biscuits, Pastries) Confectionery & Chocolate Dairy Beverages & Fermented Drinks Dairy Products (Cheese, Yogurt, Ice Cream) Soups, Sauces & Seasonings Nutritional & Sports Nutrition Products Animal Feed & Pet Food Others |

| By Product Form | Regular/Conventional Powder Instantized/Agitated Powder Blends & Customized Formulations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Production Managers, Quality Assurance Officers |

| Retail Grocery Chains | 100 | Category Managers, Purchasing Agents |

| Dairy Product Distributors | 90 | Sales Managers, Logistics Coordinators |

| Food Service Providers | 80 | Executive Chefs, Procurement Specialists |

| Market Research Analysts | 70 | Industry Analysts, Market Strategists |

The Middle East Buttermilk Powder Market is valued at approximately USD 230 million, reflecting a significant growth trend driven by increasing dairy consumption and health consciousness among consumers in the region.