Region:Middle East

Author(s):Shubham

Product Code:KRAA0974

Pages:80

Published On:August 2025

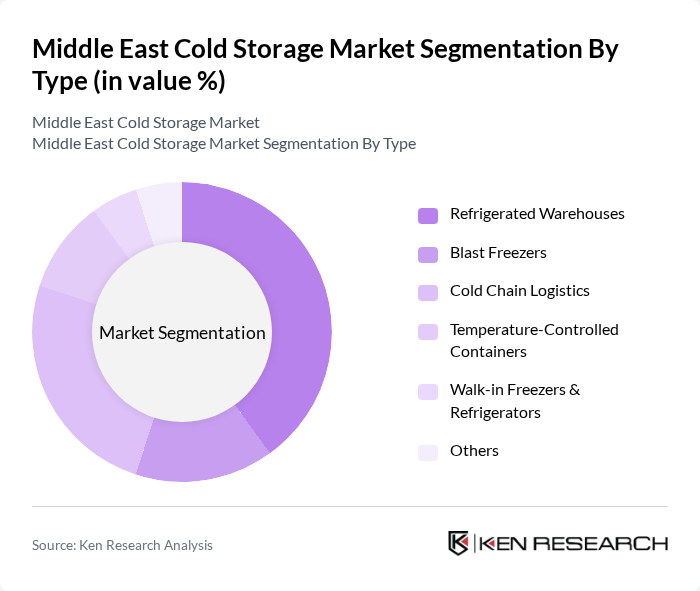

By Type:The cold storage market can be segmented into various types, including Refrigerated Warehouses, Blast Freezers, Cold Chain Logistics, Temperature-Controlled Containers, Walk-in Freezers & Refrigerators, and Others. Among these, Refrigerated Warehouses are the most dominant due to their extensive use in storing perishable goods and their ability to accommodate large volumes of products. The increasing demand for fresh produce and frozen foods has led to a surge in the establishment of these facilities, making them a critical component of the cold storage infrastructure .

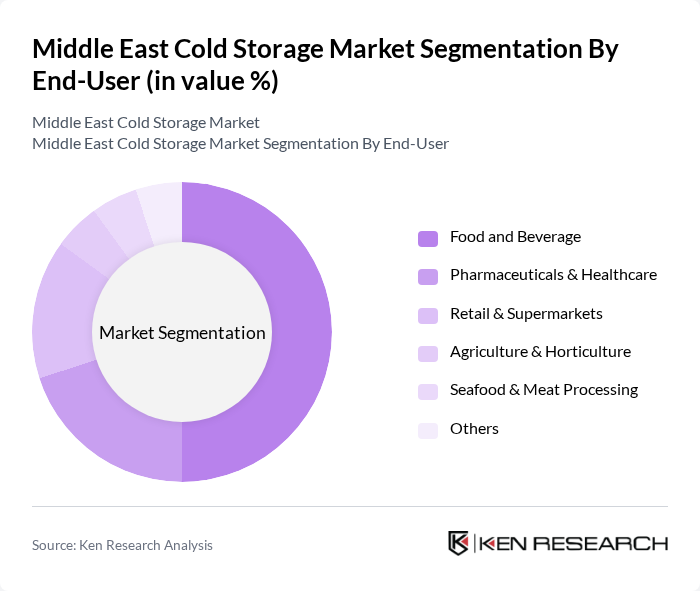

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals & Healthcare, Retail & Supermarkets, Agriculture & Horticulture, Seafood & Meat Processing, and Others. The Food and Beverage sector is the leading end-user, driven by the rising demand for fresh and frozen products. The increasing consumer preference for convenience foods and the growth of the e-commerce sector have further fueled the need for efficient cold storage solutions in this segment .

The Middle East Cold Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Logistics, Agility Logistics, Gulf Warehousing Company (GWC), Emirates Logistics, Almarai, FreshOnTable, YallaMarket, Reefer-x, TruKKer, Themar, National Cold Storage Company, Al Jazeera Cold Storage, Al Khorayef Group, Al Ain Farms, Al Mufeed Cold Storage contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East cold storage market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of automation and IoT technologies is expected to enhance operational efficiency, while the shift towards sustainable practices will likely reshape industry standards. As e-commerce continues to grow, particularly in food delivery, the demand for innovative cold storage solutions will increase. This evolution presents opportunities for companies to invest in energy-efficient systems and expand their market reach, ultimately improving food safety and reducing waste.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehouses Blast Freezers Cold Chain Logistics Temperature-Controlled Containers Walk-in Freezers & Refrigerators Others |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Retail & Supermarkets Agriculture & Horticulture Seafood & Meat Processing Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Others |

| By Application | Frozen Foods Dairy Products Meat and Seafood Fruits and Vegetables Pharmaceuticals & Vaccines Others |

| By Storage Capacity | Small Scale (up to 5,000 pallets) Medium Scale (5,000–20,000 pallets) Large Scale (above 20,000 pallets) |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (5°C to 15°C) |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 120 | Warehouse Managers, Supply Chain Directors |

| Pharmaceutical Cold Chain Logistics | 90 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Solutions | 60 | Logistics Coordinators, Inventory Managers |

| Technology Providers in Cold Storage | 50 | Product Managers, Business Development Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The Middle East Cold Storage Market is valued at approximately USD 18.3 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and beverage, as well as pharmaceuticals.