Region:Middle East

Author(s):Dev

Product Code:KRAC8722

Pages:91

Published On:November 2025

By Type:

The market is segmented into various types of analytics services, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others. Among these, Predictive Analytics is currently dominating the market due to its ability to forecast trends and behaviors, which is crucial for businesses aiming to enhance operational efficiency and customer satisfaction. The increasing reliance on data-driven insights for strategic planning and decision-making has led to a surge in demand for predictive models across industries.

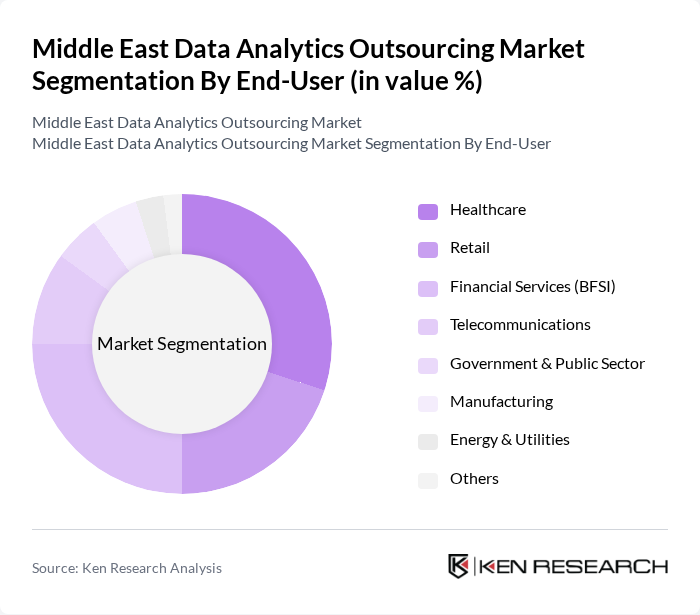

By End-User:

The end-user segmentation includes Healthcare, Retail, Financial Services (BFSI), Telecommunications, Government & Public Sector, Manufacturing, Energy & Utilities, and Others. The Healthcare sector is leading this market segment, driven by the increasing need for data analytics to improve patient outcomes, streamline operations, and enhance decision-making processes. The growing adoption of electronic health records and telemedicine solutions has further accelerated the demand for analytics in this sector.

The Middle East Data Analytics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, Accenture, Deloitte, Capgemini, Infosys, Wipro, Tata Consultancy Services (TCS), PwC (PricewaterhouseCoopers), EY (Ernst & Young), SAS Institute, Oracle, SAP, Microsoft, Teradata, Qlik, Injazat (UAE), STC Solutions (Saudi Arabia), G42 (UAE), eSense Software (Jordan), and Devoteam Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East data analytics outsourcing market appears promising, driven by technological advancements and increasing reliance on data for strategic decision-making. As organizations continue to embrace digital transformation, the demand for real-time analytics and AI integration is expected to rise. Furthermore, the growing emphasis on predictive analytics will enable businesses to anticipate market trends, enhancing their competitive edge. Overall, the market is poised for significant growth, supported by favorable government policies and investments in technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Others |

| By End-User | Healthcare Retail Financial Services (BFSI) Telecommunications Government & Public Sector Manufacturing Energy & Utilities Others |

| By Industry Vertical | Government Education Manufacturing Transportation and Logistics Oil & Gas Hospitality & Tourism Others |

| By Service Model | On-Premise Cloud-Based Hybrid Others |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud Community Cloud Others |

| By Analytics Type | Text Analytics Web Analytics Social Media Analytics Geospatial Analytics Others |

| By Geographic Presence | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Israel, Palestine, Syria) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Turkey Iran Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Analytics | 100 | Chief Data Officers, Analytics Managers |

| Healthcare Analytics Outsourcing | 80 | IT Directors, Healthcare Analysts |

| Retail Data Insights | 70 | Marketing Managers, Data Scientists |

| Telecommunications Data Management | 60 | Operations Managers, Business Intelligence Analysts |

| Government Sector Analytics | 50 | Policy Analysts, IT Managers |

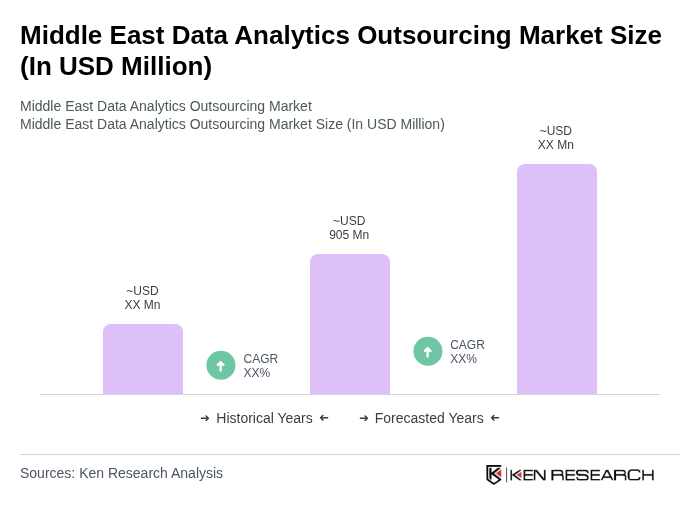

The Middle East Data Analytics Outsourcing Market is valued at approximately USD 905 million, reflecting a significant growth trend driven by the increasing demand for data-driven decision-making across various sectors such as healthcare, finance, and retail.