Region:Middle East

Author(s):Rebecca

Product Code:KRAC8603

Pages:91

Published On:November 2025

By Technology Type:The technology type segmentation includes various innovative solutions that are transforming the fashion industry. The subsegments are Augmented Reality (AR) and Virtual Try-On Solutions, Artificial Intelligence and Machine Learning Platforms, Smart Fabrics and Wearable Technology, Blockchain for Supply Chain Transparency, Fashion E-commerce and Mobile-First Platforms, and IoT and Connected Fashion Solutions. Among these, Fashion E-commerce and Mobile-First Platforms are currently leading the market due to the rapid shift towards online shopping, especially post-pandemic. Consumers are increasingly favoring mobile shopping experiences, which has driven significant investments in mobile-first strategies by retailers. Smart apparel and digital fashion are also experiencing robust growth, reflecting the region’s focus on innovation and consumer engagement .

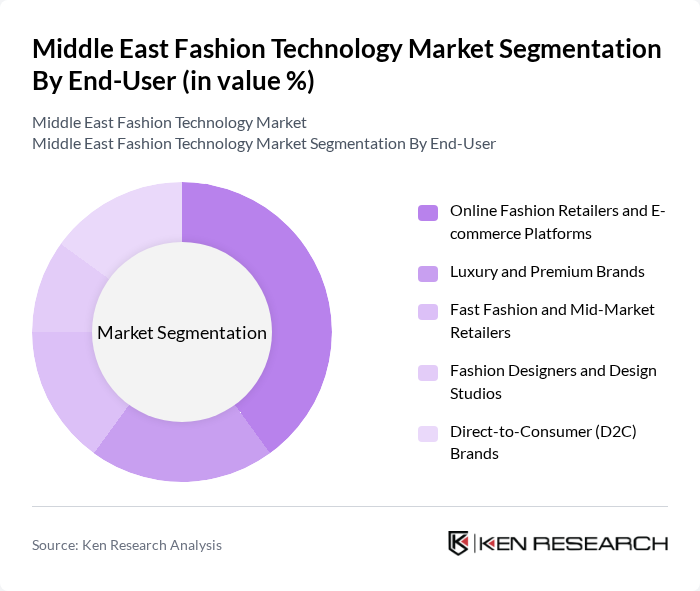

By End-User:The end-user segmentation encompasses various categories of consumers and businesses utilizing fashion technology. The subsegments include Online Fashion Retailers and E-commerce Platforms, Luxury and Premium Brands, Fast Fashion and Mid-Market Retailers, Fashion Designers and Design Studios, and Direct-to-Consumer (D2C) Brands. Online Fashion Retailers and E-commerce Platforms dominate this segment, driven by the increasing consumer preference for online shopping and the convenience it offers. The rise of social media and influencer marketing has also significantly contributed to the growth of this subsegment, as brands leverage these platforms to reach a wider audience. The luxury and premium segment is also expanding, supported by strong tourist spending and the prominence of international brands in the region .

The Middle East Fashion Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Namshi (Noon Fashion), Ounass, Modanisa, Noon.com, Amazon Fashion Middle East, Farfetch, ASOS, Zara (Inditex), H&M Group, Shein, Mango, Uniqlo, Adidas, Nike, Carrefour Fashion (Middle East Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East fashion technology market appears promising, driven by a growing emphasis on sustainability and digital transformation. As consumer preferences shift towards eco-friendly products, brands are increasingly adopting innovative technologies to enhance their offerings. Furthermore, the integration of AI and blockchain is expected to revolutionize supply chain transparency and efficiency. With government support for tech adoption, the region is poised for significant advancements in fashion technology, fostering a more sustainable and competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Augmented Reality (AR) and Virtual Try-On Solutions Artificial Intelligence and Machine Learning Platforms Smart Fabrics and Wearable Technology Blockchain for Supply Chain Transparency Fashion E-commerce and Mobile-First Platforms IoT and Connected Fashion Solutions |

| By End-User | Online Fashion Retailers and E-commerce Platforms Luxury and Premium Brands Fast Fashion and Mid-Market Retailers Fashion Designers and Design Studios Direct-to-Consumer (D2C) Brands |

| By Fashion Category | Modest Fashion and Abaya Technology Luxury and Designer Fashion Sports and Athleisure Apparel Accessories and Jewelry Sustainable and Eco-Friendly Fashion |

| By Distribution Channel | Online Retail and Mobile Apps Social Commerce and Influencer Platforms Offline Retail and Physical Stores Direct-to-Consumer Channels |

| By Region | GCC Countries (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, Oman) Levant Region (Lebanon, Syria, Jordan, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Sub-Saharan Africa |

| By Payment and Financing Model | Digital Wallets and Contactless Payments Buy Now Pay Later (BNPL) Solutions Traditional Payment Methods Cryptocurrency and Blockchain Payments |

| By Price Segment | Luxury Segment (USD 500+) Premium Segment (USD 200-500) Mid-Range Segment (USD 50-200) Budget Segment (Below USD 50) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retail Technology Adoption | 150 | Retail Managers, IT Directors |

| Consumer Attitudes Towards Fashion Tech | 150 | Fashion Consumers, Trend Analysts |

| Supply Chain Innovations in Fashion | 100 | Supply Chain Managers, Logistics Coordinators |

| Investment Trends in Fashion Tech Startups | 80 | Venture Capitalists, Angel Investors |

| Impact of E-commerce on Fashion Sales | 120 | E-commerce Managers, Digital Marketing Specialists |

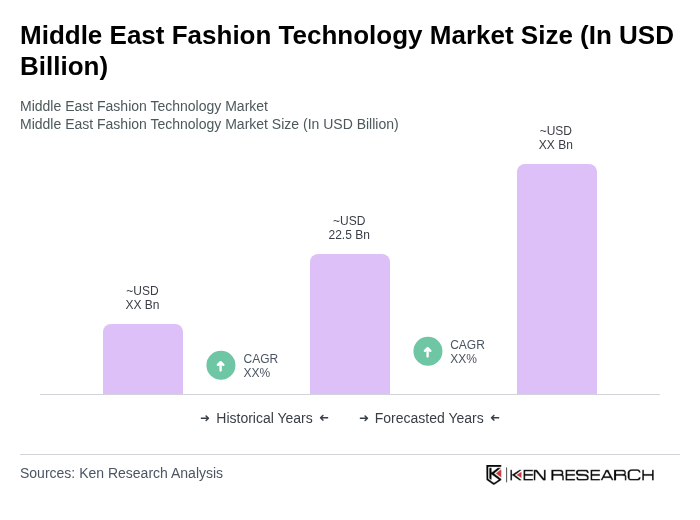

The Middle East Fashion Technology Market is valued at approximately USD 22.5 billion, driven by the adoption of digital technologies, e-commerce platforms, and consumer demand for personalized shopping experiences.