Middle East Fiber Supplements Market Overview

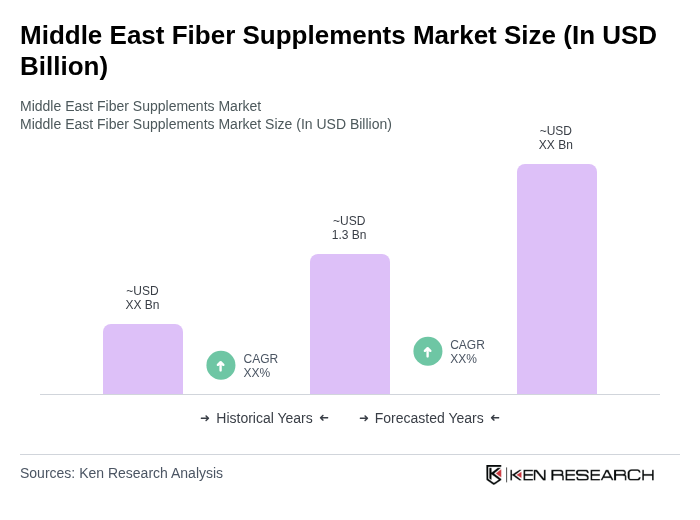

- The Middle East Fiber Supplements Market is valued at approximately USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health awareness among consumers, a rising prevalence of lifestyle-related diseases, and a growing demand for dietary supplements that promote digestive health. The market has seen a significant uptick in consumer interest in natural and organic products, further fueling its expansion .

- Countries such as the United Arab Emirates, Saudi Arabia, and Egypt dominate the Middle East Fiber Supplements Market due to their large populations, increasing disposable incomes, and a growing trend towards health and wellness. The urbanization and lifestyle changes in these regions have led to a higher demand for dietary supplements, making them key players in the market .

- In 2023, the Saudi Food and Drug Authority (SFDA) issued the "Regulation for Registration and Clearance of Food Supplements, 2023," requiring all dietary supplements, including fiber supplements, to undergo safety and efficacy testing before market approval. This regulation, issued by the Saudi Food and Drug Authority, mandates comprehensive documentation of product composition, quality standards, and clinical substantiation for health claims, thereby enhancing consumer safety and fostering trust in the dietary supplement industry .

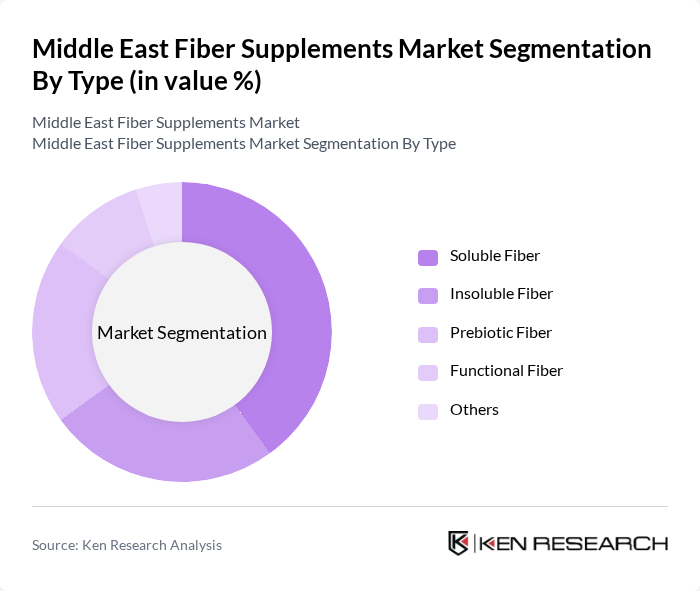

Middle East Fiber Supplements Market Segmentation

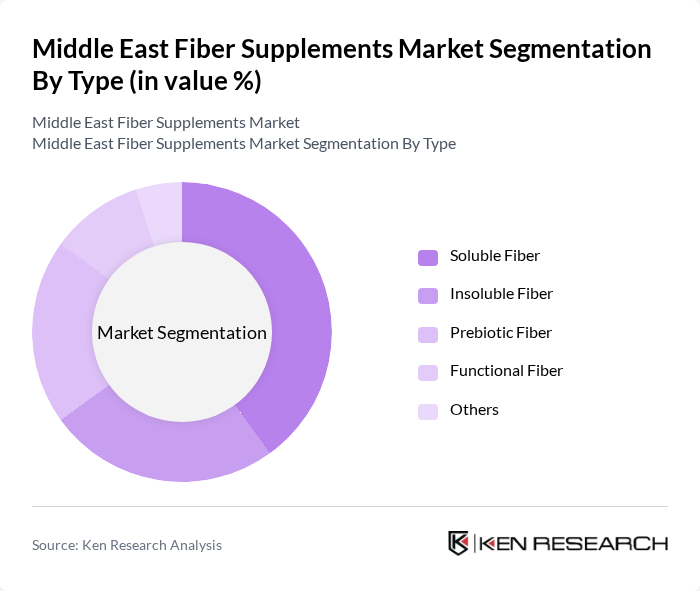

By Type:The market is segmented into various types of fiber supplements, including soluble fiber, insoluble fiber, prebiotic fiber, functional fiber, and others. Among these, soluble fiber is gaining traction due to its health benefits, such as lowering cholesterol and improving blood sugar levels. Insoluble fiber is also popular for its role in promoting digestive health. Prebiotic fiber is increasingly recognized for its ability to support gut health, while functional fiber is being incorporated into various food products .

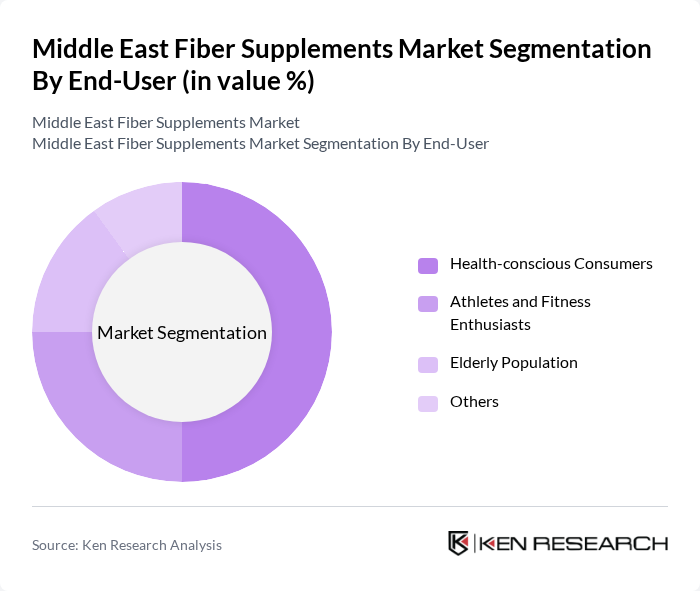

By End-User:The end-user segmentation includes health-conscious consumers, athletes and fitness enthusiasts, the elderly population, and others. Health-conscious consumers are the largest segment, driven by a growing awareness of the importance of dietary fiber in maintaining overall health. Athletes and fitness enthusiasts are increasingly incorporating fiber supplements into their diets to enhance performance and recovery. The elderly population is also a significant segment, as they seek products that support digestive health and overall well-being .

Middle East Fiber Supplements Market Competitive Landscape

The Middle East Fiber Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., GNC Holdings, Inc., NOW Foods, Garden of Life, Metagenics, Inc., Nature's Way Products, LLC, Sunfiber (Taiyo Kagaku Co., Ltd.), NutraBlast, BioCare Copenhagen, Optimum Nutrition, Vital Proteins, Ancient Nutrition, Quest Nutrition, Nutrafol, Fiber Choice (Mondelez International), Al Rabie Saudi Foods Company, Supercare Health, Herbalife Nutrition Middle East, Nature’s Sunshine Products, NutriLab contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Fiber Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness Among Consumers:The Middle East has seen a significant rise in health awareness, with 65% of consumers actively seeking healthier food options. This trend is supported by a report from the World Health Organization indicating that 75% of the population is prioritizing dietary changes to improve overall health. As a result, the demand for fiber supplements is expected to increase, driven by consumers' desire to enhance digestive health and prevent chronic diseases.

- Rising Demand for Dietary Fiber in Food Products:The demand for dietary fiber in food products is projected to reach 1.8 million tons in the Middle East in future, according to industry reports. This surge is attributed to the growing recognition of fiber's role in weight management and digestive health. Additionally, the increasing incorporation of fiber into various food products, such as cereals and snacks, is further propelling the fiber supplements market, as consumers seek convenient ways to meet their dietary needs.

- Growth in the Functional Food and Beverage Sector:The functional food and beverage sector in the Middle East is expected to grow to $12 billion in future, driven by consumer interest in products that offer health benefits beyond basic nutrition. This growth is fostering innovation in fiber supplements, as manufacturers develop products that cater to health-conscious consumers. The increasing availability of fortified foods and beverages is also contributing to the rising demand for fiber supplements, enhancing their market presence.

Market Challenges

- Limited Consumer Awareness About Fiber Supplements:Despite the growing health consciousness, consumer awareness regarding fiber supplements remains low, with only 35% of the population familiar with their benefits. This lack of knowledge poses a significant challenge for market growth, as many consumers still rely on traditional food sources for fiber intake. Educational initiatives are crucial to bridge this gap and promote the advantages of fiber supplements in improving health outcomes.

- Regulatory Hurdles in Product Approvals:The regulatory landscape for dietary supplements in the Middle East is complex, with stringent approval processes that can delay product launches. For instance, the average time for obtaining product approval can exceed 14 months, according to local regulatory bodies. These hurdles can hinder market entry for new fiber supplement products, limiting innovation and competition within the industry, ultimately affecting consumer access to diverse options.

Middle East Fiber Supplements Market Future Outlook

The future of the Middle East fiber supplements market appears promising, driven by increasing health awareness and a shift towards functional foods. As consumers continue to prioritize health and wellness, the demand for innovative fiber products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to fiber supplements, allowing consumers to explore a wider range of options. Companies that adapt to these trends and invest in consumer education will likely thrive in this evolving market landscape.

Market Opportunities

- Development of Innovative Fiber Supplement Products:There is a significant opportunity for companies to create innovative fiber supplements that cater to specific health needs, such as gut health or weight management. By leveraging emerging research and consumer trends, businesses can differentiate their products and capture a larger market share, potentially increasing sales by 25% in the next few years.

- Expansion into Untapped Regional Markets:Many regions in the Middle East remain underserved in terms of fiber supplement availability. Targeting these untapped markets can provide substantial growth opportunities. For instance, expanding distribution channels in countries like Iraq and Yemen, where health supplement awareness is growing, could lead to a 20% increase in market penetration and revenue generation.