Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0694

Pages:88

Published On:December 2025

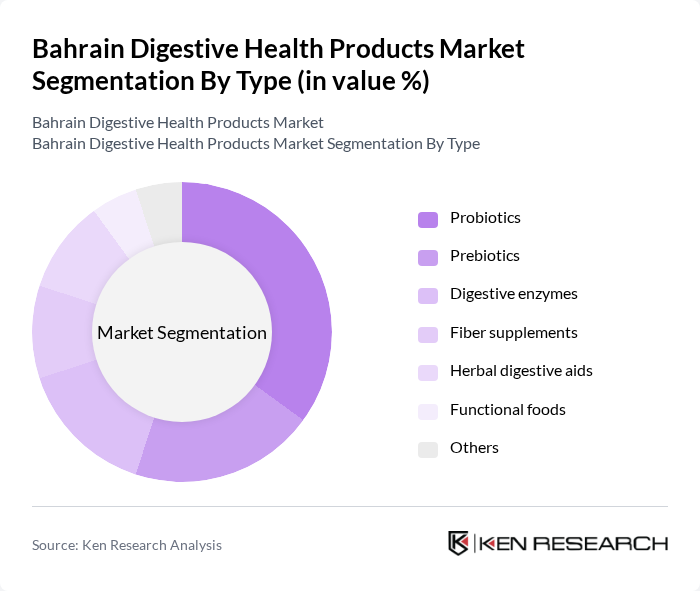

By Type:The market is segmented into various types of digestive health products, including probiotics, prebiotics, digestive enzymes, fiber supplements, herbal digestive aids, functional foods, and others. Among these, probiotics are currently the leading sub-segment due to their well-documented health benefits and increasing consumer awareness regarding gut health. The demand for probiotics is driven by a growing focus on preventive healthcare and the rising incidence of digestive disorders.

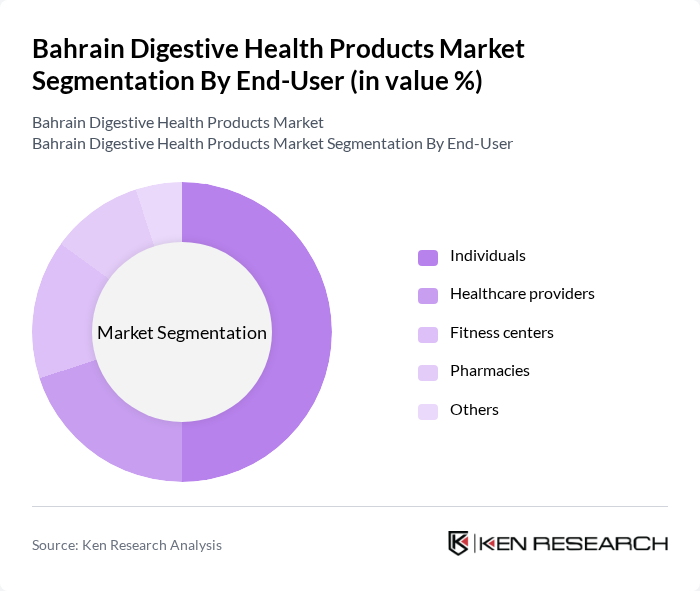

By End-User:The end-user segmentation includes individuals, healthcare providers, fitness centers, pharmacies, and others. Individuals represent the largest segment, driven by a growing consumer trend towards self-care and preventive health measures. The increasing awareness of digestive health among the general population has led to a surge in demand for digestive health products among individual consumers.

The Bahrain Digestive Health Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Health Science, Danone, Procter & Gamble, Abbott Laboratories, Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., GSK Consumer Healthcare, Reckitt Benckiser Group plc, Amway, DSM Nutritional Products, Bifidobacterium, BioCare Copenhagen, ProbioFerm, Culturelle, Renew Life contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain digestive health products market appears promising, driven by increasing consumer awareness and a shift towards preventive healthcare. As the population ages, the demand for effective digestive health solutions is expected to rise. Additionally, the trend towards natural and organic products will likely shape product development, encouraging innovation. Companies that adapt to these trends and invest in marketing strategies will be well-positioned to capture market share and meet evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Probiotics Prebiotics Digestive enzymes Fiber supplements Herbal digestive aids Functional foods Others |

| By End-User | Individuals Healthcare providers Fitness centers Pharmacies Others |

| By Distribution Channel | Online retail Supermarkets and hypermarkets Health food stores Pharmacies Direct sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Age Group | Children Adults Seniors Others |

| By Health Concern | Bloating Constipation Diarrhea Irritable bowel syndrome Others |

| By Brand Loyalty | Brand loyal consumers Price-sensitive consumers First-time buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Probiotics | 150 | Health-conscious Consumers, Regular Supplement Users |

| Dietary Supplement Usage Patterns | 100 | Nutritionists, Health Coaches |

| Market Trends in Digestive Health Products | 80 | Pharmacists, Health Product Retailers |

| Impact of Health Campaigns on Consumer Behavior | 70 | Public Health Officials, Community Health Workers |

| Awareness of Digestive Health Issues | 90 | General Public, Patients with Digestive Disorders |

The Bahrain Digestive Health Products Market is valued at approximately USD 1.75 billion, reflecting a significant growth trend driven by increasing health awareness and the prevalence of lifestyle-related digestive disorders.