Middle East Flooring Market Overview

- The Middle East Flooring Market is valued at USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, increasing construction activities, rising infrastructural development, and a rising demand for aesthetic, durable, and eco-friendly flooring solutions in both residential and commercial sectors. The market has seen a significant uptick in investments, particularly in infrastructure and real estate development including mega-projects under Saudi Vision 2030 and UAE's economic visions, which has further fueled the demand for various flooring materials.

- Countries such as the United Arab Emirates, Saudi Arabia, and Qatar dominate the Middle East Flooring Market due to their robust construction sectors and high levels of foreign investment. Major cities like Dubai and Riyadh are at the forefront, driven by ongoing mega-projects such as NEOM, Diriyah Gate, Red Sea Projects, Qiddiya, and a growing population that demands modern living spaces. The focus on luxury, high-quality, and sustainable materials in these regions also contributes to their market dominance.

- The Estidama Pearl Rating System, 2010 issued by the Abu Dhabi Urban Planning Council, establishes sustainability standards for building projects including flooring materials, requiring compliance through certification levels from Pearl 1 to Pearl 5 based on energy efficiency, water conservation, and resource conservation thresholds. This initiative encourages manufacturers to adopt greener production methods and materials, aligning with the country's vision for sustainable development and reducing the environmental impact of construction activities.

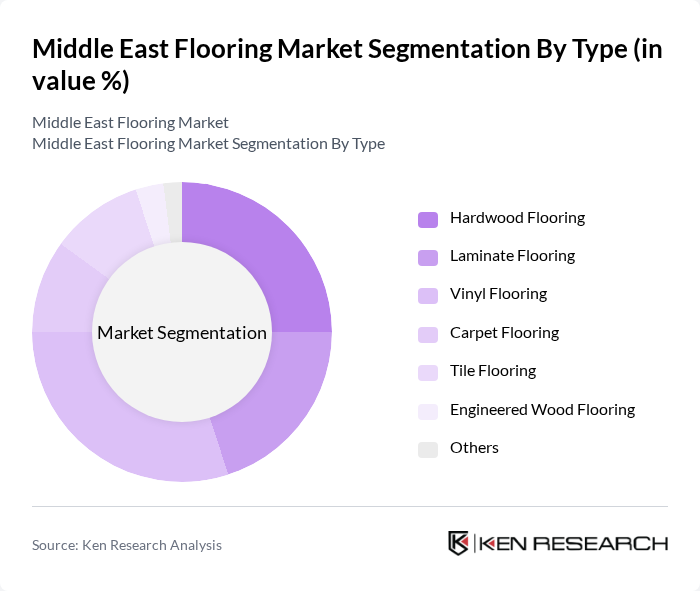

Middle East Flooring Market Segmentation

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, tile flooring, engineered wood flooring, and others. Each type caters to different consumer preferences and applications, with specific advantages in terms of durability, aesthetics, cost, and sustainability features like eco-friendly laminates and porcelain tiles.

By End-User:The flooring market is segmented by end-user categories, including residential, commercial, industrial, government & utilities, and others. Each segment has unique requirements and preferences, influencing the types of flooring materials chosen for specific applications such as resilient options for commercial durability and carpets for residential comfort.

Middle East Flooring Market Competitive Landscape

The Middle East Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Shaw Industries, Tarkett, Armstrong Flooring, Gerflor, Interface, Inc., Forbo Flooring Systems, Beaulieu International Group, LG Hausys, Boral Limited, Daltile, Karndean Designflooring, Mohawk Group, Polyflor, RAK Ceramics contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Flooring Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The Middle East is experiencing rapid urbanization, with urban populations projected to reach 85% in the future, up from 75% in 2020. This shift is driving demand for residential and commercial flooring solutions, as new construction projects emerge in urban centers. The World Bank estimates that urban areas in the region will require an additional 1.5 million housing units in the future, further fueling the flooring market's growth.

- Rising Disposable Incomes:The average disposable income in the Middle East is expected to rise to $20,000 per capita in the future, up from $15,000 in 2020. This increase allows consumers to invest in higher-quality flooring options, including luxury and sustainable materials. As a result, the demand for premium flooring products is anticipated to grow, driven by a more affluent consumer base seeking aesthetic and functional enhancements in their living spaces.

- Demand for Sustainable Flooring Solutions:With environmental concerns on the rise, the Middle East is witnessing a significant shift towards sustainable flooring solutions. The market for eco-friendly flooring materials is projected to grow by 30% annually, driven by government initiatives promoting green building practices. In the future, it is estimated that 40% of new construction projects will incorporate sustainable flooring options, reflecting a growing consumer preference for environmentally responsible choices.

Market Challenges

- Fluctuating Raw Material Prices:The flooring industry in the Middle East faces challenges due to volatile raw material prices, particularly for wood and synthetic materials. In the future, the price of hardwood increased by 15% due to supply chain disruptions and increased demand. This unpredictability can lead to higher production costs, impacting profit margins for manufacturers and potentially leading to increased prices for consumers.

- Intense Competition:The flooring market in the Middle East is characterized by intense competition among local and international players. With over 200 companies operating in the region, market saturation is a significant challenge. In the future, it is expected that 25% of new entrants will struggle to gain market share, leading to price wars and reduced profitability for established brands, which may hinder innovation and quality improvements.

Middle East Flooring Market Future Outlook

The Middle East flooring market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for innovative flooring solutions will increase, particularly those that integrate smart technology. Additionally, the focus on sustainability will continue to shape product offerings, with manufacturers investing in eco-friendly materials. By the future, the market is expected to see a notable shift towards modular flooring systems, catering to the growing need for flexibility and customization in residential and commercial spaces.

Market Opportunities

- Expansion of E-commerce Platforms:The rise of e-commerce in the Middle East presents a significant opportunity for flooring companies. With online sales projected to reach $10 billion in the future, businesses can leverage digital platforms to reach a broader audience. This shift allows for enhanced customer engagement and streamlined purchasing processes, ultimately driving sales growth in the flooring sector.

- Innovations in Flooring Technology:The flooring market is witnessing rapid innovations, particularly in smart flooring solutions. Technologies such as integrated heating systems and moisture sensors are gaining traction. In the future, it is estimated that 20% of new flooring products will incorporate smart technology, providing opportunities for manufacturers to differentiate their offerings and meet the evolving needs of tech-savvy consumers.