Saudi Arabia Flooring Market Overview

- The Saudi Arabia Flooring Market is valued at USD 3.3 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid urbanization, increasing construction activities, government investments in infrastructure development, robust real estate sector expansion, and a growing preference for aesthetic and durable flooring solutions among consumers. The market has seen a significant rise in demand for various flooring types, including hardwood, laminate, and vinyl, as the real estate sector continues to expand.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the flooring market due to their substantial construction projects and urban development initiatives. Riyadh, being the capital, leads in commercial and residential developments, while Jeddah's coastal location attracts tourism-related infrastructure. Dammam, as an industrial hub, also contributes significantly to the demand for flooring solutions.

- The Saudi Green Building Forum Guidelines, 2023 issued by the Saudi Energy Efficiency Center (SEEC), establish criteria for sustainable construction materials, including flooring, requiring projects to achieve minimum certification levels under the MOSTADAM rating system with thresholds for recycled content and low-emission materials in new buildings to promote sustainable flooring options. This regulation aims to reduce the environmental impact of construction and align with the country's Vision 2030 goals.

Saudi Arabia Flooring Market Segmentation

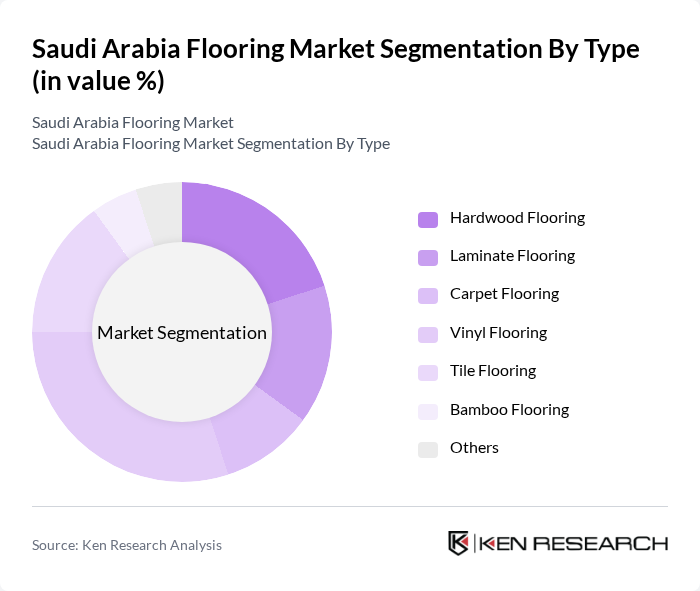

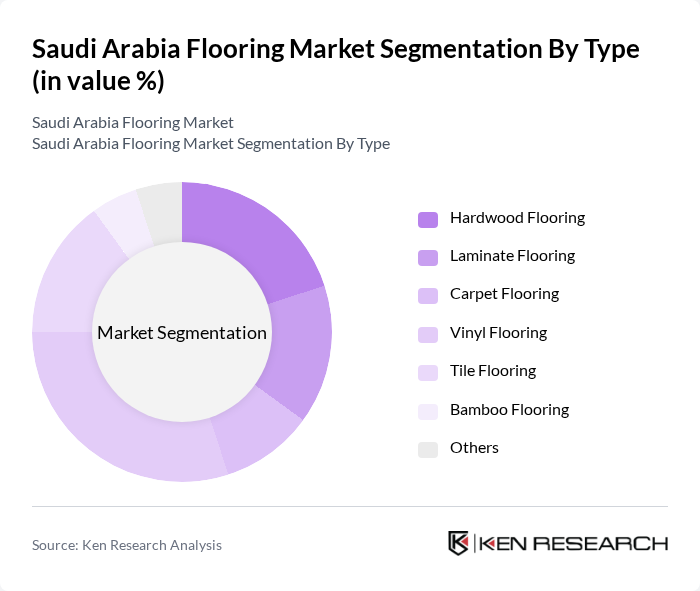

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, carpet flooring, vinyl flooring, tile flooring, bamboo flooring, and others. Each type caters to different consumer preferences and applications, with specific advantages such as durability, aesthetics, and cost-effectiveness. Among these, ceramic and porcelain tile flooring dominates due to its resistance to abrasion and suitability for desert conditions, while vinyl flooring has gained significant popularity due to its versatility and affordability, making it a preferred choice for both residential and commercial spaces.

By End-User:The flooring market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment is the largest due to the increasing number of housing projects and renovations. The commercial sector is also growing, driven by the expansion of retail spaces and office buildings. Consumer preferences for stylish and durable flooring options are influencing the market dynamics, with a notable shift towards eco-friendly materials.

Saudi Arabia Flooring Market Competitive Landscape

The Saudi Arabia Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeedah Group, Saudi Ceramics Company, Al-Fozan Group, Al-Jazira Factory for Ceramics, Al-Hokair Group, Al-Muhaidib Group, Saudi Marble & Granite Factory Company, Al-Rajhi Group, Al-Suwaidi Industrial Services, Al-Babtain Group, Al-Mansour Group, Al-Safi Group, Al-Omran Group, Al-Muhaidib Group, Al-Faisal Holding contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Flooring Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Saudi Arabia's urban population is projected to reach 38 million in the future, up from 33 million in 2020, according to the World Bank. This rapid urbanization drives demand for residential and commercial flooring solutions. As cities expand, the need for modern infrastructure, including flooring, becomes critical. Urban areas are increasingly adopting innovative flooring materials to enhance aesthetics and functionality, contributing to market growth. The urbanization trend is expected to continue, further boosting flooring demand.

- Rising Disposable Income:The average disposable income in Saudi Arabia is expected to increase to SAR 85,000 per capita in the future, up from SAR 70,000 in 2020, as reported by the Saudi Arabian Monetary Authority. This rise in disposable income allows consumers to invest in higher-quality flooring options, including luxury vinyl tiles and hardwood. Increased spending power is also driving demand for home renovations and improvements, further propelling the flooring market. This trend is expected to enhance consumer preferences for premium flooring solutions.

- Government Infrastructure Projects:The Saudi government has allocated SAR 1.8 trillion for infrastructure development as part of its Vision 2030 initiative. This investment includes significant projects in housing, commercial spaces, and public facilities, all of which require extensive flooring solutions. The construction sector is projected to grow by 5% annually, creating substantial opportunities for flooring manufacturers and suppliers. These government initiatives are expected to stimulate demand for various flooring materials, enhancing market growth in the coming years.

Market Challenges

- Fluctuating Raw Material Prices:The flooring industry in Saudi Arabia faces challenges due to volatile raw material prices, particularly for wood and synthetic materials. For instance, the price of timber has increased by 20% over the past year, driven by global supply chain disruptions. This volatility can lead to increased production costs for manufacturers, impacting profit margins and pricing strategies. Companies must navigate these fluctuations to maintain competitiveness and profitability in the market.

- Intense Competition:The Saudi flooring market is characterized by intense competition, with over 250 local and international players vying for market share. This competitive landscape has led to price wars and aggressive marketing strategies, which can erode profit margins. Companies must differentiate their offerings through innovation and quality to stand out. The presence of established brands further complicates the market dynamics, making it challenging for new entrants to gain traction and establish a foothold.

Saudi Arabia Flooring Market Future Outlook

The Saudi Arabia flooring market is poised for significant growth, driven by urbanization, rising disposable incomes, and government infrastructure investments. As consumers increasingly seek sustainable and innovative flooring solutions, manufacturers are likely to focus on eco-friendly products and smart technologies. The integration of advanced materials and customization options will also play a crucial role in meeting evolving consumer preferences. Overall, the market is expected to adapt to these trends, fostering a dynamic and competitive environment in the coming years.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Saudi Arabia, projected to reach SAR 60 billion in the future, presents a significant opportunity for flooring companies. Online platforms enable manufacturers to reach a broader audience, streamline sales processes, and reduce overhead costs. This shift towards digital retailing can enhance customer engagement and facilitate easier access to diverse flooring options, driving market growth.

- Growth in the Hospitality Sector:The hospitality sector in Saudi Arabia is expected to grow by 7% annually, driven by increased tourism and investment in hotels and resorts. This growth creates substantial demand for high-quality flooring solutions that enhance guest experiences. Flooring companies can capitalize on this trend by offering innovative and durable products tailored to the unique needs of the hospitality industry, thereby expanding their market presence.