Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3300

Pages:95

Published On:September 2025

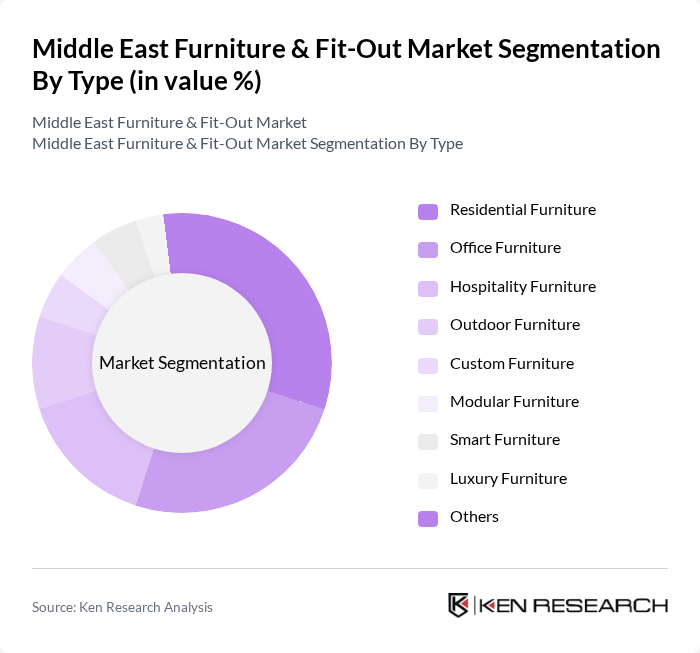

By Type:The furniture market can be segmented into various types, including residential furniture, office furniture, hospitality furniture, outdoor furniture, custom furniture, modular furniture, smart furniture, luxury furniture, and others. Each of these segments caters to specific consumer needs and preferences, reflecting trends in lifestyle, design innovation, and functionality. The market has seen a notable shift toward modular and smart furniture, driven by urban living constraints and the integration of technology into home and office environments .

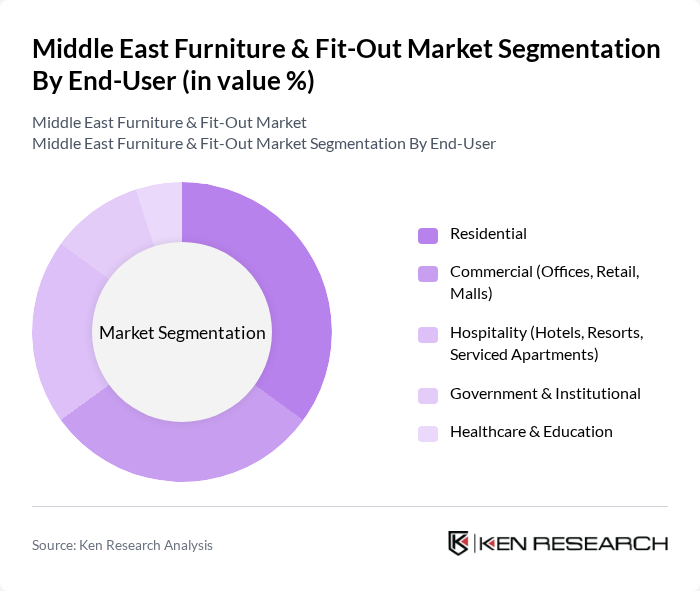

By End-User:The end-user segmentation includes residential, commercial (offices, retail, malls), hospitality (hotels, resorts, serviced apartments), government & institutional, and healthcare & education. Each segment has unique requirements and preferences that influence the types of furniture and fit-out solutions sought. The commercial and hospitality segments are particularly dynamic, driven by ongoing investments in tourism infrastructure and the expansion of retail and office spaces .

The Middle East Furniture & Fit-Out Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Al-Futtaim Group, Home Centre, Pan Emirates, Landmark Group, Royal Furniture, Muji, Danube Home, The One, Aati Home, Al-Hokair Group, Al-Muhaidib Group, Al-Jedaie Group, Saco, Home Box, United Furniture, Marina Home Interiors, Midas Furniture, Gautier Middle East, Minotti, MillerKnoll, Natuzzi Middle East, Al Rugaib Furniture, Al Huzaifa Furniture, Western Furniture LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East furniture and fit-out market is poised for significant transformation driven by technological advancements and changing consumer preferences. As smart furniture integration becomes more prevalent, manufacturers are expected to invest in innovative designs that cater to tech-savvy consumers. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly materials, shaping the future of the industry. The hospitality sector's expansion will further create opportunities for customized fit-out solutions, enhancing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Hospitality Furniture Outdoor Furniture Custom Furniture Modular Furniture Smart Furniture Luxury Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, Malls) Hospitality (Hotels, Resorts, Serviced Apartments) Government & Institutional Healthcare & Education |

| By Distribution Channel | Online Retail Offline Retail (Showrooms, Flagship Stores) Direct Sales (B2B, Project Fit-Out) Wholesale/Dealer Network |

| By Material | Wood Metal Plastic Fabric/Upholstery Glass Composite/Engineered Materials |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist Industrial |

| By Application | Residential Use Commercial Use Institutional Use Hospitality Use Outdoor/Public Spaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 120 | Homeowners, Interior Designers |

| Commercial Fit-Out Projects | 85 | Project Managers, Facility Managers |

| Hospitality Sector Furnishings | 65 | Hotel Managers, Procurement Officers |

| Office Furniture Solutions | 95 | Office Managers, HR Directors |

| Retail Space Design and Fit-Out | 75 | Retail Managers, Visual Merchandisers |

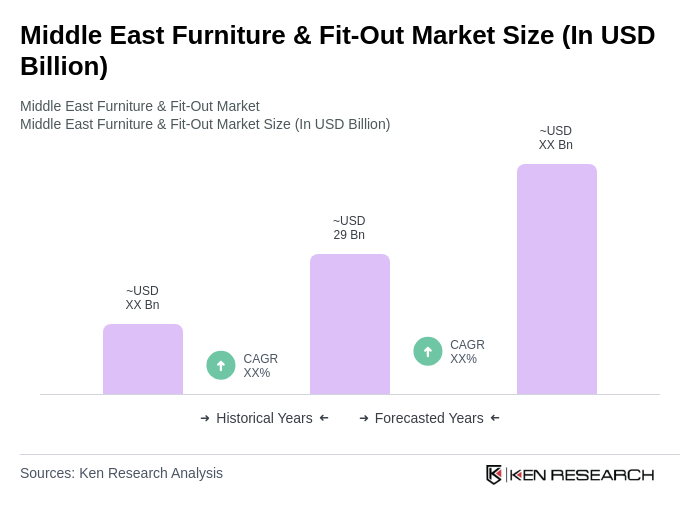

The Middle East Furniture & Fit-Out Market is valued at approximately USD 29 billion, driven by factors such as urbanization, rising disposable incomes, and a booming real estate sector, which have significantly increased the demand for both residential and commercial furniture solutions.