Region:Asia

Author(s):Rebecca

Product Code:KRAA9354

Pages:92

Published On:November 2025

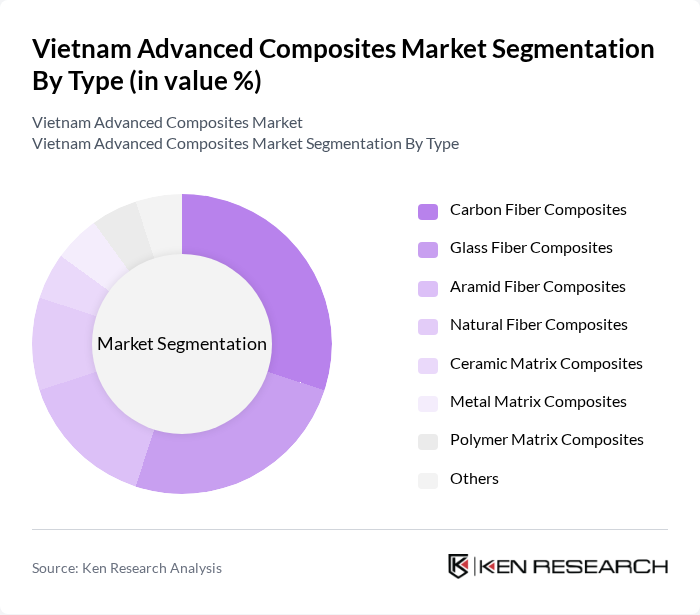

By Type:The advanced composites market is segmented into Carbon Fiber Composites, Glass Fiber Composites, Aramid Fiber Composites, Natural Fiber Composites, Ceramic Matrix Composites, Metal Matrix Composites, Polymer Matrix Composites, and Others. Each type addresses distinct applications and industry requirements, shaping the overall market dynamics .

The Carbon Fiber Composites segment leads the market due to its exceptional strength-to-weight ratio and versatility, with applications spanning aerospace, automotive, and industrial sectors. The demand for lightweight materials in automotive manufacturing, driven by fuel efficiency and emissions standards, has significantly increased the adoption of carbon fiber composites. Ongoing advancements in production technologies and cost reduction strategies have further enhanced the accessibility and market presence of these composites .

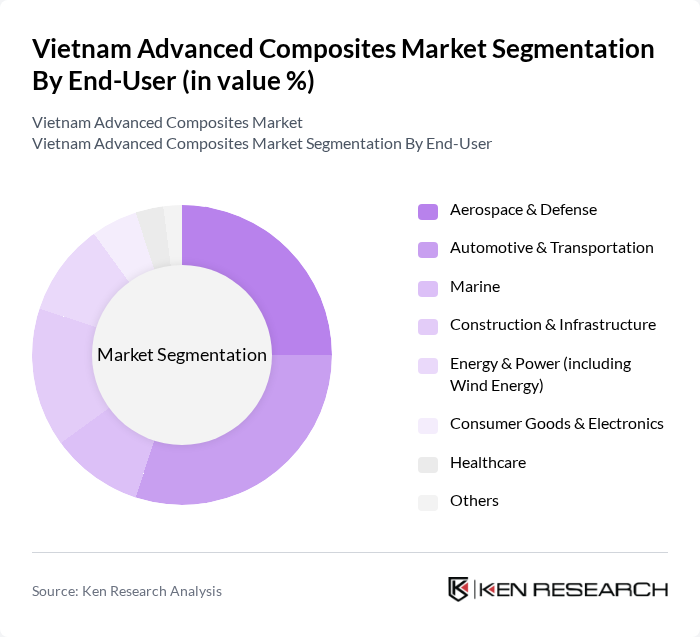

By End-User:The advanced composites market is segmented by end-user industries, including Aerospace & Defense, Automotive & Transportation, Marine, Construction & Infrastructure, Energy & Power (including Wind Energy), Consumer Goods & Electronics, Healthcare, and Others. Each segment has unique requirements and growth drivers, influencing the overall market landscape .

The Automotive & Transportation segment leads the market, reflecting the rapid adoption of advanced composites to meet fuel efficiency and emissions reduction targets. The automotive sector's shift toward lightweight, sustainable vehicles is a critical growth driver, supported by government policies and industry investments in advanced material technologies. The aerospace industry also continues to expand its use of advanced composites for weight reduction and performance enhancement in aircraft and components .

The Vietnam Advanced Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietcomposite, Vinatex, Tuan Anh Composites, H?u Ngh? Composites, Vietnam Composite Materials Co., Duy Tân Plastics Corporation, An Phát Holdings, Long Thành Plastic Company, Bình Minh Plastics, ??ng Nai Plastics, Hoàng Hà Group, Nam Vi?t Plastics, Phú Th? Composites, Minh Phát Composites, T?p ?oàn Hóa ch?t Vi?t Nam (Vinachem) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam advanced composites market appears promising, driven by increasing investments in R&D and a growing emphasis on sustainability. As industries such as automotive and aerospace continue to expand, the demand for lightweight and durable materials will rise. Furthermore, the integration of smart manufacturing technologies is expected to enhance production efficiency. With government support and a focus on innovation, the market is poised for significant growth, creating new opportunities for manufacturers and suppliers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Fiber Composites Glass Fiber Composites Aramid Fiber Composites Natural Fiber Composites Ceramic Matrix Composites Metal Matrix Composites Polymer Matrix Composites Others |

| By End-User | Aerospace & Defense Automotive & Transportation Marine Construction & Infrastructure Energy & Power (including Wind Energy) Consumer Goods & Electronics Healthcare Others |

| By Application | Structural Components Non-Structural Components Consumer Goods Industrial Applications Sporting Goods Renewable Energy Components Others |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding (RTM) Filament Winding Pultrusion Compression Molding Injection Molding Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Product Form | Sheets Rolls Prepregs Granules & Pellets Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Composites Usage | 100 | Product Development Engineers, Procurement Managers |

| Aerospace Composite Applications | 80 | R&D Directors, Quality Assurance Managers |

| Construction Material Composites | 70 | Project Managers, Materials Engineers |

| Marine Composite Solutions | 50 | Design Engineers, Operations Managers |

| Consumer Goods Composites | 60 | Product Managers, Supply Chain Analysts |

The Vietnam Advanced Composites Market is valued at approximately USD 1.1 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for lightweight and high-strength materials across various industries, including automotive, aerospace, and construction.