Region:Middle East

Author(s):Dev

Product Code:KRAB7796

Pages:98

Published On:October 2025

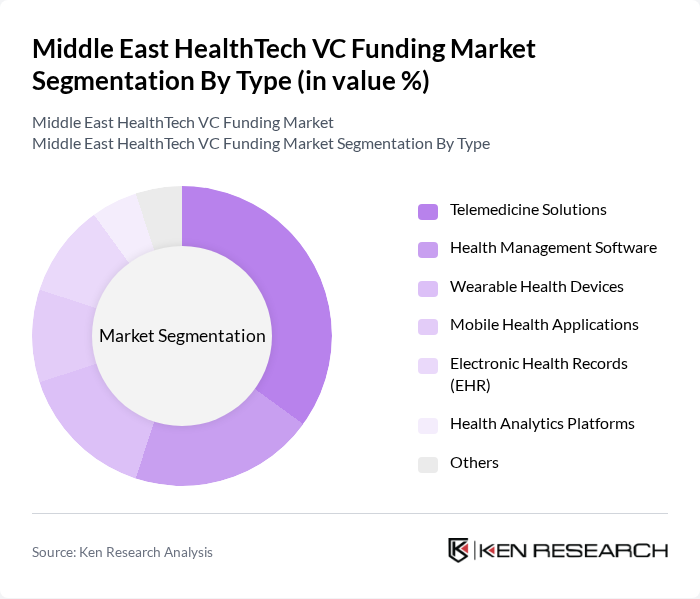

By Type:The market is segmented into various types, including Telemedicine Solutions, Health Management Software, Wearable Health Devices, Mobile Health Applications, Electronic Health Records (EHR), Health Analytics Platforms, and Others. Among these, Telemedicine Solutions have emerged as the leading sub-segment, driven by the increasing demand for remote healthcare services, especially during the COVID-19 pandemic. The convenience and accessibility offered by telemedicine have significantly influenced consumer behavior, leading to a surge in its adoption.

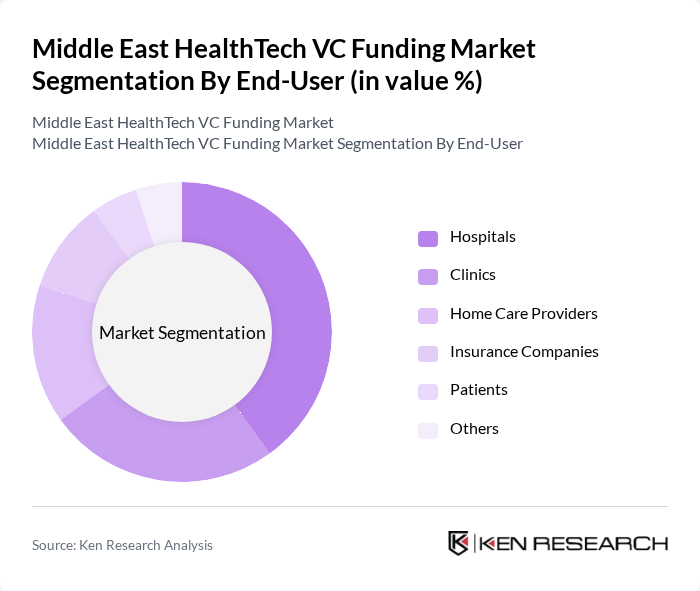

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, and Others. Hospitals are the dominant end-user segment, primarily due to their need for comprehensive health management solutions and the increasing integration of technology in patient care. The growing focus on improving patient outcomes and operational efficiency has led hospitals to invest heavily in HealthTech solutions.

The Middle East HealthTech VC Funding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vezeeta, Healthigo, Okadoc, YAPILI, DabaDoc, Altibbi, Meddy, DoctorUna, 3D Health, Qare, HealthTech Solutions, MedTech Innovations, Careem Health, Tibbiyah, HealthTech Ventures contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East HealthTech market is poised for significant transformation, driven by technological advancements and increasing consumer demand for personalized healthcare solutions. By the future, the integration of AI and machine learning in diagnostics and treatment plans is expected to enhance patient outcomes. Additionally, the collaboration between HealthTech startups and traditional healthcare providers will likely foster innovation, creating a more robust ecosystem that supports sustainable growth and improved healthcare delivery across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Solutions Health Management Software Wearable Health Devices Mobile Health Applications Electronic Health Records (EHR) Health Analytics Platforms Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Investment Source | Venture Capital Private Equity Government Grants Angel Investors Corporate Investments Others |

| By Application | Chronic Disease Management Remote Patient Monitoring Health Information Exchange Teleconsultation Health Education and Awareness Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Partnerships with Healthcare Providers Others |

| By Policy Support | Subsidies for HealthTech Startups Tax Incentives for Investors Regulatory Support for Innovation Public-Private Partnerships Others |

| By Market Maturity | Emerging Startups Established Companies Mature Market Leaders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Venture Capital Firms | 100 | Investment Managers, Partners |

| HealthTech Startups | 80 | Founders, CEOs, CTOs |

| Healthcare Policy Makers | 50 | Government Officials, Regulatory Experts |

| Industry Analysts | 40 | Market Researchers, Consultants |

| Healthcare Providers | 60 | Hospital Administrators, IT Directors |

The Middle East HealthTech VC Funding Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.