Region:Middle East

Author(s):Rebecca

Product Code:KRAD5016

Pages:85

Published On:December 2025

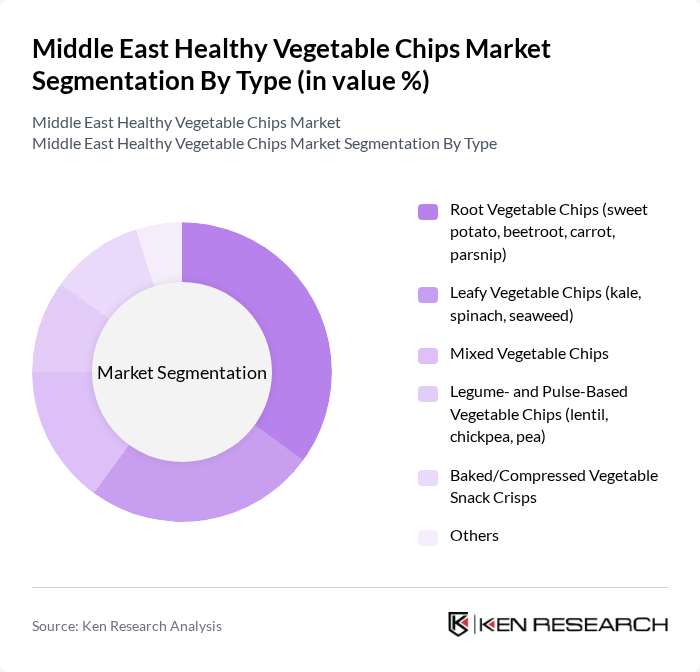

By Type:The market is segmented into various types of vegetable chips, including root vegetable chips, leafy vegetable chips, mixed vegetable chips, legume- and pulse-based vegetable chips, baked/compressed vegetable snack crisps, and others. Among these, root vegetable chips, particularly those made from sweet potatoes and beetroot, have gained significant popularity due to their higher fiber content, micronutrient profile, and appealing taste compared with conventional potato chips. Leafy vegetable chips are also emerging as a favorite among health-conscious consumers who seek low-calorie, nutrient-dense snacks, while mixed vegetable chips offer variety, convenience, and a way to combine different textures and flavors in a single pack.

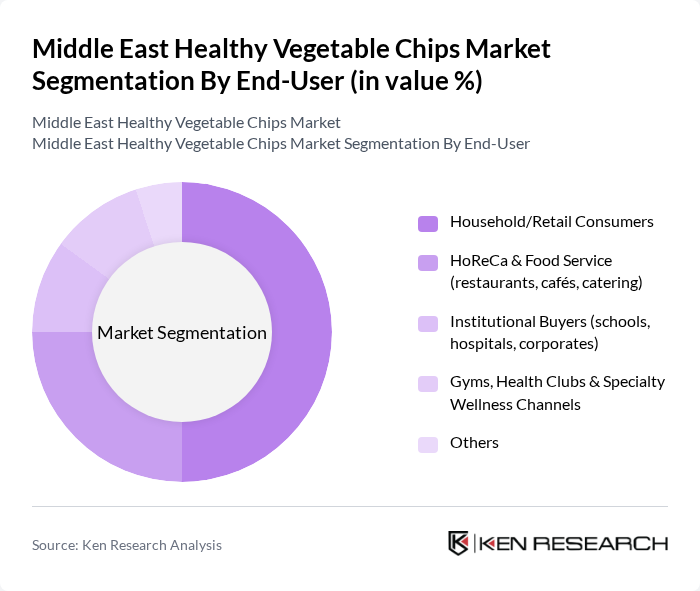

By End-User:The end-user segmentation includes household/retail consumers, HoReCa (hotels, restaurants, cafés), institutional buyers, gyms, health clubs, and specialty wellness channels, among others. Household consumers dominate the market as they increasingly seek healthier, portion-controlled snack options and clean-label products for at-home consumption. The HoReCa segment is also growing, driven by the rising trend of health-focused menus in restaurants and cafes, where vegetable chips are increasingly used as side dishes, bar snacks, and better-for-you alternatives to traditional fried potato chips.

The Middle East Healthy Vegetable Chips Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo, Inc. (Lay’s, Sunbites, Off The Eaten Path – Middle East), Calbee, Inc., Kellogg Company (Pringles), Bare Snacks (PepsiCo), Terra Chips (Hain Celestial Group), Simply 7 Snacks, Eat Real (Vegan, Lentil & Quinoa Chips), Hunter Foods LLC (Hunter’s Gourmet – UAE), Al Rifai Roastery (Lebanon/UAE), Hunter’s Gourmet “Baked” & Vegetable Chips Range, Maya’s Chips / Maya Food Industries (regional healthier snacks), IHFOOD SAL (Lebanon – better-for-you snacks), Mondelez International, Inc. (regional better-for-you snacking portfolio), Local Private Label & Retail Brands (Carrefour, Lulu, Spinneys – vegetable chip lines), Other Emerging Regional Healthy Snack Start-ups in GCC & Levant contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East healthy vegetable chips market appears promising, driven by evolving consumer preferences and increasing health awareness. As the market adapts to changing dietary habits, innovations in product offerings and sustainable practices will likely play a crucial role. The anticipated growth in e-commerce and the introduction of organic options will further enhance market dynamics, positioning healthy vegetable chips as a staple in the snack food category. Collaboration with health-focused brands will also strengthen market presence and consumer trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Root Vegetable Chips (sweet potato, beetroot, carrot, parsnip) Leafy Vegetable Chips (kale, spinach, seaweed) Mixed Vegetable Chips Legume- and Pulse-Based Vegetable Chips (lentil, chickpea, pea) Baked/Compressed Vegetable Snack Crisps Others |

| By End-User | Household/Retail Consumers HoReCa & Food Service (restaurants, cafés, catering) Institutional Buyers (schools, hospitals, corporates) Gyms, Health Clubs & Specialty Wellness Channels Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail & Quick Commerce Platforms Convenience Stores & Petrol Stations Health Food Stores & Organic/Natural Grocers Club Stores & Cash-and-Carry Others |

| By Packaging Type | Stand-Up Pouches Resealable Bags Single-Serve Sachets/Portion Packs Family-Size Bags & Multipacks Others |

| By Flavor | Sea Salt & Lightly Salted Spicy (chili, paprika, peri-peri, harissa) Middle Eastern & Levant Flavors (za’atar, sumac, shawarma, falafel-inspired) Cheese & Dairy-Inspired Flavors Herb & Gourmet Flavors (garlic herb, rosemary, truffle, mixed herbs) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, Palestine) North Africa (Egypt and other selected markets) Rest of Middle East |

| By Consumer Demographics | Age Group (Children/Teens, Young Adults, Middle-Aged, Seniors) Income Level (Mass, Upper-Middle, Premium) Lifestyle & Diet (fitness-oriented, weight-management, vegan/vegetarian, gluten-free) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences for Healthy Snacks | 150 | Health-Conscious Consumers, Fitness Enthusiasts |

| Food Industry Trends | 100 | Food Scientists, Nutritionists |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Entry Strategies | 70 | Business Development Managers, Marketing Executives |

The Middle East Healthy Vegetable Chips Market is valued at approximately USD 110 million, reflecting a growing trend towards healthier snacking options and increased health consciousness among consumers in the region.