Region:Middle East

Author(s):Dev

Product Code:KRAA9621

Pages:88

Published On:November 2025

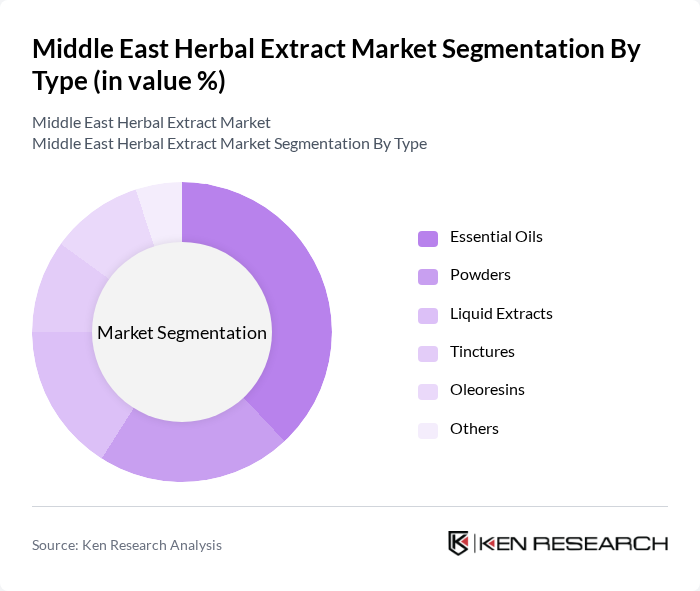

By Type:The herbal extract market can be segmented into various types, including Essential Oils, Powders, Liquid Extracts, Tinctures, Oleoresins, and Others. Among these, Essential Oils are currently leading the market due to their extensive applications in aromatherapy, cosmetics, and food flavoring. The growing trend towards natural and organic products has significantly boosted the demand for essential oils, as consumers increasingly seek alternatives to synthetic fragrances and additives. This segment is characterized by a diverse range of products sourced from various plants, making it highly versatile and appealing to a broad consumer base .

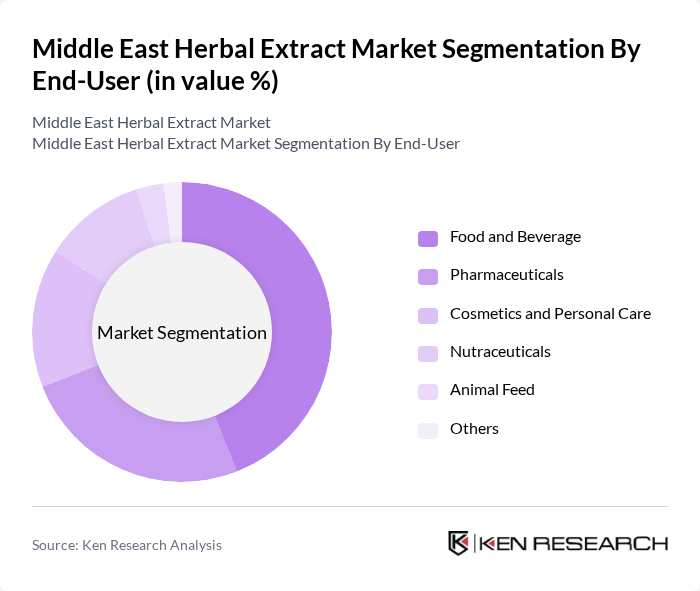

By End-User:The market can also be segmented based on end-users, including Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals, Animal Feed, and Others. The Food and Beverage sector is the dominant end-user, driven by the increasing incorporation of herbal extracts for flavoring, preservation, and health benefits. Consumers are increasingly opting for natural ingredients in their food products, leading to a surge in demand for herbal extracts. This trend is further supported by the growing health consciousness among consumers, who are seeking products that offer functional benefits .

The Middle East Herbal Extract Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Khair Natural Herbs Factory (Saudi Arabia), Döhler Middle East FZE (UAE), Martin Bauer Group (Germany/UAE), Indena S.p.A. (Italy/UAE), Naturex (Givaudan) (France/UAE), Bioextract (Egypt), Al Wadi Al Akhdar (Lebanon), Kancor Ingredients Ltd. (IFF) (India/UAE), Botanic Healthcare (India/UAE), Organic Herb Inc. (China/UAE), Herbo Nutra (India/UAE), Himalaya Wellness (India/UAE), Al-Jazeera Pharmaceutical Industries (Saudi Arabia), Vidya Herbs Pvt. Ltd. (India/UAE), Al Shifa Natural Herbs Trading LLC (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East herbal extract market appears promising, driven by increasing consumer interest in health and wellness. As the market evolves, companies are likely to invest in sustainable sourcing and innovative extraction technologies. The rise of e-commerce platforms is expected to enhance product accessibility, allowing consumers to explore a wider range of herbal products. Additionally, collaborations with health and wellness brands will likely create new opportunities for growth, fostering a more integrated approach to herbal product development.

| Segment | Sub-Segments |

|---|---|

| By Type | Essential Oils Powders Liquid Extracts Tinctures Oleoresins Others |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics and Personal Care Nutraceuticals Animal Feed Others |

| By Source | Plant-Based (Herbs, Spices, Fruits, Flowers, Roots, Leaves) Marine-Based Microbial-Based Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Pharmacies, Specialty Stores) Direct Sales (B2B, B2C) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Application | Dietary Supplements Functional Foods & Beverages Herbal Teas Pharmaceuticals Cosmetics & Personal Care Animal Nutrition Others |

| By Product Formulation | Standardized Extracts Full-Spectrum Extracts Ratio Extracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbal Extract Manufacturers | 60 | Production Managers, Quality Control Officers |

| Retailers of Herbal Products | 50 | Store Managers, Purchasing Agents |

| Health and Wellness Practitioners | 40 | Herbalists, Naturopaths |

| Consumers of Herbal Supplements | 100 | Health-Conscious Individuals, Fitness Enthusiasts |

| Regulatory Bodies and Associations | 40 | Policy Makers, Compliance Officers |

The Middle East Herbal Extract Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by consumer preferences for natural and organic products, as well as increased awareness of the health benefits associated with herbal extracts.