Region:Middle East

Author(s):Shubham

Product Code:KRAD5382

Pages:92

Published On:December 2025

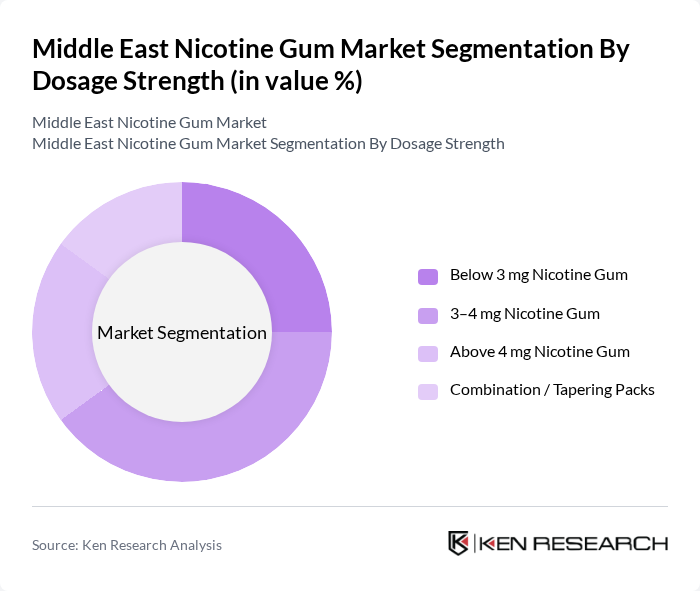

By Dosage Strength:The market is segmented based on the dosage strength of nicotine gum, which includes various levels of nicotine content to cater to different consumer needs. The subsegments include Below 3 mg Nicotine Gum, 3–4 mg Nicotine Gum, Above 4 mg Nicotine Gum, and Combination / Tapering Packs. Each subsegment serves a specific demographic, with varying preferences for nicotine intake.

The 3–4 mg Nicotine Gum subsegment dominates the market due to its balanced nicotine delivery, appealing to both moderate and heavy smokers looking to quit. This dosage is often recommended by health professionals as it effectively reduces withdrawal symptoms while allowing users to taper off nicotine gradually, with above?3?mg formats generally showing higher adherence in cessation programs. The increasing trend of personalized smoking cessation plans, often combining higher?dose gum with behavioral support and digital coaching tools, further supports the growth of this subsegment as consumers seek tailored solutions to their quitting journey.

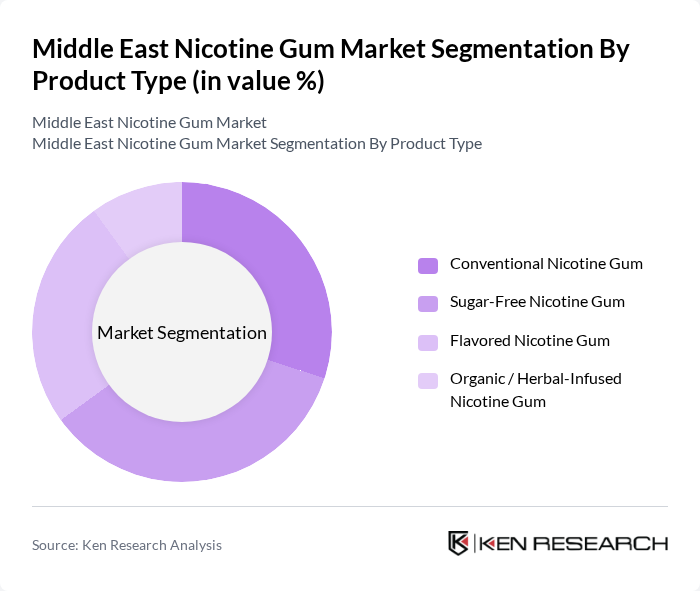

By Product Type:The market is also segmented by product type, which includes Conventional Nicotine Gum, Sugar-Free Nicotine Gum, Flavored Nicotine Gum, and Organic / Herbal-Infused Nicotine Gum. Each type caters to different consumer preferences, with a growing trend towards healthier and more appealing options such as low?calorie, tooth?friendly formulations and gums with improved texture and taste.

The Sugar-Free Nicotine Gum subsegment is leading the market, driven by increasing health consciousness among consumers and the preference for products that support oral health and weight management during smoking cessation. As more individuals become aware of the health risks associated with sugar consumption and dental caries, the demand for sugar-free options has surged, particularly in markets with high rates of diabetes and metabolic disorders common in parts of the Middle East. Additionally, flavored gums are gaining popularity, particularly among younger demographics and first?time quitters, as they provide a more enjoyable quitting experience and help mask the bitter taste of nicotine. This trend indicates a shift towards more innovative and health-oriented products in the nicotine gum market, including novel flavors, softer chew bases, and clean?label positioning in premium segments.

The Middle East Nicotine Gum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Nicorette), GlaxoSmithKline plc, Perrigo Company plc, Dr. Reddy's Laboratories Ltd., Cipla Limited, Glenmark Pharmaceuticals Ltd., Tabuk Pharmaceuticals Manufacturing Co., Jamjoom Pharma, Julphar (Gulf Pharmaceutical Industries), Neopharma, Hikma Pharmaceuticals plc, Aspen Pharmacare Holdings Ltd., Walmark a.s., Rigo Trading S.A. (Private Label & Contract Manufacturer), Other Regional & Private Label Nicotine Gum Manufacturers contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East nicotine gum market is poised for growth, driven by increasing health consciousness and a shift towards smoking cessation products. As consumers become more aware of the benefits of nicotine replacement therapies, the market is likely to see innovations in product offerings. Additionally, the expansion of online retail platforms will enhance accessibility, allowing for greater consumer engagement and sales. The focus on personalized health solutions will further shape the market landscape, creating opportunities for tailored products.

| Segment | Sub-Segments |

|---|---|

| By Dosage Strength | Below 3 mg Nicotine Gum –4 mg Nicotine Gum Above 4 mg Nicotine Gum Combination / Tapering Packs |

| By Product Type | Conventional Nicotine Gum Sugar-Free Nicotine Gum Flavored Nicotine Gum Organic / Herbal-Infused Nicotine Gum |

| By End-User | Adult Smokers (18+ Years) Former Smokers Patients in Smoking Cessation Programs Pregnant & Postpartum Smokers (Under Medical Supervision) Others |

| By Distribution Channel | Hospital Pharmacies Retail / Community Pharmacies Supermarkets & Hypermarkets Online Pharmacies & E-commerce Platforms Convenience Stores & Petrol Stations Others |

| By Flavor | Mint Fruit Cinnamon Coffee & Menthol Blends Others |

| By Age Group | –24 Years –34 Years –44 Years –54 Years Years and Above |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant (Jordan, Lebanon, Iraq, Others) Iran North Africa (Egypt and Other MENA Countries) Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Psychologists, Addiction Specialists |

| Pharmacy Retailers | 90 | Pharmacy Managers, Retail Pharmacists |

| Consumer Users of Nicotine Gum | 150 | Former Smokers, Current Users of Nicotine Replacement |

| Public Health Officials | 70 | Health Policy Makers, Tobacco Control Advocates |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

The Middle East Nicotine Gum Market is valued at approximately USD 190 million, reflecting a growing demand for smoking cessation products driven by health awareness and government initiatives aimed at reducing tobacco use.