Region:Middle East

Author(s):Rebecca

Product Code:KRAB8372

Pages:90

Published On:October 2025

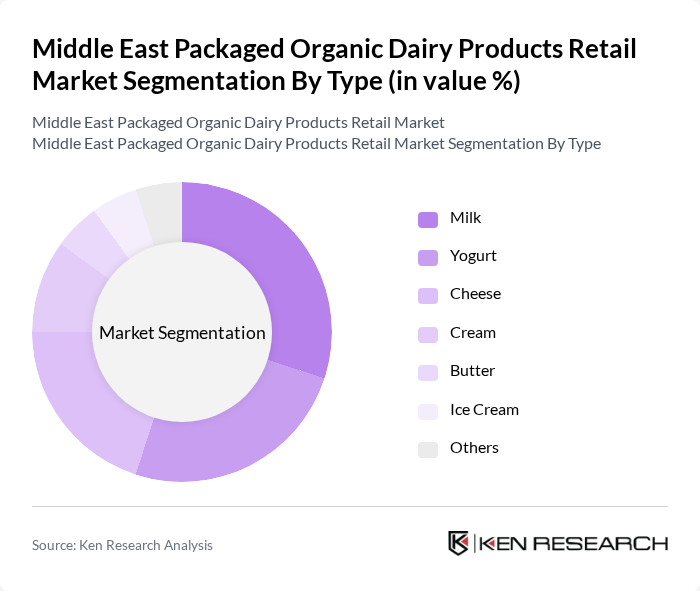

By Type:The market is segmented into various types of packaged organic dairy products, including Milk, Yogurt, Cheese, Cream, Butter, Ice Cream, and Others. Each of these sub-segments caters to different consumer preferences and dietary needs, with milk and yogurt being the most popular choices among health-conscious consumers. The increasing trend of snacking and on-the-go consumption has also contributed to the growth of yogurt and cheese products.

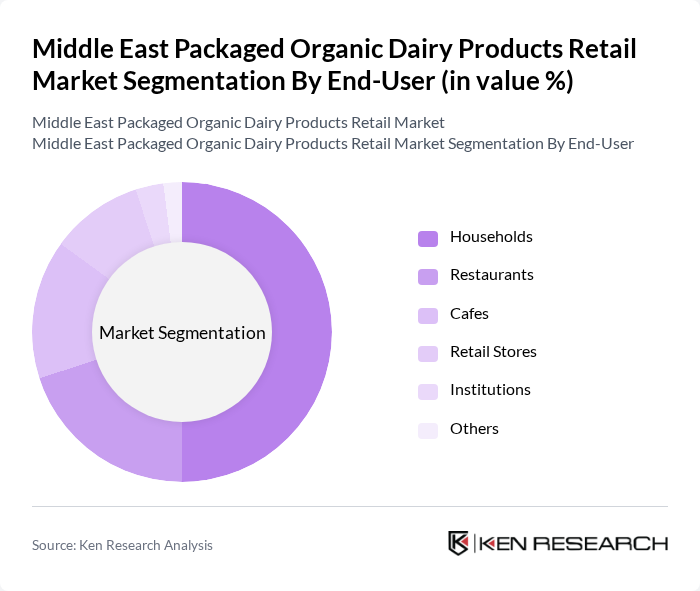

By End-User:The end-user segmentation includes Households, Restaurants, Cafes, Retail Stores, Institutions, and Others. Households represent the largest segment, driven by the increasing trend of healthy eating and the growing number of families opting for organic products. Restaurants and cafes are also significant contributors, as they increasingly incorporate organic dairy products into their menus to cater to health-conscious diners.

The Middle East Packaged Organic Dairy Products Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al Ain Dairy, Nadec, Al Safi Danone, Organic Valley, Tetra Pak, Al Rawabi Dairy Company, Al Baddad Capital, Al Ain Farms, Al Jazeera Dairy, Almarai Dairy, Al Watania, Al Kabeer Group, Al Mufeed, Al Mufeed Dairy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East packaged organic dairy products retail market appears promising, driven by increasing health consciousness and a shift towards sustainable consumption. As consumers become more informed about the benefits of organic products, demand is expected to rise significantly. Additionally, advancements in e-commerce and retail strategies will enhance accessibility, allowing for greater market penetration. Collaborations with health institutions and innovative product offerings will further support growth, positioning the market for robust expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Yogurt Cheese Cream Butter Ice Cream Others |

| By End-User | Households Restaurants Cafes Retail Stores Institutions Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales Others |

| By Packaging Type | Bottles Tetra Packs Cartons Pouches Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Organic Certification | USDA Organic EU Organic Local Certifications Others |

| By Region | GCC Countries Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Dairy Retailers | 150 | Store Managers, Category Buyers |

| Organic Dairy Producers | 100 | Farm Owners, Production Managers |

| Consumer Insights | 200 | Health-Conscious Consumers, Organic Product Shoppers |

| Distribution Channels | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Analysts | 50 | Industry Experts, Market Researchers |

The Middle East Packaged Organic Dairy Products Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of health benefits associated with organic products and a rising demand for natural dairy options.