Region:Middle East

Author(s):Rebecca

Product Code:KRAD7413

Pages:92

Published On:December 2025

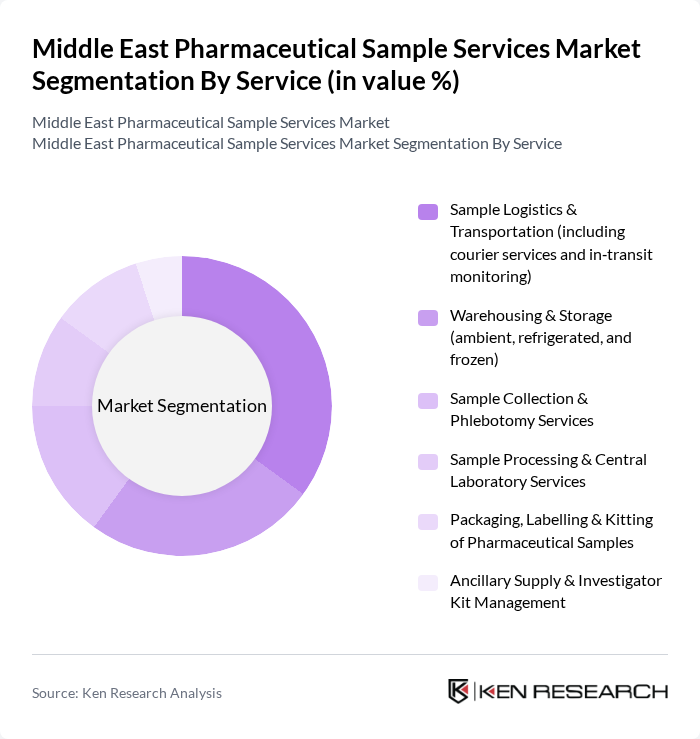

By Service:The service segment encompasses various offerings that facilitate the handling and management of pharmaceutical samples. Key subsegments include Sample Logistics & Transportation, Warehousing & Storage, Sample Collection & Phlebotomy Services, Sample Processing & Central Laboratory Services, Packaging, Labelling & Kitting of Pharmaceutical Samples, and Ancillary Supply & Investigator Kit Management. Among these, **Warehousing & Storage** is currently the leading subsegment, driven by the increasing need for reliable temperature-controlled storage solutions across the region.

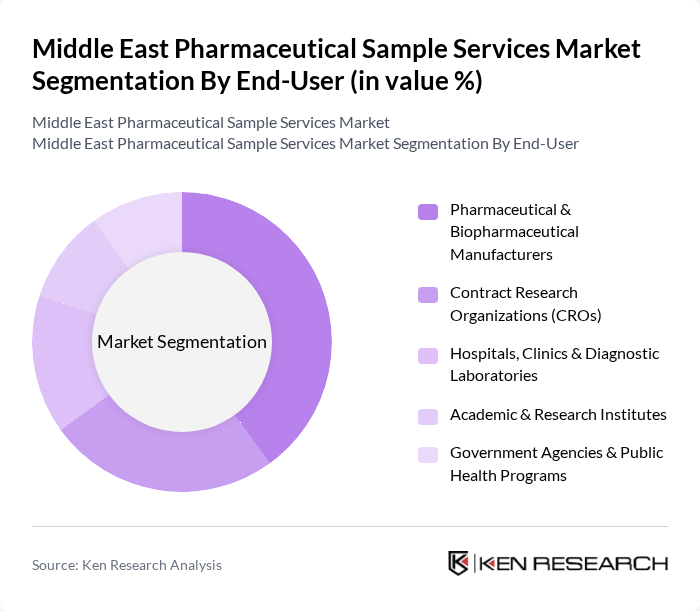

By End-User:This segmentation focuses on the various entities that utilize pharmaceutical sample services. The primary end-users include Pharmaceutical & Biopharmaceutical Manufacturers, Contract Research Organizations (CROs), Hospitals, Clinics & Diagnostic Laboratories, Academic & Research Institutes, and Government Agencies & Public Health Programs. The Pharmaceutical & Biopharmaceutical Manufacturers segment is the most significant, as these companies require extensive sample services for drug development and regulatory compliance.

The Middle East Pharmaceutical Sample Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as World Courier (AmerisourceBergen / Cencora), Marken (a UPS Company), DHL Life Sciences & Healthcare (DHL Global Forwarding), UPS Healthcare, FedEx HealthCare Solutions, Aramex Healthcare & Life Sciences, Biocair, Cryoport Systems, Thermo Fisher Scientific – Clinical Trial Services, IQVIA – Clinical & Commercial Services, Parexel International – Clinical Trial Logistics & Sample Management, Eurofins Scientific – Central Laboratory & Bioanalytical Services, Alcami / Almac Group – Clinical Services & Sample Management, Regional Players (e.g., Gulf Drug LLC, Life Science Logistics Middle East, National Medical Care Co.), Local Niche Couriers & Depots (country-specific specialist providers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East pharmaceutical sample services market appears promising, driven by technological advancements and a growing focus on personalized medicine. As the region embraces digital transformation, the integration of AI and data analytics in sample management is expected to enhance operational efficiency. Furthermore, the increasing collaboration between pharmaceutical companies and research institutions will likely foster innovation, leading to the development of more effective therapies tailored to patient needs, thereby expanding the market's potential.

| Segment | Sub-Segments |

|---|---|

| By Service | Sample Logistics & Transportation (including courier services and in?transit monitoring) Warehousing & Storage (ambient, refrigerated, and frozen) Sample Collection & Phlebotomy Services Sample Processing & Central Laboratory Services Packaging, Labelling & Kitting of Pharmaceutical Samples Ancillary Supply & Investigator Kit Management |

| By End-User | Pharmaceutical & Biopharmaceutical Manufacturers Contract Research Organizations (CROs) Hospitals, Clinics & Diagnostic Laboratories Academic & Research Institutes Government Agencies & Public Health Programs |

| By Sample Type | Blood and Blood-Derived Samples (serum, plasma, PBMCs) Tissue and Biopsy Samples Urine & Other Body Fluid Samples Genomic and Molecular Samples (DNA, RNA, cell lines) Temperature-Sensitive Drug Product Samples (biologics, vaccines) |

| By Service Model | In?house Sample Services Outsourced Sample Services Hybrid / Partnership Models |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq and others) North Africa (Egypt and other MENA countries) Rest of Middle East |

| By Technology | Automated Sample Handling & Robotics Manual Sample Handling Cold Chain & Ultra-Cold Chain Technologies Real-Time Temperature & Location Monitoring (IoT, RFID, data loggers) Digital Sample Management Platforms & LIMS |

| By Application | Clinical Trials & Clinical Research Drug Development & Stability Studies Commercial Distribution of Promotional/Physician Samples Pharmacovigilance & Post-Marketing Studies Diagnostics & Personalized Medicine Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Services | 120 | Pharmacy Managers, Retail Pharmacists |

| Hospital Pharmacy Services | 90 | Hospital Pharmacists, Clinical Directors |

| Patient Support Programs | 70 | Patient Care Coordinators, Healthcare Providers |

| Regulatory Compliance Services | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Access and Reimbursement | 80 | Market Access Managers, Health Economists |

The Middle East Pharmaceutical Sample Services Market is valued at approximately USD 520 million, reflecting a significant growth driven by the increasing demand for efficient logistics and supply chain solutions in the pharmaceutical sector.