Region:Middle East

Author(s):Rebecca

Product Code:KRAD5035

Pages:100

Published On:December 2025

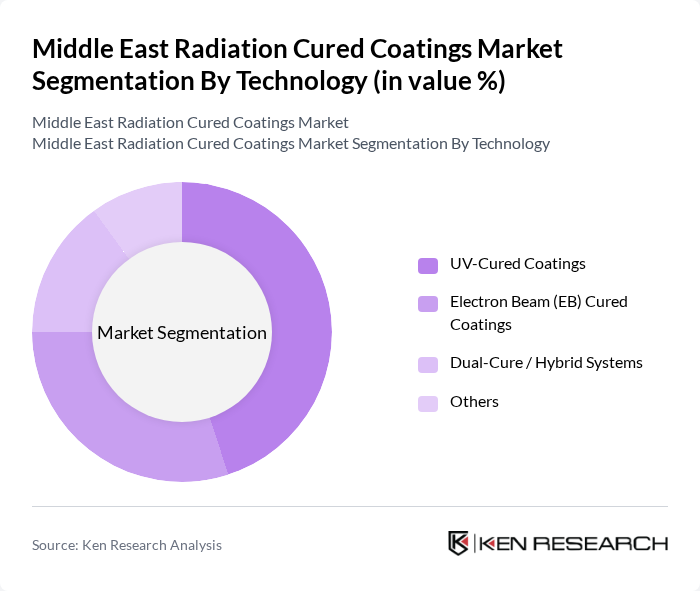

By Technology:

The technology segment of the radiation cured coatings market includes UV-Cured Coatings, Electron Beam (EB) Cured Coatings, Dual-Cure / Hybrid Systems, and Others. UV-Cured Coatings lead the market due to their rapid, on-demand curing at ambient or low temperatures, high line speeds, and excellent performance characteristics such as abrasion resistance, gloss, and adhesion on substrates including wood, plastics, metals, and flexible packaging films. The increasing demand for high-quality finishes in applications such as automotive refinishing, plastic components, wood furniture, flooring, electronics, and printing/packaging has driven the preference for UV technology, supported by the growing penetration of UV-LED curing systems that offer lower energy use and longer lamp life. Additionally, the trend towards sustainability, lower VOC emissions, and process efficiency—through reduced oven usage and shorter curing cycles—has further solidified the position of UV-Cured Coatings in the market.

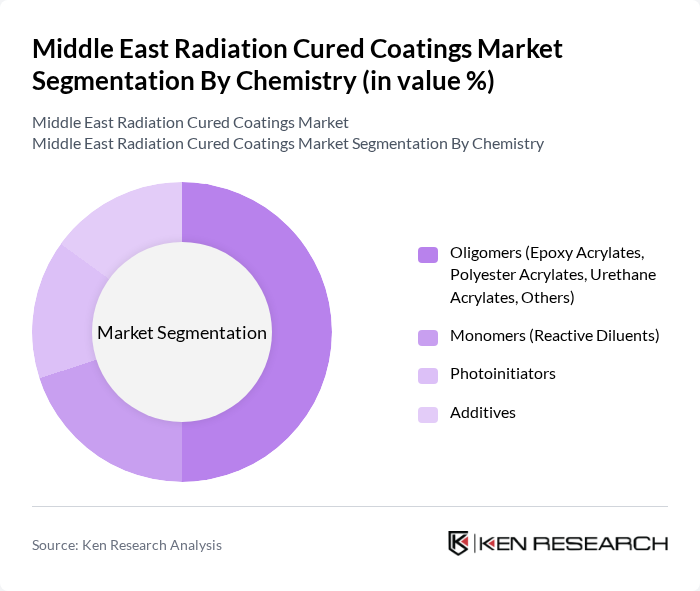

By Chemistry:

This segment encompasses Oligomers (Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, Others), Monomers (Reactive Diluents), Photoinitiators, and Additives. Oligomers, particularly Epoxy Acrylates and Urethane Acrylates, dominate the market due to their superior adhesion, hardness, flexibility, and chemical and abrasion resistance, making them ideal for wood coatings, plastic and metal components, and high?performance industrial applications. The increasing demand for high-performance coatings in the automotive, construction, packaging, and electronics sectors has further enhanced the growth of this sub-segment, with formulators tailoring oligomer backbones and functionality to achieve specific properties such as scratch resistance, low yellowing, or flexibility. Additionally, the trend towards customization in coatings formulations, including the use of specialized oligomers, low-viscosity reactive diluents, and advanced photoinitiator packages, has led to a rise in engineered systems optimized for UV-LED curing, low migration in packaging, and higher solids content.

The Middle East Radiation Cured Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, BASF SE, Axalta Coating Systems Ltd., Jotun A/S, Kansai Paint Co., Ltd., Hempel A/S, Asian Paints Limited (including Berger Paints Emirates), Sika AG, Dow Inc., Allnex Group, Arkema S.A. (including Sartomer), Covestro AG, Henkel AG & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East radiation cured coatings market appears promising, driven by increasing environmental regulations and a shift towards sustainable practices. As industries such as construction and automotive continue to expand, the demand for innovative and eco-friendly coatings is expected to rise. Additionally, advancements in technology will likely lead to the development of more efficient curing processes, enhancing product performance. Overall, the market is poised for growth, with significant opportunities for companies that can adapt to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Technology | UV-Cured Coatings Electron Beam (EB) Cured Coatings Dual-Cure / Hybrid Systems Others |

| By Chemistry | Oligomers (Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, Others) Monomers (Reactive Diluents) Photoinitiators Additives |

| By Substrate | Wood and Wood-Based Panels Plastics and Composites Metals Paper and Paperboard Glass and Optical Media Others |

| By Application | Wood Coatings (Furniture, Flooring, Joinery) Industrial Coatings (General Industrial, Coil & Metal, Machinery) Automotive OEM & Refinish Printing Inks & Overprint Varnishes Electronics & PCB Coatings Packaging (Flexible & Rigid) Others |

| By End-Use Industry | Building & Construction Automotive & Transportation Furniture & Woodworking Electronics & Electrical Printing & Packaging Industrial Manufacturing Others |

| By Formulation | % Solids (Solvent-Free) Waterborne Solventborne Powder UV Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 120 | Production Managers, Quality Control Supervisors |

| Construction Coatings | 100 | Architects, Project Managers |

| Electronics Coatings | 90 | Product Development Engineers, R&D Managers |

| Industrial Coatings | 110 | Operations Directors, Procurement Specialists |

| Consumer Goods Coatings | 80 | Marketing Managers, Brand Managers |

The Middle East Radiation Cured Coatings Market is valued at approximately USD 2.0 billion, reflecting a significant share within the broader paints and coatings market in the region, driven by the demand for eco-friendly and high-performance coatings.