Region:North America

Author(s):Rebecca

Product Code:KRAC3236

Pages:97

Published On:October 2025

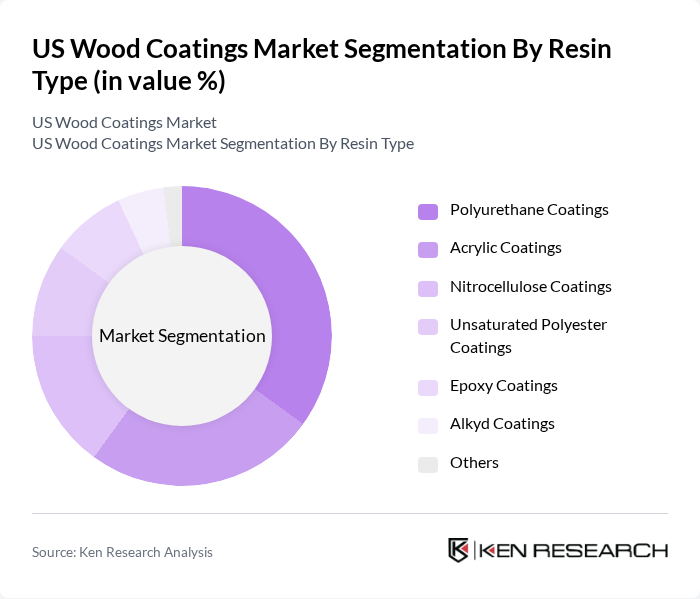

By Resin Type:The resin type segmentation includes Polyurethane Coatings, Acrylic Coatings, Nitrocellulose Coatings, Unsaturated Polyester Coatings, Epoxy Coatings, Alkyd Coatings, and Others. Polyurethane Coatings hold the largest market share, attributed to their superior durability, chemical resistance, and versatility across residential and commercial applications. These coatings are preferred for their long-lasting finishes and ability to withstand heavy use in furniture, flooring, and cabinetry. Acrylic Coatings are also widely adopted for their fast-drying properties and environmental benefits, while Nitrocellulose and Unsaturated Polyester Coatings serve niche applications requiring specific performance characteristics.

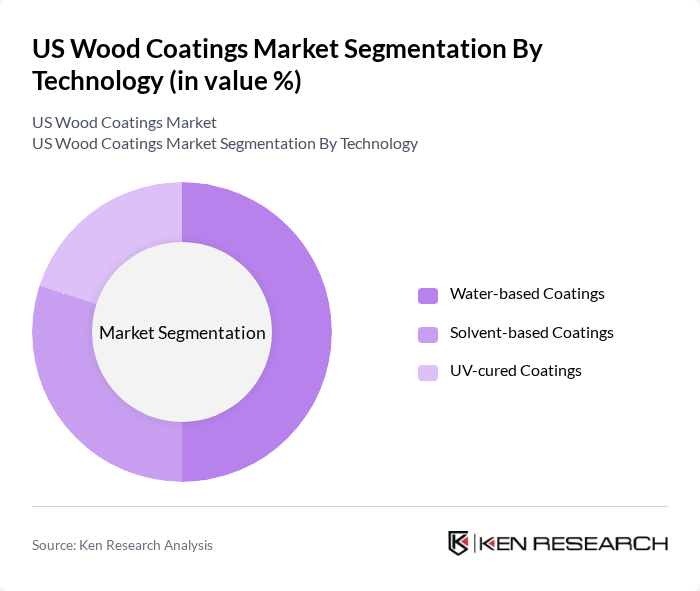

By Technology:The technology segmentation comprises Water-based Coatings, Solvent-based Coatings, and UV-cured Coatings. Water-based Coatings lead the segment due to their low environmental impact, ease of application, and compliance with VOC regulations. These coatings are increasingly preferred for their quick drying times and reduced emissions, supporting the market’s sustainability trend. Solvent-based Coatings remain important for applications requiring robust performance, while UV-cured Coatings are gaining traction in specialty and high-speed manufacturing environments.

The US Wood Coatings Market features a dynamic mix of regional and international players. Leading participants such as Sherwin-Williams Company, PPG Industries, Inc., Benjamin Moore & Co., AkzoNobel N.V., RPM International Inc., Valspar Corporation, Behr Process Corporation, Dunn-Edwards Corporation, BASF SE, Eastman Chemical Company, Axalta Coating Systems Ltd., Hempel A/S, Tikkurila Oyj, Sika AG, and Rust-Oleum Corporation drive innovation, geographic expansion, and service delivery. These companies focus on sustainable product development, advanced coating technologies, and robust distribution networks to maintain competitive advantage.

The US wood coatings market is poised for dynamic growth, driven by increasing consumer demand for sustainable products and technological innovations. As the construction and furniture industries expand, the need for high-performance coatings will rise. Companies are likely to invest in R&D to develop eco-friendly formulations that comply with stringent regulations. Additionally, the trend towards customization and personalization in coatings will create new opportunities for manufacturers to differentiate their products and capture market share in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Polyurethane Coatings Acrylic Coatings Nitrocellulose Coatings Unsaturated Polyester Coatings Epoxy Coatings Alkyd Coatings Others |

| By Technology | Water-based Coatings Solvent-based Coatings UV-cured Coatings |

| By Application | Furniture Flooring & Decking Cabinetry Millwork Musical Instruments Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Distribution Channel | Direct Sales Retail Online Sales Distributors |

| By Price Range | Economy Mid-range Premium |

| By Packaging Type | Cans Drums Pails |

| By Brand Positioning | Luxury Brands Value Brands Mass Market Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wood Coatings | 100 | Home Improvement Retailers, DIY Enthusiasts |

| Commercial Wood Coatings | 80 | Facility Managers, Architects, Interior Designers |

| Industrial Wood Coatings | 60 | Manufacturing Plant Managers, Procurement Specialists |

| Eco-friendly Wood Coatings | 50 | Sustainability Managers, Product Development Teams |

| Wood Coatings Distribution Channels | 60 | Distributors, Supply Chain Managers |

The US Wood Coatings Market is valued at approximately USD 1.8 billion, driven by increasing demand for high-performance wood finishes in both residential and commercial applications, alongside a growing preference for sustainable and eco-friendly coatings.