Middle East Ready Mix Concrete Market Overview

- The Middle East Ready Mix Concrete Market is valued at USD 16.9 billion, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, large-scale infrastructure projects, and a surge in construction activities across the region. The demand for ready-mix concrete is significantly influenced by ongoing development in residential, commercial, and industrial sectors, which require high-performance concrete solutions. Notable drivers include the rise in population, increased tourism, development of new cities, and greater investment in transportation and affordable housing projects .

- Key players in this market include the UAE, Saudi Arabia, and Qatar, which dominate due to substantial investments in infrastructure and real estate development. The UAE, particularly Dubai, is recognized for its ambitious construction projects, while Saudi Arabia's Vision 2030 initiative is driving economic diversification and infrastructure spending. Qatar’s preparations for the FIFA World Cup have also led to increased demand for ready-mix concrete, supporting commercial and infrastructure segments as the largest consumers .

- In 2023, the Saudi Arabian government implemented the "Technical Regulation for Building Materials – Part 1: Cement and Concrete Products," issued by the Saudi Standards, Metrology and Quality Organization (SASO). This regulation mandates that all ready-mix concrete suppliers must comply with SASO quality standards and obtain certification from recognized bodies, ensuring materials used in construction projects meet strict safety and durability requirements. Compliance is required for product labeling, performance thresholds, and periodic quality audits .

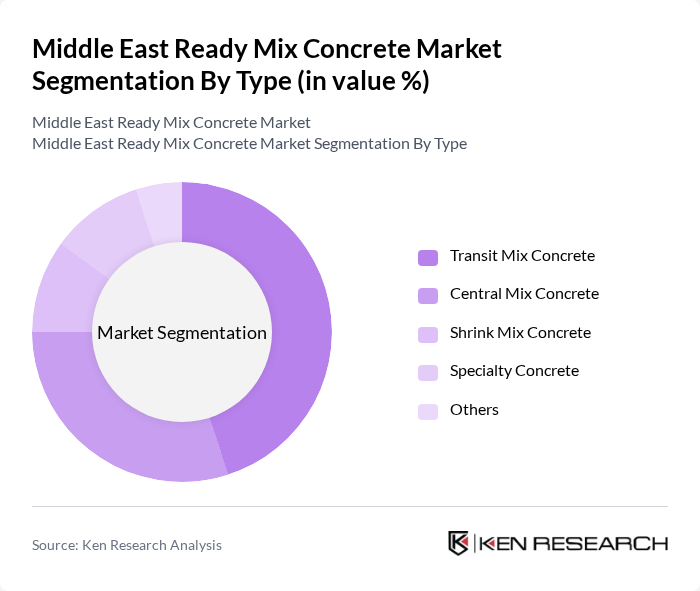

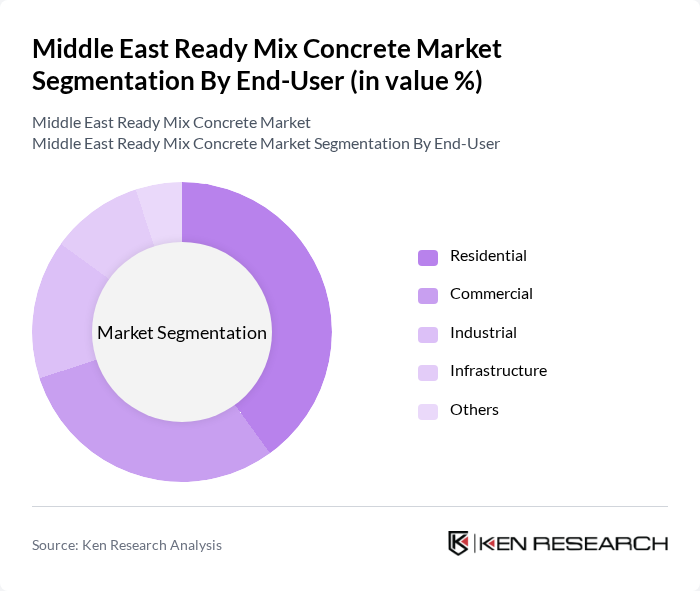

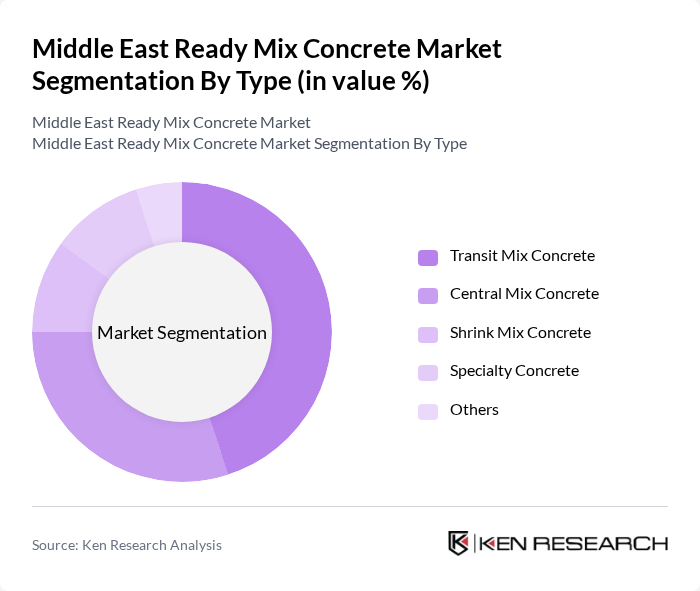

Middle East Ready Mix Concrete Market Segmentation

By Type:The market is segmented into Transit Mix Concrete, Central Mix Concrete, Shrink Mix Concrete, Specialty Concrete, and Others. Transit Mix Concrete remains the most widely used due to its logistical convenience and efficiency for urban and infrastructure projects. Central Mix Concrete is preferred for large-scale developments requiring consistent quality and rapid placement, while Specialty Concrete addresses specific needs such as high-strength, lightweight, or self-compacting applications .

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Infrastructure, and Others. The residential sector is the largest consumer of ready-mix concrete, driven by ongoing housing developments and urban expansion. The commercial sector follows closely, supported by demand from office buildings, retail centers, and hospitality projects. Infrastructure projects, including roads, bridges, and public facilities, contribute substantially to market growth, reflecting the region’s focus on connectivity, modernization, and public service enhancement .

Middle East Ready Mix Concrete Market Competitive Landscape

The Middle East Ready Mix Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as LafargeHolcim, CEMEX, Al Ghurair Construction, Ready Mix Concrete Industries (RMCI), Arabian Cement Company, Qatar National Cement Company, National Ready Mix Concrete Company, Al Falah Ready Mix, Emirates Beton, Bina Ready Mix, Al Kifah Ready Mix, Al Maktoum Ready Mix, Al Mufeed Ready Mix, Al Maktab Al Aam Ready Mix, Al Mufeed Concrete, Heidelberg Materials, UltraTech Cement, Buzzi Unicem, Vulcan Materials, China National Building Material Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Ready Mix Concrete Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The Middle East is experiencing rapid urbanization, with urban populations projected to reach 80% in the future, up from 70% in the past. This surge necessitates substantial construction of residential and commercial buildings, driving demand for ready mix concrete. For instance, the UAE's urban population is expected to grow by 1.5 million people, leading to an estimated increase in concrete consumption by 5 million cubic meters annually, according to the World Bank.

- Infrastructure Development Projects:Major infrastructure projects, such as the NEOM city in Saudi Arabia, are set to require over 100 million cubic meters of concrete in the future. The region's governments have allocated approximately $200 billion for infrastructure development, including roads, bridges, and airports. This investment is expected to significantly boost the ready mix concrete market, as these projects demand high-quality concrete solutions to meet stringent construction standards.

- Government Investments in Construction:Governments in the Middle East are heavily investing in construction to diversify their economies away from oil dependency. For example, Qatar's government has earmarked $70 billion for infrastructure projects leading up to the future FIFA World Cup. Such investments are projected to increase the demand for ready mix concrete by approximately 15 million cubic meters annually, fostering growth in the sector and creating job opportunities.

Market Challenges

- Fluctuating Raw Material Prices:The ready mix concrete industry faces challenges due to volatile raw material prices, particularly cement and aggregates. In the future, cement prices surged by 20% due to supply chain disruptions and increased demand. This fluctuation can lead to unpredictable production costs, affecting profit margins for manufacturers and potentially leading to project delays as contractors seek to manage expenses effectively.

- Stringent Environmental Regulations:Increasingly stringent environmental regulations in the Middle East pose challenges for the ready mix concrete market. For instance, the UAE has implemented regulations that require a 30% reduction in carbon emissions from construction activities in the future. Compliance with these regulations necessitates investment in cleaner technologies and processes, which can increase operational costs for manufacturers and impact their competitiveness in the market.

Middle East Ready Mix Concrete Market Future Outlook

The future of the Middle East ready mix concrete market appears promising, driven by ongoing urbanization and significant government investments in infrastructure. As cities expand and new projects emerge, the demand for high-quality concrete solutions will continue to rise. Additionally, the adoption of innovative technologies, such as smart concrete, is expected to enhance production efficiency and sustainability, positioning the market for robust growth in the coming years. Strategic partnerships will also play a crucial role in navigating challenges and seizing opportunities.

Market Opportunities

- Expansion into Emerging Markets:Companies can capitalize on the growing demand for ready mix concrete in emerging markets within the Middle East, such as Iraq and Yemen. With reconstruction efforts underway, these regions present opportunities for suppliers to establish a foothold and cater to the increasing need for construction materials, potentially increasing market share significantly.

- Adoption of Sustainable Practices:The shift towards sustainable construction practices offers a lucrative opportunity for the ready mix concrete market. By incorporating eco-friendly materials and processes, companies can meet the rising demand for green building solutions. This trend is supported by government incentives for sustainable construction, which can enhance brand reputation and attract environmentally conscious clients.