Region:Middle East

Author(s):Rebecca

Product Code:KRAA9398

Pages:97

Published On:November 2025

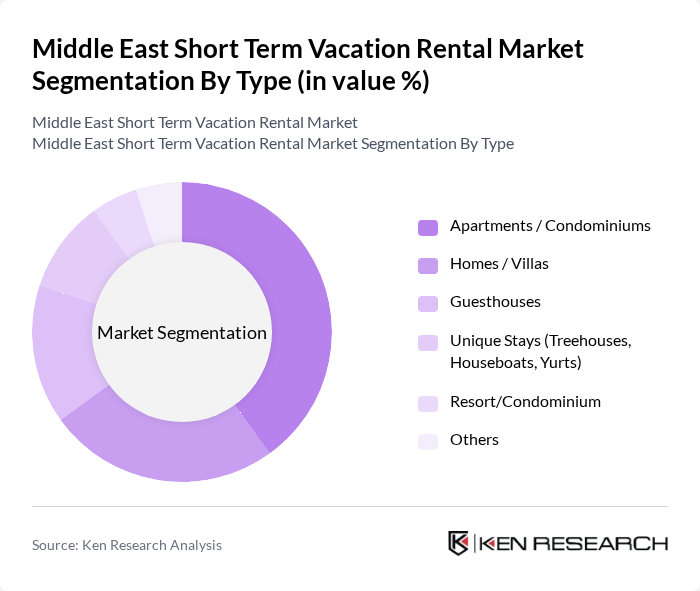

By Type:The market is segmented into various types of accommodations, including Apartments / Condominiums, Homes / Villas, Guesthouses, Unique Stays (Treehouses, Houseboats, Yurts), Resort/Condominium, and Others. Among these, Apartments / Condominiums are the most popular choice due to their affordability, convenience, and availability in prime locations. They cater to a wide range of travelers, from solo adventurers to families, making them a dominant segment in the market. Homes/Villas remain a key segment, especially for extended stays and group travel, while Unique Stays are gaining traction as travelers seek immersive and distinctive experiences .

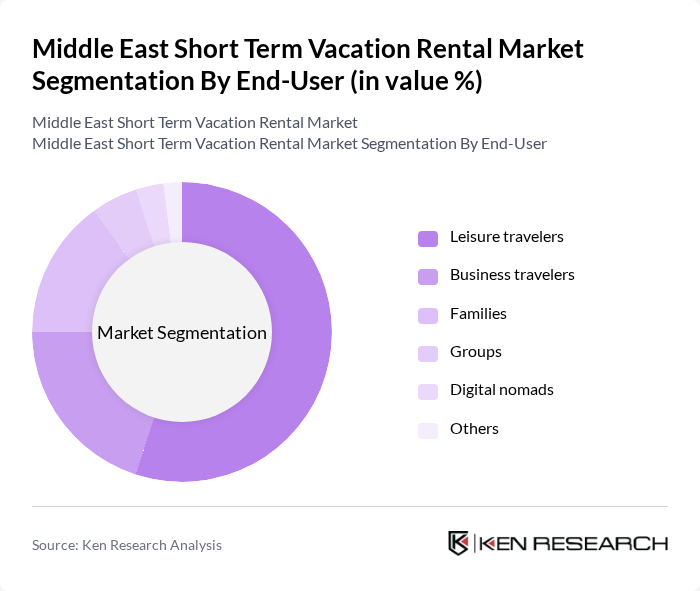

By End-User:The end-user segmentation includes Leisure travelers, Business travelers, Families, Groups, Digital nomads, and Others. Leisure travelers dominate the market, driven by the increasing trend of experiential travel and the desire for personalized accommodations. This segment's growth is fueled by the rise of social media, which encourages travelers to seek unique and memorable experiences. Business travelers and digital nomads are also emerging as important segments, with flexible work arrangements and remote work trends supporting longer stays and demand for fully equipped rentals .

The Middle East Short Term Vacation Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbnb, Booking.com, Vrbo, HomeAway, OYO Rooms, Stella Stays, bnbme, Deluxe Holiday Homes, Kennedy Towers, Bayut, Dubizzle, Plum Guide, Sonder, Staycae, Driven Holiday Homes contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East short-term vacation rental market appears promising, driven by ongoing tourism growth and evolving traveler preferences. As digital platforms continue to innovate, operators will likely leverage technology to enhance guest experiences. Additionally, the increasing focus on sustainability will push rental providers to adopt eco-friendly practices, appealing to a growing segment of environmentally conscious travelers. Overall, the market is poised for continued expansion, adapting to changing consumer demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments / Condominiums Homes / Villas Guesthouses Unique Stays (Treehouses, Houseboats, Yurts) Resort/Condominium Others |

| By End-User | Leisure travelers Business travelers Families Groups Digital nomads Others |

| By Region | UAE Saudi Arabia Egypt Qatar South Africa Rest of Middle East & Africa |

| By Property Size | Studio apartments One-bedroom apartments Two-bedroom apartments Larger properties Others |

| By Booking Channel | Online travel agencies (OTAs) Direct bookings (host websites) Property management companies Offline channels Others |

| By Duration of Stay | Short-term (less than a week) Medium-term (1 week to 1 month) Long-term (more than 1 month) Others |

| By Amenities Offered | Wi-Fi Pool access Kitchen facilities Parking Pet-friendly Wellness facilities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Short-Term Rentals | 75 | Property Owners, Rental Managers |

| Tourist Preferences | 60 | Travelers, Tour Operators |

| Regulatory Impact Assessment | 45 | Local Government Officials, Policy Makers |

| Market Trends Analysis | 50 | Real Estate Analysts, Market Researchers |

| Consumer Behavior Insights | 55 | Frequent Travelers, Vacation Rental Users |

The Middle East Short Term Vacation Rental Market is valued at approximately USD 12 billion, driven by increasing tourism, domestic travel, and the popularity of alternative accommodations among travelers seeking unique experiences.