Region:Middle East

Author(s):Shubham

Product Code:KRAA8858

Pages:95

Published On:November 2025

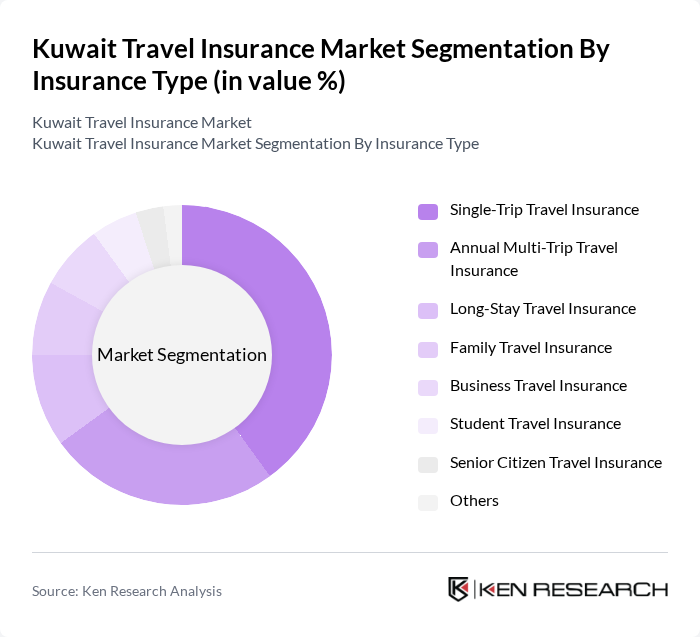

By Insurance Type:

The insurance type segmentation includes sub-segments such as Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, Long-Stay Travel Insurance, Family Travel Insurance, Business Travel Insurance, Student Travel Insurance, Senior Citizen Travel Insurance, and Others. Among these, Single-Trip Travel Insurance is the most popular choice among travelers, driven by its flexibility and affordability for short-term trips. The increasing trend of spontaneous travel, the rise in international tourism, and regulatory requirements for outbound travelers have further propelled demand for this sub-segment. Annual Multi-Trip Travel Insurance is also gaining traction, particularly among frequent travelers and business professionals, as it offers convenience and cost savings for multiple trips within a year.

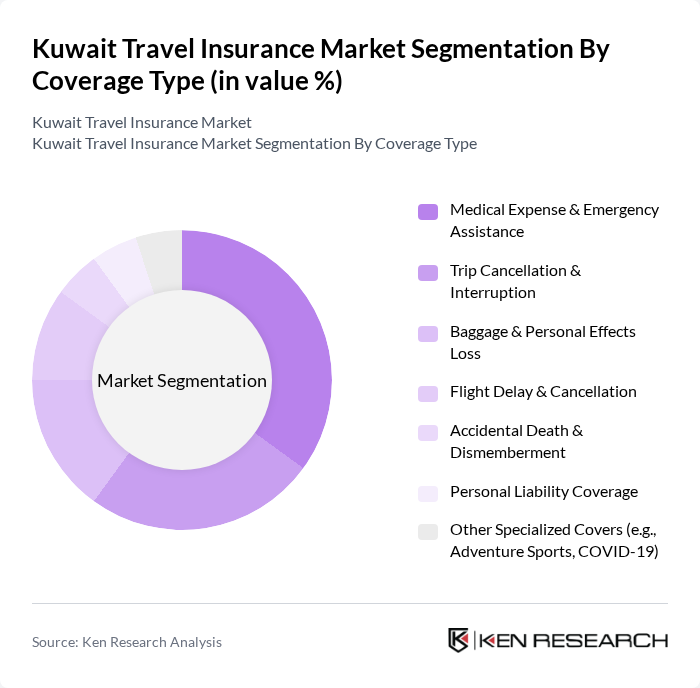

By Coverage Type:

The coverage type segmentation encompasses Medical Expense & Emergency Assistance, Trip Cancellation & Interruption, Baggage & Personal Effects Loss, Flight Delay & Cancellation, Accidental Death & Dismemberment, Personal Liability Coverage, and Other Specialized Covers (such as Adventure Sports and COVID-19). Medical Expense & Emergency Assistance is the leading coverage type, driven by travelers’ increasing awareness of health risks abroad and the need for immediate medical support. Trip Cancellation & Interruption coverage is also gaining popularity as travelers seek to protect their investments against unforeseen changes in travel plans, especially in the context of evolving global health and geopolitical risks.

The Kuwait Travel Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Insurance Group (GIG), Kuwait Insurance Company (KIC), Warba Insurance Company, Al Ahleia Insurance Company, Al Sagr National Insurance Company, Boubyan Takaful Insurance Company, Wethaq Takaful Insurance Company, Al Fajer Insurance Company, Al-Dhafra Insurance Company, AXA Gulf (now GIG Gulf), Zurich Insurance Middle East, Chubb Arabia Cooperative Insurance Company, MetLife Gulf, Takaful International Company, and National Life & General Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait travel insurance market is poised for significant evolution in the coming years, driven by technological advancements and changing consumer preferences. The increasing adoption of digital platforms for purchasing insurance is expected to streamline the buying process, enhancing customer engagement. Additionally, as the tourism sector continues to grow, insurance providers will likely innovate their offerings to include more tailored solutions, ensuring they meet the diverse needs of travelers while maintaining competitive pricing.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Single-Trip Travel Insurance Annual Multi-Trip Travel Insurance Long-Stay Travel Insurance Family Travel Insurance Business Travel Insurance Student Travel Insurance Senior Citizen Travel Insurance Others |

| By Coverage Type | Medical Expense & Emergency Assistance Trip Cancellation & Interruption Baggage & Personal Effects Loss Flight Delay & Cancellation Accidental Death & Dismemberment Personal Liability Coverage Other Specialized Covers (e.g., Adventure Sports, COVID-19) |

| By Distribution Channel | Insurance Brokers & Agencies Banks & Financial Institutions Online Aggregators Insurance Companies - Direct Travel Agents & Tour Operators OTA & Airline Embedded Sales Others |

| By End User | Individual Travelers Business Travelers Family Travelers Student Travelers Senior Citizens Group Travelers Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Premium Range | Low Premium Medium Premium High Premium Others |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Travelers | 100 | Individuals aged 18-65 who travel for leisure |

| Business Travelers | 60 | Corporate employees who travel for work purposes |

| Travel Agency Representatives | 50 | Agents and managers from travel agencies in Kuwait |

| Insurance Brokers | 40 | Professionals working in travel insurance brokerage |

| Frequent Travelers | 60 | Individuals who travel more than three times a year |

The Kuwait Travel Insurance Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is attributed to an increase in outbound travelers and heightened awareness of travel-related risks.