Region:Middle East

Author(s):Shubham

Product Code:KRAB8249

Pages:87

Published On:October 2025

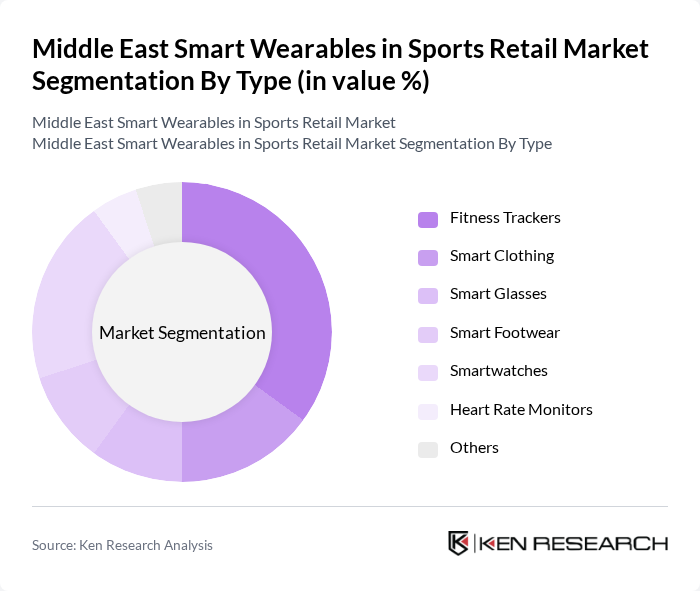

By Type:The market is segmented into various types of smart wearables, including fitness trackers, smart clothing, smart glasses, smart footwear, smartwatches, heart rate monitors, and others. Among these, fitness trackers and smartwatches are particularly popular due to their multifunctionality and ease of use. The increasing trend of health monitoring and fitness tracking has led to a surge in demand for these devices, making them the leading subsegments in the market.

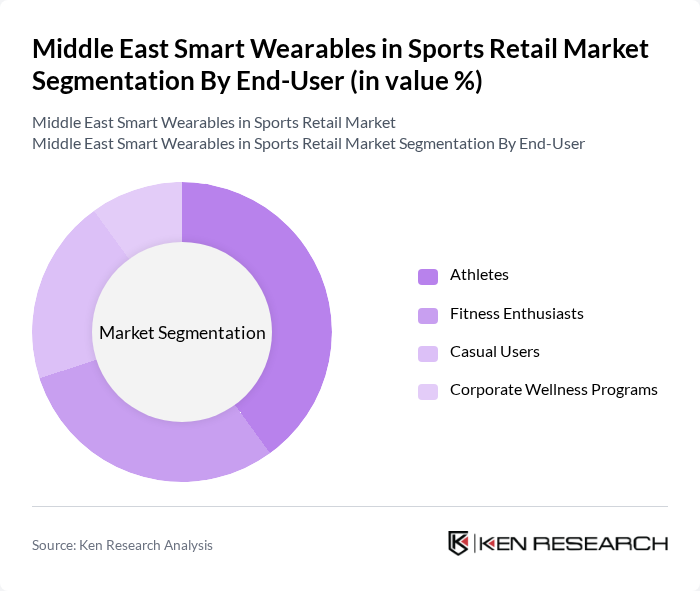

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual users, and corporate wellness programs. Athletes and fitness enthusiasts are the primary consumers of smart wearables, as they seek advanced features for performance tracking and health monitoring. The growing awareness of health and fitness among the general population has also led to an increase in casual users, contributing to the overall market growth.

The Middle East Smart Wearables in Sports Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garmin Ltd., Fitbit Inc., Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Polar Electro Oy, Suunto, Under Armour, Inc., Adidas AG, Nike, Inc., Withings, Amazfit, Jabra, Misfit contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart wearables market in the Middle East appears promising, driven by technological advancements and changing consumer preferences. As more individuals prioritize health and fitness, the demand for innovative wearables is expected to rise. Additionally, the integration of AI and machine learning will enhance user experience, making wearables more appealing. Companies are likely to focus on developing eco-friendly products and subscription-based services, aligning with global sustainability trends and consumer expectations for personalized fitness solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smart Clothing Smart Glasses Smart Footwear Smartwatches Heart Rate Monitors Others |

| By End-User | Athletes Fitness Enthusiasts Casual Users Corporate Wellness Programs |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Application | Health Monitoring Performance Tracking Coaching and Training |

| By Distribution Mode | B2B B2C C2C |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Smart Wearables | 150 | Fitness Enthusiasts, Tech Savvy Consumers |

| Retailer Perspectives on Smart Wearables | 100 | Store Managers, Product Buyers |

| Expert Opinions on Market Trends | 50 | Industry Analysts, Technology Experts |

| Usage Patterns Among Athletes | 80 | Professional Athletes, Coaches |

| Adoption Barriers and Motivations | 70 | Casual Users, Health and Fitness Trainers |

The Middle East Smart Wearables in Sports Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased health consciousness and the adoption of fitness monitoring technologies among consumers.