Region:Middle East

Author(s):Shubham

Product Code:KRAA8700

Pages:91

Published On:November 2025

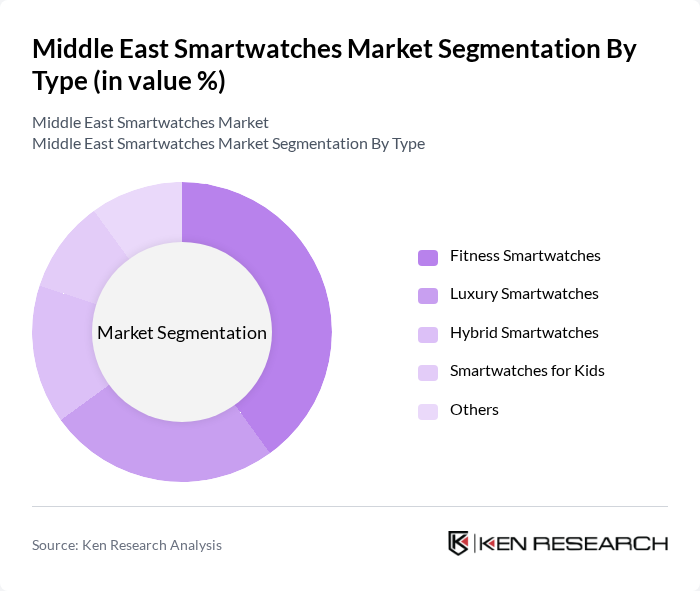

By Type:The market is segmented into various types of smartwatches, including Fitness Smartwatches, Luxury Smartwatches, Hybrid Smartwatches, Smartwatches for Kids, and Others. Fitness Smartwatches are leading the market due to the growing trend of health and fitness awareness among consumers. The demand for features such as heart rate monitoring, step tracking, workout analysis, and advanced display technologies like AMOLED has significantly increased, making fitness-focused devices a popular choice. Luxury Smartwatches also hold a substantial share, appealing to affluent consumers seeking both functionality and style .

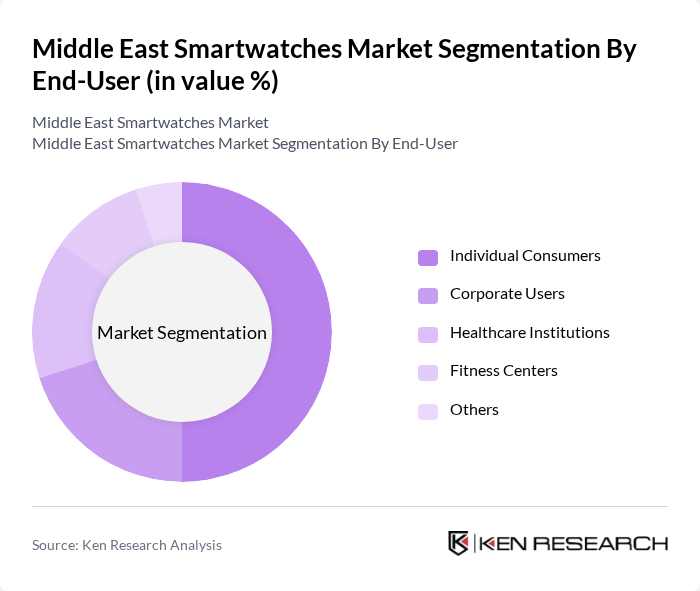

By End-User:The end-user segmentation includes Individual Consumers, Corporate Users, Healthcare Institutions, Fitness Centers, and Others. Individual Consumers dominate the market, driven by the increasing trend of personal health monitoring and lifestyle management. Corporate Users are also emerging as a significant segment, as companies adopt smartwatches for employee wellness programs. Healthcare Institutions are leveraging smartwatches for patient monitoring and remote health tracking, further expanding the market's reach .

The Middle East Smartwatches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit, Inc. (Google LLC), Huawei Technologies Co., Ltd., Fossil Group, Inc., Zepp Health Corporation (Amazfit), Suunto Oy, Mobvoi Information Technology Co., Ltd. (TicWatch), Withings S.A., Xiaomi Corporation, Guangdong Oppo Mobile Telecommunications Corp., Ltd., Realme Chongqing Mobile Telecommunications Corp., Ltd., Honor Device Co., Ltd., Skagen Designs Ltd. (Fossil Group) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East smartwatch market appears promising, driven by technological advancements and changing consumer preferences. As health awareness continues to rise, smartwatches will increasingly serve as essential health management tools. Additionally, the integration of AI and machine learning will enhance user experience, making devices more intuitive. The market is likely to see a surge in demand for fashion-forward designs, appealing to a broader demographic, thus expanding the consumer base significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Smartwatches Luxury Smartwatches Hybrid Smartwatches Smartwatches for Kids Others |

| By End-User | Individual Consumers Corporate Users Healthcare Institutions Fitness Centers Others |

| By Price Range | Budget Smartwatches Mid-Range Smartwatches Premium Smartwatches Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Brand | Apple Samsung Garmin Fitbit Huawei Xiaomi Amazfit Oppo Honor Others |

| By Features | Health Monitoring GPS Tracking Mobile Notifications Customizable Watch Faces Others |

| By Region | GCC Countries (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Turkey Israel South Africa Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Smartwatches | 120 | Tech-savvy Consumers, Fitness Enthusiasts |

| Retail Insights on Smartwatch Sales | 60 | Store Managers, Sales Representatives |

| Market Trends in Wearable Technology | 50 | Industry Analysts, Market Researchers |

| Brand Perception and Loyalty | 90 | Brand Loyalists, Casual Users |

| Impact of Health Features on Purchase Decisions | 40 | Healthcare Professionals, Fitness Trainers |

The Middle East Smartwatches Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by increased adoption of wearable technology and rising health consciousness among consumers.