Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3859

Pages:85

Published On:October 2025

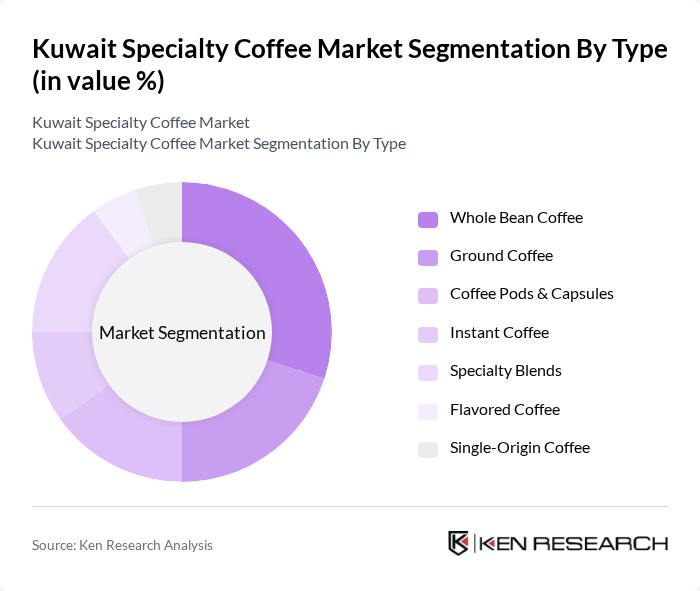

By Type:The specialty coffee market is segmented into Whole Bean Coffee, Ground Coffee, Coffee Pods & Capsules, Instant Coffee, Specialty Blends, Flavored Coffee, and Single-Origin Coffee. Whole Bean Coffee and Specialty Blends are particularly popular, driven by the trend of home brewing and the demand for unique flavor profiles. Consumers increasingly seek high-quality, freshly roasted beans for a superior taste experience. The convenience segment, including Coffee Pods & Capsules, is also witnessing growth as busy consumers opt for quick brewing solutions .

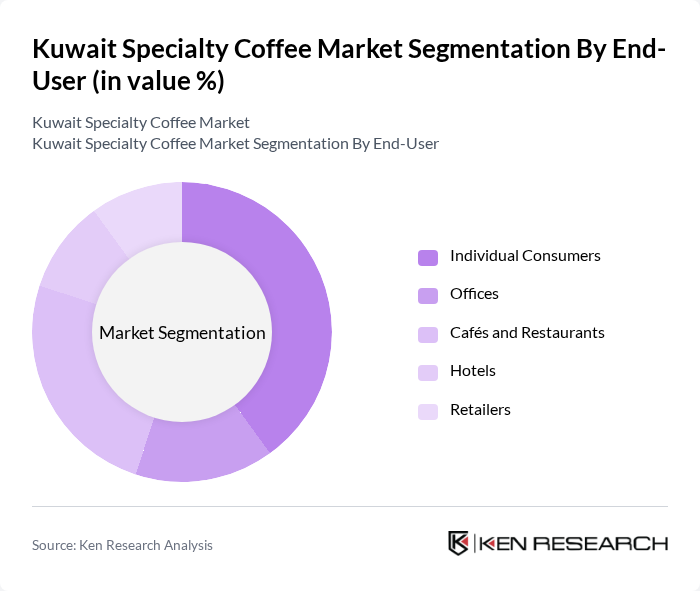

By End-User:The end-user segmentation includes Individual Consumers, Offices, Cafés and Restaurants, Hotels, and Retailers. Individual Consumers represent the largest segment, driven by the increasing trend of coffee consumption at home and the growing interest in specialty coffee. Offices are a significant segment as businesses increasingly provide premium coffee options for employees, while Cafés and Restaurants continue to attract customers seeking unique coffee experiences .

The Kuwait Specialty Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Costa Coffee, Lavazza S.p.A., Illycaffè S.p.A., Nespresso S.A., Tim Hortons Inc., Peet's Coffee, Inc., Dunkin' Brands Group, Inc., The Coffee Bean & Tea Leaf, Caribou Coffee, Alshaya Group (Starbucks Kuwait, Costa Coffee Kuwait, etc.), Arabica Coffee Company (Kuwait-based), Café Najjar, Coffee Planet, Kaffeine Coffee (Kuwait-based), Brewed Awakening (Kuwait-based), Qahwa Coffee (Kuwait-based), Coffee Lab (Kuwait-based), Barista Coffee Company, Specialty Coffee Association of Kuwait contribute to innovation, geographic expansion, and service delivery in this space .

The future of the specialty coffee market in Kuwait appears promising, driven by evolving consumer preferences and a growing café culture. As disposable incomes rise, consumers are likely to seek premium coffee experiences, leading to increased demand for specialty products. Additionally, the trend towards sustainability and ethical sourcing will shape purchasing decisions, encouraging local businesses to adapt. The expansion of e-commerce platforms will further facilitate access to specialty coffee, enhancing market growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Coffee Ground Coffee Coffee Pods & Capsules Instant Coffee Specialty Blends Flavored Coffee Single-Origin Coffee |

| By End-User | Individual Consumers Offices Cafés and Restaurants Hotels Retailers |

| By Sales Channel | Online Marketplaces Brand Websites Supermarkets and Hypermarkets Specialty Coffee Shops Subscription Services |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bags Boxes Tins Pods |

| By Brand Origin | Local Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Specialty Coffee Retailers | 60 | Café Owners, Store Managers |

| Consumer Preferences Survey | 100 | Coffee Drinkers, Specialty Coffee Enthusiasts |

| Importers and Distributors | 40 | Supply Chain Managers, Import Specialists |

| Barista Insights | 50 | Baristas, Coffee Trainers |

| Market Trend Analysts | 40 | Market Researchers, Industry Analysts |

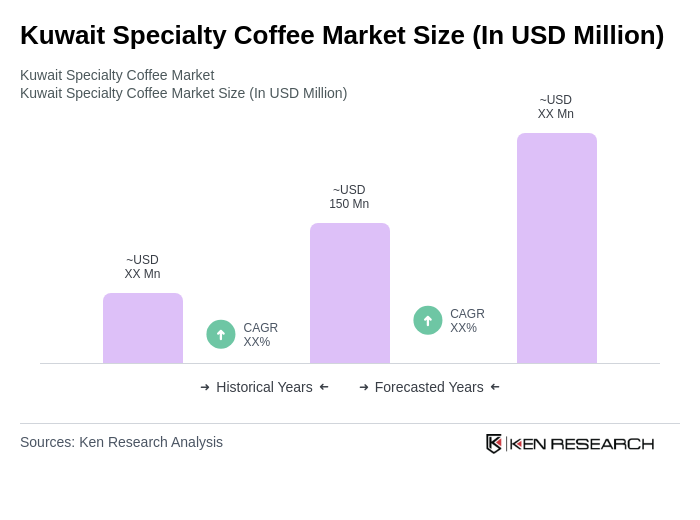

The Kuwait Specialty Coffee Market is valued at approximately USD 150 million, reflecting a growing consumer preference for high-quality coffee and the rise of specialty coffee shops, particularly among the youth.