Region:Middle East

Author(s):Rebecca

Product Code:KRAD7518

Pages:96

Published On:December 2025

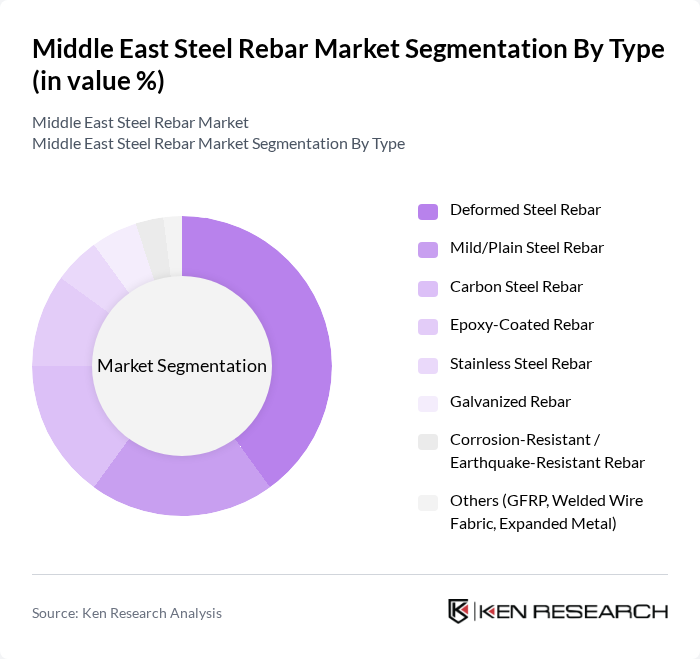

By Type:The market is segmented into various types of steel rebar, including Deformed Steel Rebar, Mild/Plain Steel Rebar, Carbon Steel Rebar, Epoxy-Coated Rebar, Stainless Steel Rebar, Galvanized Rebar, Corrosion-Resistant / Earthquake-Resistant Rebar, and Others (GFRP, Welded Wire Fabric, Expanded Metal). Each type serves different applications and is preferred based on specific project requirements, with value?added categories such as epoxy?coated, corrosion?resistant, and seismic?grade rebar gaining share in long?life infrastructure, marine structures, and high?performance buildings.

The Deformed Steel Rebar segment dominates the market due to its superior strength and performance characteristics, making it the preferred choice for construction projects requiring high tensile strength. This type of rebar is widely used in reinforced concrete structures, which are essential for high-rise buildings, bridges, industrial facilities, and transportation infrastructure projects across the region. The increasing focus on safety, service life, and structural resilience in construction practices, supported by stricter building codes and the adoption of higher grades such as Fe500 and Fe550, has further propelled the demand for deformed rebar, solidifying its position as the leading sub-segment in the market.

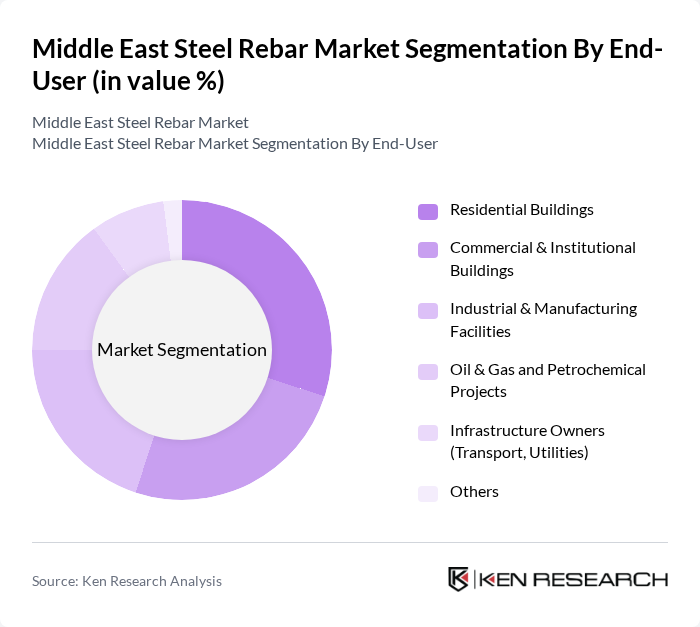

By End-User:The market is segmented by end-user applications, including Residential Buildings, Commercial & Institutional Buildings, Industrial & Manufacturing Facilities, Oil & Gas and Petrochemical Projects, Infrastructure Owners (Transport, Utilities), and Others. Each segment reflects the diverse applications of steel rebar in various construction and infrastructure projects, from high-density housing and mixed?use developments to roads, bridges, ports, power and water utilities, and industrial complexes across the Gulf and wider Middle East.

The Residential Buildings segment is the largest end-user category, driven by the increasing demand for housing in urban areas across the Middle East, supported by demographic growth and household formation in Gulf cities. Rapid population growth and urbanization have led to a surge in residential construction projects, including affordable housing, mid?income apartments, and large master?planned communities, making this segment a key driver of steel rebar consumption. Additionally, government initiatives aimed at promoting affordable and social housing, as well as mortgage and ownership programs in markets such as Saudi Arabia and the UAE, further bolster the demand for rebar in residential applications, establishing it as the leading end-user segment in the market.

The Middle East Steel Rebar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Steel Arkan (UAE), Qatar Steel Company (Qatar), Union Iron and Steel Company (UAE), Saudi Iron & Steel Company – Hadeed (Saudi Arabia), Rajhi Steel Industries Co. (Saudi Arabia), Watania Steel Factory Corp. (Saudi Arabia), United Steel Industrial Company – KWT Steel (Kuwait), Hamriyah Steel FZC (UAE), Conares Metal Supply Ltd. (UAE), Emirates Rebar Limited (UAE), Star Steel International LLC (UAE), Ezz Steel (Egypt), Al Ghurair Iron & Steel LLC (UAE), Oman National Steel Co. LLC (Oman), Al Rashed Steel Products Co. (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East steel rebar market appears promising, driven by ongoing infrastructure projects and urbanization trends. As governments continue to invest in construction, the demand for high-quality rebar is expected to rise. Additionally, the integration of smart technologies and eco-friendly practices in construction will likely shape the market landscape. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Deformed Steel Rebar Mild/Plain Steel Rebar Carbon Steel Rebar Epoxy-Coated Rebar Stainless Steel Rebar Galvanized Rebar Corrosion-Resistant / Earthquake-Resistant Rebar Others (GFRP, Welded Wire Fabric, Expanded Metal) |

| By End-User | Residential Buildings Commercial & Institutional Buildings Industrial & Manufacturing Facilities Oil & Gas and Petrochemical Projects Infrastructure Owners (Transport, Utilities) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, etc.) Iran Turkey Rest of Middle East |

| By Application | Building Construction (Residential & Commercial) Infrastructure (Roads, Bridges, Railways, Airports, Ports) Energy & Utilities (Power, Water, Desalination) Oil & Gas Facilities Others |

| By Manufacturing Process | Basic Oxygen Furnace (BOF) Electric Arc Furnace (EAF) Induction Furnace Others |

| By Distribution Channel | Direct Sales to End-Users and EPC Contractors Regional Distributors & Stockists Trading Houses & Service Centers Online & E-Procurement Platforms Others |

| By Pricing Strategy | Cost-Plus Pricing Linked to Scrap/Iron Ore Benchmarks Competitive / Market-Based Pricing Long-Term Contract Pricing (with Indexation/Formula) Value-Based Pricing for Premium Grades Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 120 | Project Managers, Site Engineers |

| Manufacturing Insights | 110 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Sales Directors |

| Regulatory Impact Assessment | 60 | Policy Makers, Industry Analysts |

| Market Trends and Innovations | 70 | Research & Development Managers, Market Strategists |

The Middle East Steel Rebar Market is valued at approximately USD 14.5 billion, driven by rapid urbanization, infrastructure development, and significant investments in construction projects across the region, particularly in Saudi Arabia and the UAE.