Region:Middle East

Author(s):Shubham

Product Code:KRAD5524

Pages:86

Published On:December 2025

By Type:The market is segmented into various types of stereotactic surgery devices, including frame-based stereotactic systems, frameless stereotactic systems, robotic stereotactic systems, stereotactic navigation and planning software, and stereotactic radiosurgery platforms. This typology is consistent with leading global market studies that group systems into hardware platforms, software and radiosurgical delivery equipment. Among these, robotic stereotactic systems and image-guided platforms are gaining traction due to their precision, ability to enhance surgical outcomes, and support for complex cranial and spinal procedures. The demand for frameless stereotactic and navigation-based systems is also increasing as they offer greater flexibility and comfort for patients, enable repeat imaging, and integrate more easily with intraoperative imaging and radiotherapy workflows in modern neurosurgical suites.

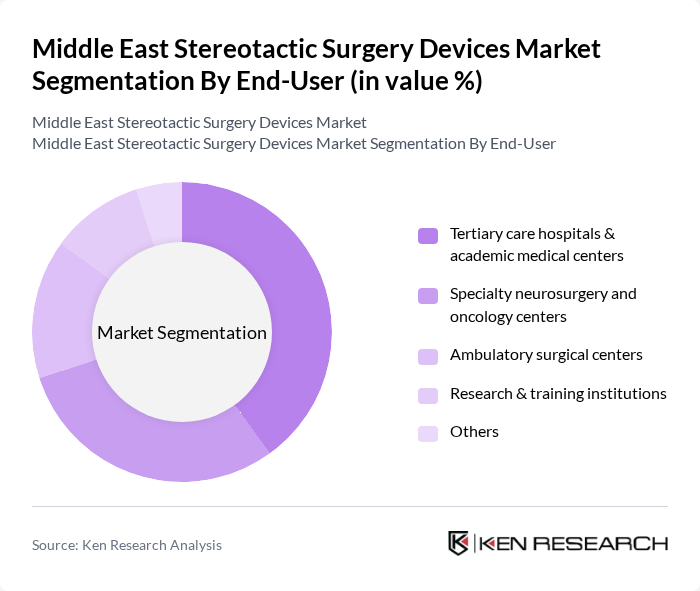

By End-User:The end-user segment includes tertiary care hospitals and academic medical centers, specialty neurosurgery and oncology centers, ambulatory surgical centers, research and training institutions, and others. This structure reflects the global deployment pattern of stereotactic systems, which are most commonly installed in large multispecialty hospitals, cancer centers and university hospitals due to the capital intensity and complexity of these technologies. Tertiary care hospitals are the leading end-users due to their advanced facilities, availability of hybrid operating rooms, integrated imaging, and specialized staff capable of performing complex stereotactic procedures in neurosurgery and radiosurgery. The increasing number of specialty centers focused on oncology, radiosurgery and movement disorder clinics in GCC countries is also contributing to market growth, as these institutions prioritize precision treatments and adopt high-end stereotactic platforms and planning software.

The Middle East Stereotactic Surgery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Elekta AB, Varian Medical Systems, Inc. (Siemens Healthineers company), Brainlab AG, Accuray Incorporated, Siemens Healthineers AG, GE Healthcare Technologies Inc., Philips Healthcare (Koninklijke Philips N.V.), Canon Medical Systems Corporation, Hitachi Healthcare (Hitachi, Ltd.), Stryker Corporation, Monteris Medical Inc., Inomed Medizintechnik GmbH, Micromar Indústria e Comércio Ltda., Mizuho Medical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East stereotactic surgery devices market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As healthcare infrastructure expands, particularly in countries like Saudi Arabia and the UAE, the adoption of innovative surgical technologies is expected to rise. Furthermore, the integration of artificial intelligence and telemedicine into surgical practices will likely enhance the precision and accessibility of stereotactic procedures, fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Frame-based stereotactic systems Frameless stereotactic systems Robotic stereotactic systems Stereotactic navigation & planning software Stereotactic radiosurgery platforms (Gamma Knife, LINAC-based, CyberKnife, proton) |

| By End-User | Tertiary care hospitals & academic medical centers Specialty neurosurgery and oncology centers Ambulatory surgical centers Research & training institutions Others |

| By Application | Functional neurosurgery (Parkinson’s, movement disorders, epilepsy) Intracranial tumors & brain metastases Spine & orthopedic stereotactic procedures Stereotactic body radiotherapy (SBRT) for extracranial tumors Pain management & psychosurgery Others |

| By Technology | Gamma Knife radiosurgery systems LINAC-based stereotactic radiosurgery (SRS/SBRT) Robotic radiosurgery systems (e.g., CyberKnife) Image-guided stereotactic navigation (CT, MRI, PET, cone-beam CT) Hybrid & multimodality platforms Others |

| By Region | GCC Countries (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, others) North Africa (Egypt, Morocco, Algeria, others) Rest of Middle East & Africa |

| By Distribution Channel | Direct sales to healthcare providers Regional distributors & agents Group purchasing organizations (GPOs) and tenders Others |

| By Pricing Model | Capital equipment sales Lease and pay-per-use models Service & maintenance contracts Bundled pricing (systems, software, and upgrades) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurosurgeons in Major Hospitals | 100 | Neurosurgeons, Surgical Directors |

| Medical Device Procurement Managers | 80 | Procurement Managers, Supply Chain Officers |

| Healthcare Policy Makers | 50 | Health Administrators, Policy Analysts |

| Patients with Stereotactic Surgery Experience | 70 | Patients, Caregivers |

| Clinical Researchers in Neurosurgery | 60 | Clinical Researchers, Medical Professors |

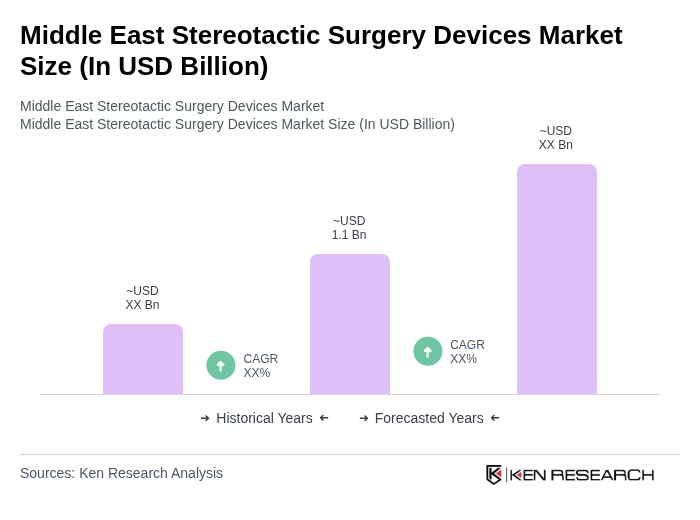

The Middle East Stereotactic Surgery Devices Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by advancements in medical technology and the increasing prevalence of neurological disorders.